Drill Tracker Weekly: Pilot Gold Adds Copper-Gold Intersections at TV Tower

Last week, Pilot Gold announced additional results from the Columbaz porphyry on its TV Tower project. Geologist Wayne Hewgill weighs in.

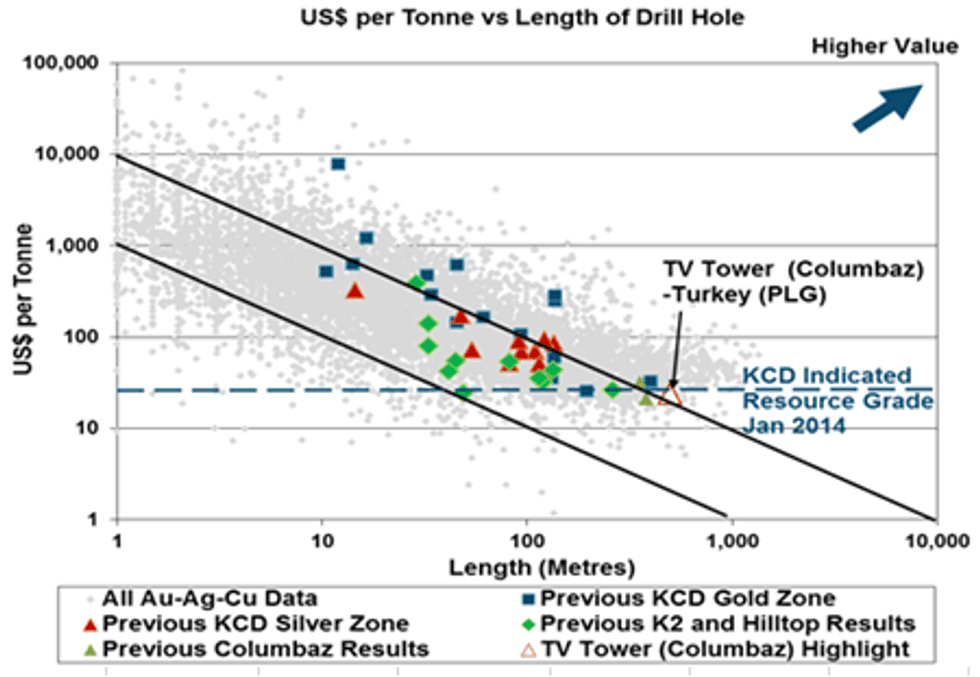

Drill Tracker Weekly highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

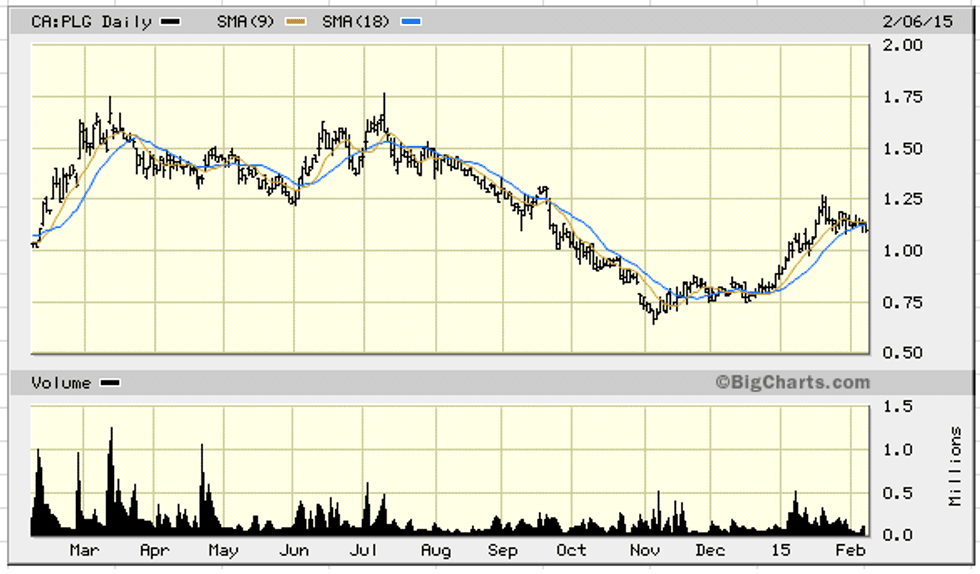

Pilot Gold (TSX:PLG)

Price: $1.10

Market cap: $118 million

Cash estimate: $24 million

Project: TV Tower

Country: Turkey

Ownership: 60 percent

Resources: No resources to date on the porphyries; KCD hosts separate indicated resources of 11.4 million tonnes at 46.7 g/t silver and 11.6 million tonnes at 1.22 g/t gold

Project status: Continued drilling in 2015

- Pilot Gold announced additional results from the Columbaz porphyry on its TV Tower project in Western Turkey. On completion of a 43-101 and technical review by Teck Resources (TSX:TCK.B), Pilot Gold will have earned a 60-percent interest in TV Tower after having completed the $21-million earn in on the project. The company also holds a 40-percent interest with Teck on the nearby Haliaga porphyry.

- The Columbaz porphyry, discovered in October 2014, is the third gold-rich porphyry on the TV Tower project, with the recently discovered Valley and Hilltop porphyries located 6.5 kilometers to the south. Highlights from recent drilling include 499.1 meters grading 0.36 g/t gold and 0.13 percent copper starting from surface. The low-grade porphyry mineralization is overprinted by epithermal gold veins that were the initial drilling target on the prospect. While on the low side with respect to grade, the near-surface occurrence and the project’s proximity to the company’s 40-percent-owned Haliaga porphyry make the three porphyries at TV Tower an attractive target.

- On January 29, 2015, the company announced the results of an updated preliminary economic assessment (PEA) on the Haliaga porphyry, located 15 kilometers to the east of TV Tower. The revised PEA envisions a smaller, but scalable, 25,000-tonne-per-day operation with an initial capital cost of $364 million and operating costs of $1.08 per pound copper (net of by-products). The project has an estimated strip ratio of 1.3:1. The PEA estimates an after-tax NPV (7 percent) of $474 million, a 43.1-percent IRR and a 1.3-year payback.

- The TV Tower project also hosts the KCD silver and K2 oxide gold deposits, which contain 43-101 resources.

Discovery hole (October 2014): 357 meters at 0.6 g/t gold, 0.11 percent copper

Current holes: 499.1 meters at 0.36 g/t gold, 0.13 percent copper; 381.8 meters at 0.34 g/t gold, 0.19 percent copper

Disclosure: I, Wayne Hewgill, certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report.

At the date of this release the author, Wayne Hewgill, owns shares in the following companies:

- Pilot Gold (TSX:PLG)

This report makes not recommendations to buy sell or hold.

Wayne Hewgill is a geologist with extensive knowledge of the global mining industry gained through 30 years of diversified experience in mineral exploration and new business development in Canada, as well as 10 years living in Africa, New Zealand and Australia. He was previously senior research officer at BHP Billiton, an executive with an exploration company working in Argentina and a mining analyst at three Vancouver-based financial groups where he developed the Drill Tracker database in 2006. He holds a B.Sc. in Geology from the University of British Columbia and is registered as a Professional Geoscientist (P.Geo) with APEGBC.