Nickel Price Update: Q1 2022 in Review

Here’s an overview of the main factors that impacted the nickel market in Q1 2022, and what’s ahead for the next quarter.

Click here to read the latest nickel price update.

The first three months of the year saw the nickel market make history, with prices reaching unprecedented levels that prompted the suspension of trading on the London Metal Exchange (LME).

Nickel surpassed the US$100,000 per tonne mark in early March, jumping over 250 percent in just two days. The base metal had already been trading at high levels on the back of Russia's invasion of Ukraine.

But what else is happening in the nickel space? Read on to learn about the main trends in the nickel market in Q1, including supply and demand dynamics and what market participants are expecting for the rest of the year.

Nickel price update: Q1 overview

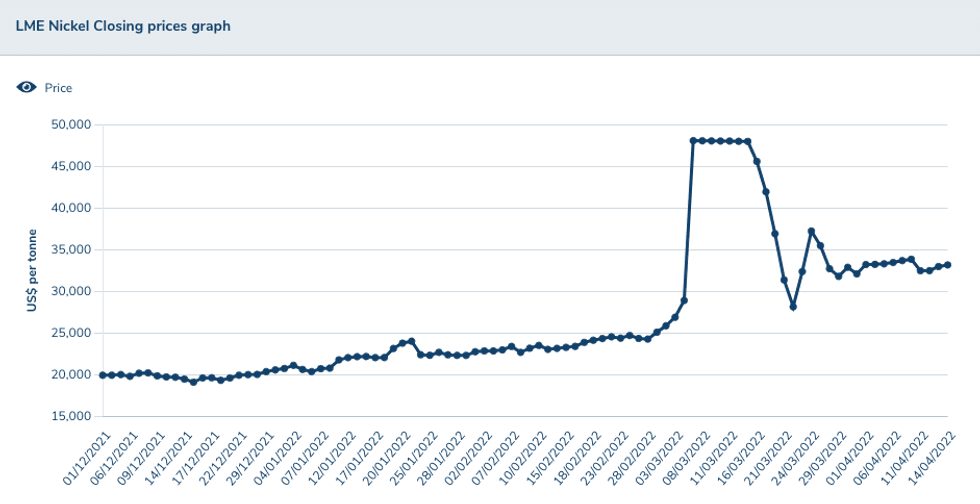

After finishing 2021 trading above the US$20,000 threshold, nickel prices hit their highest level in a decade in mid-January as stockpiles dwindled and potential demand from the electric vehicle (EV) sector supported prices.

Nickel's price performance in Q1 2022.

Chart via the London Metal Exchange.

“Positive electric vehicle sales data for 2021, coupled with major car manufacturers, notably in China, accelerating their EV production, sent prices for nickel flying,” FocusEconomics analysts said in a January report. “Against this backdrop of elevated demand, significantly lower inventories in the London Metal Exchange — around 30 percent lower than in September 2021— provided another boost.”

February continued to see the base metal trading higher, reaching another milestone as it surpassed the US$25,000 level, partially due to Russia’s invasion of Ukraine as uncertainty hit markets.

Russia is a top nickel producer, and concerns over supply increased as global sanctions hit the country.

“The ongoing war between Russia — the world’s third largest producer of nickel — and Ukraine drove an unprecedented rally in nickel prices in March,” FocusEconomics analysts said. “Fears of global supply drying up, due to the ongoing conflict and associated international sanctions unleashed against Russia, sent investors scrambling for the base metal, which is used in battery and steel production.”

But nickel’s price rise was far from over. On March 8, nickel steeply spiked to hit a record level of US$100,000 before the LME decided to suspend trading. “Fundamentals, though supportive of stronger prices, do not justify this frenzy,” Wenyu Yao, senior analyst at ING, said in a note on March 8. “It remains to be seen how this crisis ends. However, the market has long been faced with structural issues.”

The largest-ever move seen on the LME was attributed to the massive short position held by Chinese tycoon Xiang Guangda, who controls the world’s largest nickel producer, Tsingshan Holding Group; he was facing billions of dollars in mark-to-market losses.

The 145-year-old exchange resumed trading, although not without some hiccups, with UK regulators planning to launch a review of the “disorderly market” in nickel contracts in March.

“We expect the LME nickel price to remain volatile in the near term, as the global nickel market finds equilibrium following the price spike and subsequent events,” Jason Sappor, senior research analyst with S&P Global Market Intelligence, told the Investing News Network (INN).

At the end of the quarter, nickel prices were trading above US$30,000 and have remained at that level.

Nickel price update: Supply and demand dynamics

At the end of last year, most analysts anticipated a balanced nickel market and strong prices ahead.

Despite Russia's invasion of Ukraine, StoneX’s market balance forecast for nickel hasn’t been altered significantly since the start of 2022.

Senior Metals Analyst Natalie Scott-Gray told INN that’s because no direct sanctions have been placed on Russian exports or producers. Additionally, Russia’s Norilsk Nickel (MCX:GMKN), the world’s largest producer of refined nickel, has largely avoided shipment logistic difficulties given that the company has its own shipping line.

“However, this is hinging on what the next set of sanctions bring,” she explained.

Russia is responsible for 9 percent of global nickel production and 15 percent of Class I nickel supply — on which Europe has a very high reliance.

“If we do see sanctions placed on metal exports or Russian producers, there is very little alternative supply that could feed Europe in the near to medium term,” Scott-Gray said. “This is particularly true for Class I nickel, which would have a direct impact on the ability for Europe to maintain EV production guidance for this year.”

Speaking about the long-term impact the war could have on the nickel supply chain, Sappor said he anticipates that the Russian invasion will prompt a period of upheaval in global nickel trade flows.

“Indeed, Norilsk’s president recently confirmed market expectations that the company is looking to redirect its European and US supplies to China,” he said. “This is likely to displace material from countries such as Australia, which in turn could be diverted toward the US and the EU.”

Aside from Russian concerns, a spread of COVID-19 in Indonesia could bring risks to Class II nickel supply. “Meanwhile, any delays to high-pressure acid leach or nickel pig iron (NPI) to nickel matte could see a downgrade to our forecast,” Scott-Gray said.

Looking over to demand, the market is already seeing less need within China for stainless steel and EVs, and any further extension of COVID-19 lockdown measures could exacerbate the situation.

“A prolonged (Russia/Ukraine) war will also hurt the demand profile within Europe for nickel, in addition to stretching out supply chain pain given elevated freight rates,” Scott-Gray said.

Investor interest in nickel has been rising in recent years due to its use in the cathodes of EV batteries, with the price spike seen in Q1 prompting many to question how this could impact costs for EVs.

Alice Yu, senior research analyst at S&P Global Market Intelligence, said EV sales are expected to be affected primarily by lower EV production from a shortage of wire harness caused by the Russia/Ukraine conflict; higher nickel prices are less of an issue in comparison.

“Battery metals costs have been rising prior to the invasion,” Yu said. “The largest contributor to higher battery metals costs is higher lithium prices, even when accounting for much higher nickel prices in the first half of March.”

Another interesting impact from concerns regarding Russian supply and the recent price spike has been the LME nickel cash price outperforming the price of NPI, a Class 2 nickel product, in China this year.

“This has resulted in a significant widening of the premium of the LME price over Chinese NPI prices in US dollar terms,” Sappor said.

Last year, Chinese producer Tsingshan started processing NPI into high-grade nickel matte in Indonesia. The material can be converted into nickel sulfate to manufacture lithium-ion batteries for the EV battery sector.

“We calculate that, thanks to the currently elevated LME price, converting NPI into nickel matte in Indonesia offers better margins than producing NPI in Indonesia, where last year the opposite was the case partly due to supply tightness in the NPI sector,” Sappor said.

“Given that Tsingshan has said that its nickel matte output will depend on the economics of producing NPI versus nickel matte, these dynamics may push the company to produce more nickel matte from its plants in Indonesia.”

However, Tsingshan's chances of taking advantage of the improved profitability of nickel matte production may be thwarted by the lack of buying interest in the nickel market following recent events on the LME, Sappor said.

“Concerns regarding the potential environmental impact of converting NPI to nickel matte, especially among EV battery producers outside China, also remains a significant headwind to the long-term success of Tsingshan’s nickel matte plan,” he commented to INN.

Nickel price update: What’s ahead?

What’s on the horizon for the nickel market will be determined by many factors, but further sanctions on Russia is one key element to keep an eye out for.

“While the possibility that outright sanctions will be placed on exports or Russian producers remains moderate to low in our view, if the EU goes ahead with banning Russian vessels from EU ports, we again will see a significant impact on nickel,” Scott-Gray said.

Norilsk Nickel produces 100 percent of nickel in Russia, and as mentioned, the company has been able to largely avoid logistical issues on shipments as it uses its own shipping line. “(But) in this scenario, our market balance will be altered, with nickel to flip into a deficit market this year,” Scott-Gray said.

Commenting on other factors to watch as the second quarter kicks off, the analyst pointed to battery cathodes.

Scott-Gray sees lithium-iron-phosphate batteries dominating the lithium-ion battery space within China over nickel-containing batteries, but she noted that nickel's higher price point could encourage faster uptake not just in China, but also within Europe.

“Indeed, if Russian nickel is banned from entering the EU, with alternative supply limited (and facing potentially questionable carbon footprint issues given a source such as from Indonesia), there could be an industry shift — although this would be an extreme scenario,” she said.

For her part, Yu said there also isn’t an obvious alternative that can match the performance of nickel-intensive batteries in terms of driving range and low-temperature performance.

“So any technical shift away from nickel in EV batteries will take longer to play out,” she said.

Looking at how prices could perform, panelists recently polled by FocusEconomics expect nickel to average US$23,435 in Q4 2022 and US$20,611 in Q4 2023.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- LME Halts Nickel Trading Again on Technical Issue Soon After ... ›

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain ... ›