Oil and Gas Price Forecast: Top Trends That Will Affect Oil and Gas in 2023

What’s the oil and gas outlook in 2023? Read on to learn what analysts see coming for the sector next year.

Pull quote was provided by Investing News Network client Enterprise Group. This article is not paid-for content.

2022 was a banner year for the oil and gas sector as prices rallied to decade highs.

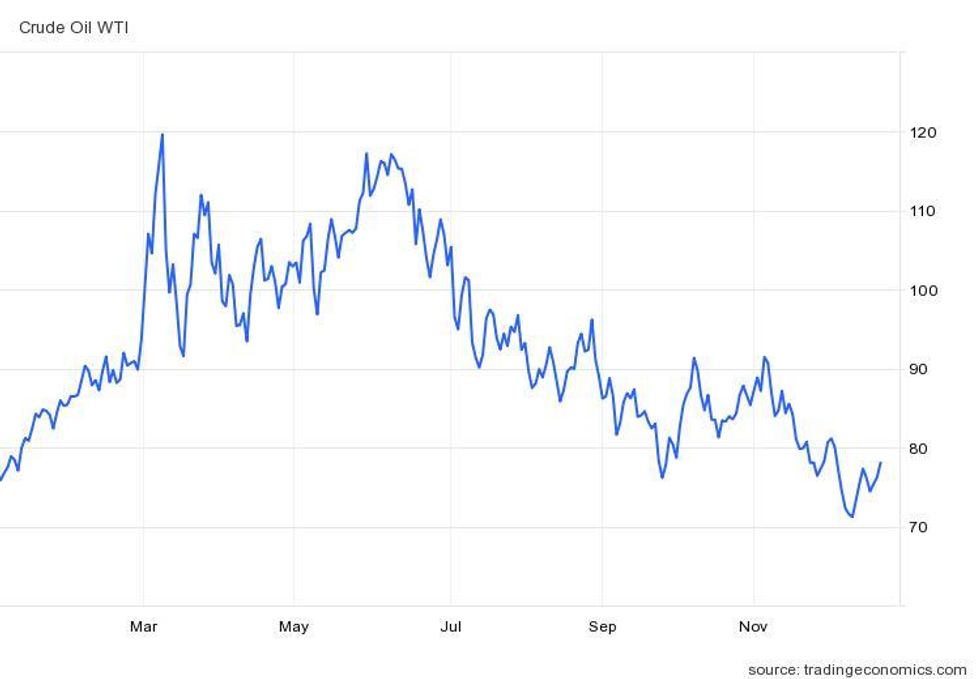

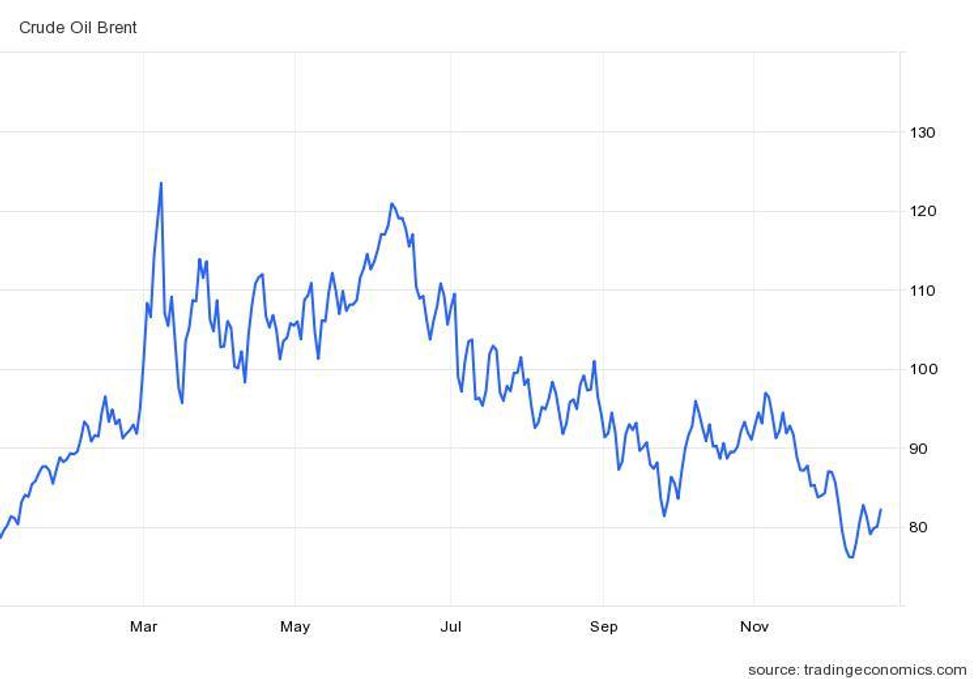

A resurgence in demand following pandemic lockdowns converged with supply disruptions caused by sanctions on Russia, driving West Texas Intermediate and Brent crude to US$120 per barrel during the first half of the year.

Values began to trend lower in H2, leaving both crude types on course to end the year in the same price territory as they started.

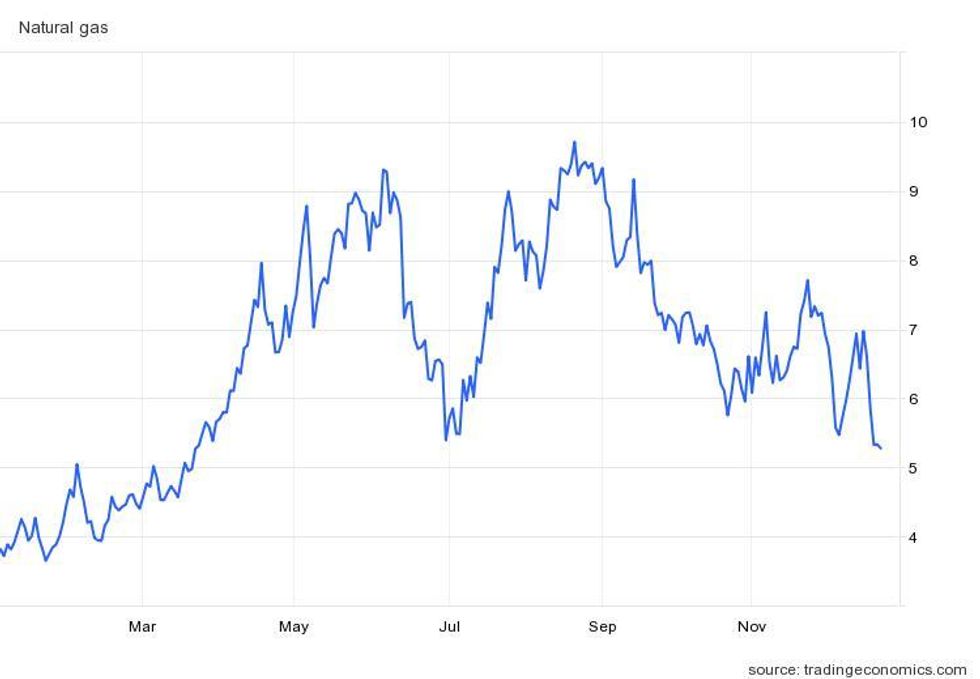

Meanwhile, European natural gas supply faced hurdles as Russia's invasion of Ukraine infused global markets and economies with uncertainty. By August, prices for the fuel used to heat homes had reached a 14 year high of US$9.71 MMBtu.

According to FocusEconomics, the war severely disrupted energy supply out of Russia, which last year accounted for more than 10 percent of world crude supply and 40 percent of Europe’s natural gas imports.

“Most of the volatility seen in oil prices this year was caused by the announcement of Russia’s invasion of Ukraine — with prices spiking around 30 percent by early March — and the later announcement of sanctions by western countries and their allies,” FocusEconomics panelist Matthew Cunningham told the Investing News Network (INN).

However, the economist went on to point out that the ongoing war shouldn’t have such a pronounced effect on energy prices moving forward. “With a major escalation of the war involving NATO unlikely, and most significant sanctions already announced, the war is less likely to cause prices to spike or plummet as sharply as in 2022,” he said.

How did oil and gas prices perform in 2022?

Amid high inflation and rising interest rates, the global economic outlook has worsened and pushed energy prices lower. Prices for crude fell below US$90 in November and have remained at that level since.

WTI crude's price performance year-to-date.

Chart via TradingEconomics.

“It's basically at a year-to-date low,” Mercenary Geologist Mickey Fulp told INN. “A lot of that has to do with lockdowns in China decreasing demand, and high gas prices have decreased demand in the US.”

Brent crude's price performance year-to-date.

Chart via TradingEconomics.

These weakened economic conditions are expected to persist into the new year, although some analysts believe a worldwide recession is avoidable. “With the winter set to aggravate China’s COVID problems and Europe’s natural gas crisis, the global growth outlook remains depressed, but we do not see the global economy at imminent risk of sliding into recession in early 2023,” wrote Bruce Kasman, head of economic and policy research at JPMorgan (NYSE:JPM).

Natural gas' price performance year-to-date.

Chart via TradingEconomics.

“The financial conditions drag is being cushioned by a fading of supply chain and commodity price shocks,” he added.

2022’s high inflation and strict monetary policy have resulted in global GDP growth shrinking by almost half, from 6 percent in 2021 to 3.2 percent. That number is forecast to contract to 2.7 percent in 2023, representing the weakest growth period since 2001.

A muted economic performance is projected to keep energy prices from surging to fresh heights. “Our panelists see energy prices easing throughout 2023 on mild global economic growth,” a FocusEconomics report states. “However, they will remain elevated owing to constrained supply, amid OPEC+’s production cut and sanctions on Russian energy exports.”

Oil and gas supply questions to persist

With sanctions on Russia — the third largest oil-producing nation — impeding output from that country, the world has looked to the Organization of the Petroleum Exporting Countries (OPEC) to ramp up production.

“The other factors we are watching include OPEC+ output, the potential lifting of sanctions on Iran and Venezuela, further oil reserve releases and global economic growth — with a focus on US (Federal Reserve) hikes — as well as China, following the recent relaxation of the country’s zero-COVID policy," Cunningham said.

In November, OPEC production contracted by 310,000 barrels per day. The 11th month of the year also saw the oil cartel fail to meet its projected quota by as much as 1.81 million barrels per day. On the flip side, liquefied natural gas imports into Europe jumped, helping to bring the price of the heating fuel to US$5.28, its lowest point since March.

For oil, supply remains a concern. Not only will countries need to secure steady supply to keep their economies running, but nations like the US will also need to replenish reserves they tapped into earlier this year.

In 2022, the US released 180 million barrels of crude from its Strategic Petroleum Reserve, raking in a total of US$4 billion. Currently, the reserve houses 378.62 million barrels, down from 598.92 million one year ago.

“The US was the swing producer the day that (US President Donald Trump) left office, and had been for three years,” Fulp said. “And now we're back to OPEC being the swing producer. And that's not good. You know, OPEC now controls prices.”

He explained that US production may contract over the next few years as big banks choose not to invest in the space.

“They are not funding any oil and gas ventures, so companies cannot raise money and their production's flat,” he said. “Production has been flat in the US for basically a year and a half now since we recovered from the pandemic, and it's not going higher.”

According to the Mercenary Geologist, the US has an opportunity regarding liquefied natural if it can find more efficient ways to transport it internationally.

Oil and gas companies expected to perform well

Even though institutional investors have moved away from oil and gas, the sector saw significant profits in 2022.

2022’s strong performance has led to Fitch Ratings giving the sector a stable outlook score.

“Sector performance in 2023 will remain broadly in line with that in 2022 and significantly stronger than in the mid-cycle,” it states. “We expect average oil and gas prices to moderate in 2023, not least because of an economic slowdown, but the hydrocarbon markets will remain tight due to lower oil and in particular natural gas supplies from Russia and OPEC+’s cautious stance.”

The industry watchdog expects 75 percent of oil and gas companies to report positive free cash flow after dividends.

“(Oil and gas) companies across the globe will continue to report high earnings despite windfall taxes introduced by some countries. Inflation will bite but most companies have significantly reduced costs during the period of low oil prices, which will contribute to their cash flows,” Senior Director Dmitry Marinchenko said in a report.

Optimistic about the year ahead, the ratings group believes demand growth out of China will be a price catalyst. That said, the reintroduction of COVID-19 protocols could hinder demand out of the Asian nation.

Spare capacity could be impacted if OPEC+ remains cautious, adding tailwinds to values, as per Fitch. But the larger, longer-term energy transition could lead to slowing demand and price weakness.

Expect oil and gas price volatility in 2023

FocusEconomic panelists see production from OPEC largely stagnating in 2023, capped by the recent output quota cut.

“Moreover, Iranian oil output will stay depressed due to a slim path to a nuclear deal. However, Venezuelan oil output should rise thanks to the US government’s recent decision to allow Chevron to resume production in the country," Cunningham said.

He expects Russian production to fall due to tighter sanctions, while output in the US is set to grow, albeit at a limited rate as a result of recent weak drilling activity by shale producers.

As a result, prices are expected to see some volatility. “We expect crude prices on the whole to average around 7 percent lower in 2023 than they did in 2022,” he added. “A bearish demand outlook will drag on prices, with global economic growth set to slow as the Fed and other major central banks continue with monetary tightening.”

Cunningham also noted that uncertainty will keep prices at the highest levels in the past decade, holding in the US$90 level.

“Increasing disruption to Russian exports and OPEC+’s recent cut to output quotas will limit supply, with the market projected to be in a slight deficit next year,” Cunningham said. “Moreover, there are upside risks to prices posed by better-than-expected growth in China or a sharper-than-expected fall in supply.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.