Nickel Price Forecast: Top Trends That Will Impact Nickel in 2023

What's ahead for nickel in 2023? Read on to learn about the nickel forecast for next year.

Pull quotes were provided by Investing News Network clients Canada Nickel Company and Nova Royalty. This article is not paid-for content.

Nickel’s price volatility in early 2022 made news headlines, shaking the industry as the important base metal surpassed the historic US$100,000 per metric ton (MT) level for the first time ever.

Although the market is struggling to stabilize, stainless steel looks set to remain its main demand driver for some time; however, interest in nickel’s use in electric vehicle (EV) batteries is quickly picking up pace.

As the year comes to a close, the Investing News Network (INN) asked analysts in the field for their thoughts on what’s ahead for the commodity. Read on to find out what they had to say.

How did nickel prices perform in 2022?

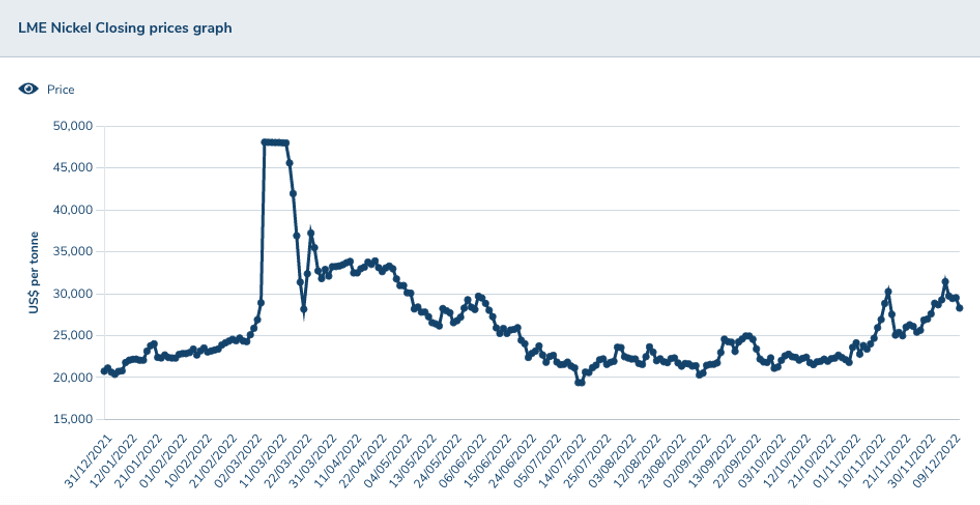

Nickel's unprecedented price increase in Q1, which sent it up over 250 percent in just two days, prompted the suspension of trading at the London Metal Exchange (LME). The 145-year-old exchange resumed trading in mid-March after canceling some of the trades, with prices retreating to trade at around US$22,000 by mid-year — almost the same level at which they started in 2022.

Nickel's price performance year-to-date.

Chart via the London Metal Exchange.

During the first months of the year, the market saw a downgrade to demand within China for both stainless steel and EVs, with any further extension of COVID-19 lockdown measures expected to exacerbate the situation.

“Generally, with nickel prices falling, and therefore stainless prices, stainless customers have become cautious, not wanting to buy a product that then loses value. So orders dropped,” Sean Mulshaw of Wood Mackenzie told INN at the time.

The third quarter proved to be stable for nickel prices, which ended the period almost neutral.

“Tightening monetary policy globally, the fallout from the war in Ukraine, a wobbly property sector in China and a new Covid-19 outbreak in Shenzhen all hurt activity,” analysts at FocusEconomics said. “That said, lower nickel stocks in LME warehouses provided some lift to nickel prices.”

In November, prices saw an uptick as volatility increased, with the LME stepping in to scrutinize trading.

ING’s Ewa Manthey told INN that this volatility is likely to continue until market participants feel they can trust the LME's benchmark nickel contract again. “We forecast nickel prices to remain under pressure in the short term as a surplus in the market builds; however, the tightness in the Class 1 market is likely to offer some support,” she added.

On December 7, nickel was trading at US$31,441, up from its starting point of US$20,888 on January 3.

What is the nickel supply and demand forecast for 2023?

At the end of 2021, most analysts expected the nickel market to remain balanced in 2022, with strong prices forecast for the base metal. However, weak stainless steel sector demand has changed the situation.

With the year nearly over, Manthey said it now looks like the global nickel market will record a surplus, although it will be mostly in the Class 2 market, which includes ferronickel and nickel pig iron.

“The LME deliverable Class 1 market has been relatively tight, with LME stocks falling by around 50,000 tonnes since the start of the year and recently hitting a 14 year low. The reported LME stocks are now below three weeks of consumption — another factor driving the price swings in the LME nickel contract," she said.

Nickel is a key cathode material for EV batteries, and many believe demand from this sector will increase significantly in coming decades. But for now EVs account for a relatively small segment of demand, well below stainless steel, which is responsible for 70 percent of consumption. “Although demand from the battery sector is growing rapidly, making up around 5 percent of total demand at the moment, it isn’t enough to offset a slowdown in traditional sectors like construction,” Manthey said.

Speaking further about demand, she pointed out that nickel is one of many metals whose usage has been hurt by China’s strict zero-COVID policy, which has dampened the construction industry. “China’s relaxation of its COVID policy would have a significant effect on the steel market, and by extension on the nickel market,” Manthey said.

Looking over to supply, Indonesia will be key to watch as it boosts production to meet demand. Citing data from the International Nickel Study Group, Manthey noted that the country's output rose 41 percent year-on-year in the first seven months of 2022, with its output of 814,000 tonnes accounting for 47 percent of supply globally. That's up from 38 percent over the same period of 2021.

“We believe rising output in Indonesia will pressure nickel prices next year,” she said, pointing out that the US Geological Survey sees the nation producing 1.25 million to 1.5 million tonnes of nickel this year, over 40 percent of world mined production.

For Rodney Hooper of RK Equity, nickel is the metal to be watching next year. “A lot of people, when they originally had quite conservative estimates on EV sales, didn't have EVs as a major component of the nickel market,” he told INN. “But of course, that's all turned on its head and now EVs represent a big percentage of nickel demand, and they will continue to rise going forward.”

Permitting times are one of the main challenges that upcoming nickel projects continue to come up against.

“Funding (for battery metals projects) has happened, but it's not happening still at a rate that anyone needs; institutional money is still not as aggressive as it should be,” Simon Moores of Benchmark Mineral Intelligence told INN. “And then, if they get the money to take it to the permitting stage, permitting is a massive hurdle — it can add 50 percent of the time onto building your mine.”

As governments continue to push to take further control of their lithium-ion battery supply chains, including sourcing raw materials regionally, the US, Canada, Europe and even Australia have been moving forward with critical minerals strategies, which are expected to address mining, among other issues.

What factors will move the nickel market in 2023?

In closing, Manthey reiterated that ING expects short-term pressure for nickel due to a surplus in the market, but said prices should see some support from tight conditions for Class 1 material.

“We see prices hovering between US$20,000 and US$20,500 over the first two quarters of 2023 before gradually increasing to US$21,000 in 3Q and US$22,000 in 4Q as the global growth outlook starts to improve,” Manthey said.

Looking at catalysts to keep an eye out for in 2023, analysts at FocusEconomics believe a global economic recession is a key downside risk to prices, while potential disruption to Russian nickel supply — either because of western sanctions or Russian export controls — is an upside risk for the metal.

“The resilience of the Chinese economy and the country’s handling of new COVID-19 outbreaks are key factors to watch,” they said. “In the long run, the rise of EVs bodes well for demand, as nickel is an important component in lithium-ion batteries.”

Panelists polled by FocusEconomics see nickel prices averaging US$21,559 by the end of 2022 and US$20,366 by the end of 2023.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.