Gold Price Forecast: Top Trends That Will Affect Gold in 2023

The gold price fluctuated in 2022, rising above US$2,000 and falling below US$1,700. What does 2023 hold for the precious metal?

Click here to read the latest gold forecast.

Pull quotes were provided by Investing News Network clients Empress Royalty and Falcon Gold. This article is not paid-for content.

Gold had highs and lows in 2022, breaking US$2,000 per ounce in March before shedding over 20 percent to hit an 18 month low of US$1,619 in Q3. The yellow metal is now on course to end the year near its start value at US$1,805.

Various factors converged to cancel out many of the traditional tailwinds that aid the yellow metal. As investors sought gold as a hedge against decade-high inflation, a strong US dollar prevented it from locking in large gains.

However, as Junior Stock Review’s Brian Leni explained, the story was different for gold in other currencies.

“Without a doubt, the strongest trend against gold this year was the strength of the US dollar,” he said. “That said, in every currency that I can think of besides the US dollar, the gold price performed or held strong — this is why you own gold. And given enough time, in my view, gold will once again appreciate in US dollar terms too.”

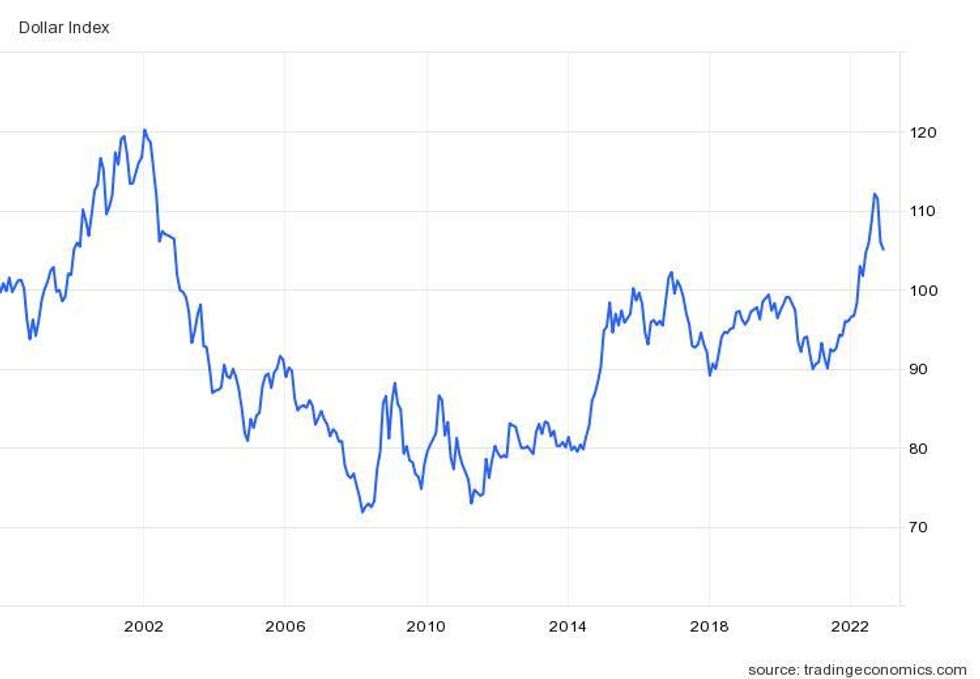

By September, central bank efforts to tamp down inflation around the globe had pushed the US dollar to a 20 year high, a moment that coincided with gold’s 18 month low.

US dollar index performance over 25 years.

Chart via TradingEconomics.

“Honestly, with everything going on in the world, I thought gold should have been sustained over US$2,000. This wasn’t the case,” Leni said. “However, the financial world is still hooked on the old paradigm of using the US dollar as a safety net.”

Gerardo Del Real, founder of Junior Resource Monthly and Junior Resource Trader, echoed Leni’s sentiment.

“Though gold underperformed — I thought we’d be above US$2,000 and headed towards new all-time highs — it performed well as a store of value during a very volatile year in all financial assets,” he commented.

Following gold’s dip below the US$1,700 level at the end of the third quarter, the yellow metal began to climb higher in Q4, adding 9 percent between November 3 (US$1,625) and December 8 (US$1,789).

“I expect 2023 to be a breakout year for gold, with a rush past the US$2,000 level and finally a run towards new all-time highs,” said Del Real, who is also co-owner of ResourceStockDigest.com and Digest Publishing.

Fed's fight against inflation to stay in focus

Combating runaway inflation became the primary story of the US economy in 2022. The Federal Reserve implemented six consecutive rate hikes, taking the federal funds rate from 0.25 to 0.5 percent in March 2022 to 3.75 to 4 percent by November.

The attack on inflation began to take charge in H2 after inflation spiked to a near 40 year high in June. October saw inflation fall to 7.7 percent, the lowest point since January, prompting speculation that the Fed may slow its interest rate regime.

“A policy pivot by the Fed would be a major turning point for the gold price,” said Junior Stock Review’s Leni. “Honestly though, I think that the pivot in the gold price has already happened. We’re seeing it now.”

After four consecutive 0.75 percent rate hikes, the Fed’s decision to ease its hawkish stance would add more tailwinds to gold. “The official pivot just becomes the rocket fuel the price needs to put the market into a frenzy,” he added.

Del Real also anticipates a price shift if the US central bank softens its hard line.

“The Fed will have no choice but to slow and then pause its hikes, or it will risk a prolonged and unnecessary recession,” he said. “Though that will be a catalyst, it won’t be the only tailwind for the gold price.”

As gold approaches the US$1,800 level, concerns around a recession in 2023 or 2024 are also growing.

Navigating a soft landing that either avoids a recession or prevents a prolonged downturn will be the Fed’s main focus heading into 2023, and because of that, Philip Newman, director at Metals Focus, believes the US central bank may not lower rates very quickly.

He expects a lag between sustained declines in inflation and the Fed’s response to those indicators.

“(It) could (be) a while between inflation falling and then rates falling, and that suggests to us that real yields will remain relatively high,” he said, emphasizing the word "relatively." “And again, I think that will act as a bit of a headwind to investors … we'll see gold remain under pressure, even if we start to see inflation fall back into next year.”

Economic uncertainty in the driver's seat

As the Fed tries to steer clear of a recession, signals of a broad downturn in the global economy are growing.

According to the International Monetary Fund, global inflation is set to double year-over-year for 2022.

“The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the (global) outlook,” its World Economic Outlook reads.

The report notes that global growth is expected to contract from 6 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. That would be the weakest growth profile since 2001 outside the 2008 financial crisis and COVID-19's "acute" phase.

As the world faces a recession in 2023 — or at least what "will feel like a recession" — gold's setup is improving. According to the World Gold Council (WGC), the threat of a mild recession and ongoing geopolitical risk will benefit gold, as they have historically. Gold is also likely to come out on top if the economic situation worsens — for example, if central banks tighten too much and create a larger and more severe downturn, or if they shift their policy before inflation is under control and create stagflation.

On the flip side, continued strength in the US dollar could throw gold off track.

“If we do see a recession, or concerns of a recession grow, what we could see is flight into the dollar,” Newman said. In that scenario, investors might move away from emerging currencies, and that liquidity would support the greenback and weigh on gold.

Ultimately, the main factor that could prevent gold from gaining price traction in 2023 is the Fed’s success at quashing inflation.

“Downside risks also exist for gold via a soft-landing scenario, where business confidence is restored and spending rebounds,” states the WGC. “Risk assets would likely benefit, and bond yields remain high — a challenging environment for gold.”

Gold price expectations for 2023

The current economic landscape is precarious, making price forecasting challenging.

For the experts at FocusEconomics, the gold price is expected to remain rangebound.

“A weakening of the USD and the likely decline in interest rates later in 2023 should both be positive for gold prices,” the firm states in a report. “In contrast, falling global inflation will reduce demand for the metal as a hedge against high price pressures.”

Geopolitical tension and China’s zero-COVID policy are also factors that will drive the market in 2023.

Continued central bank gold purchases may also impact the metal's 2023 performance. 2022 saw central banks add more gold to their holdings, bolstering levels to their highest point since 1974.

"Central bank gold purchases have fluctuated notably in the last few years, with Q3 2022 purchases up more than 300 percent in annual terms,” states FocusEconomics. "Similar fluctuations going forward pose a risk to prices in both directions.”

Analysts polled by the firm believe that in 2023 gold could trade anywhere between US$1,470 (minimum) and US$1,830 (maximum), with the consensus price hovering at US$1,694.

More broadly, Junior Stock Review’s Leni will be watching for two major pieces of news in the new year.

"First, for precious metals investors, the Fed’s policy pivot news should be a huge turning point in precious metal perception,” he said. “Worldwide, I think this has to be on everyone’s radar.”

The second event will be developments out of Ukraine.

“News from the Ukraine and Russia conflict, good or bad, could have a major impact on the direction of the market and the velocity of money,” Leni said. “I think 2023 has the potential to be a much better year for resource sector investors.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Gold Price 2022 Year-End Review ›

- Chris Vermeulen: Gold, Silver, Miners to Hit Major Bottom ›

- Nick Barisheff: Investors Liquidating Gold — "It's Never Happened Like This" ›

- Gareth Soloway: Gold, Silver and Bitcoin Price Predictions for 2023 ›