Triumph Gold Announces Results From Rock Sampling And Trenching Along The Irene-Goldstar Epithermal Gold-Silver Corridor, With Samples Grading Up To 93.8 g/t Au And 1108 g/t Ag

Triumph Gold Corp., (TSXV:TIG) (OTC:TIGCF) is pleased to announce results from the 2019 trench and grab sampling program conducted along the Irene-Goldstar Epithermal Gold-Silver Corridor.

Triumph Gold Corp., (TSXV:TIG) (OTC:TIGCF) (“Triumph Gold” or the “Company”) is pleased to announce results from the 2019 trench and grab sampling program conducted along the 3.7 kilometre long Irene-Goldstar Epithermal Gold-Silver Corridor on its 100% owned, 200 square kilometre, road accessible Freegold Mountain Project in the Yukon Territory.

Jesse Halle, Vice President of Exploration for Triumph Gold, comments, “The 2019 trenching program along a 600 metre portion of the Irene-Goldstar Epithermal Gold-Silver Corridor has revealed impressive grades and widths of precious metal mineralization, and suggests that substantial mineralization is present along the Irene-Goldstar trend. Significant opportunities for discovery of new mineralized zones exist along the untested portion of the corridor. A new access road constructed in 2019 will enable additional trenching and drill testing of this mineralized corridor during the 2020 exploration season.”

Highlights of the results include:

- Fifteen grab samples* from outcrop or subcrop in or near to eleven new trenches, including assays of:

- 93.80 grams per tonne (g/t) gold (Au), 1108.0 g/t silver (Ag), 0.28% copper (Cu), 1.51% lead (Pb), and 0.41% zinc (Zn) from sample C00048158

- 8.92 g/t Au, 542.0 g/t Ag, and 1.28% Pb from sample C00048156

- 5.85 g/t Au, 129.0 g/t Ag, and 0.32% Pb from sample C00048153

- Chip-sampling** of bedrock from new trenches yielding anomalous to multi-gram gold and silver, including assays of:

- 2.08 g/t Au, 33.5 g/t Ag, and 0.17% Pb over 4 metres in trench 19RFV-A, including 3.49 g/t Au, 55.0 g/t Ag, and 0.27% Pb over 2 metres

- 3.85 g/t Au, 103.0 g/t Ag, and 0.09% Pb over 2 metres in trench 19RFV-D

- 1.49 g/t Au, 216.0 g/t Ag, 0.12% Cu, 0.55% Pb and 0.10% Zn over 4 metres in trench 19RFV-K

- Sampling extended the Goldstar Vein by 600 metres along strike through the Vindicator Zone. Mineralization along the Irene-Goldstar Epithermal Gold-Silver Corridor remains untested where it may be present beneath vegetation between the Vindicator Zone and the Irene Zone, 2000 metres to the northwest.

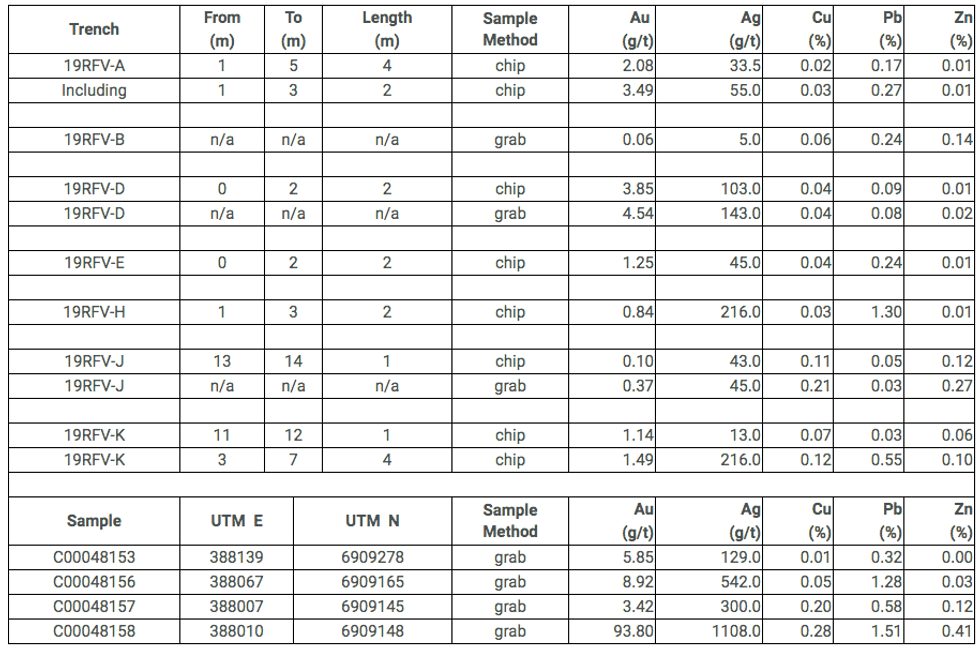

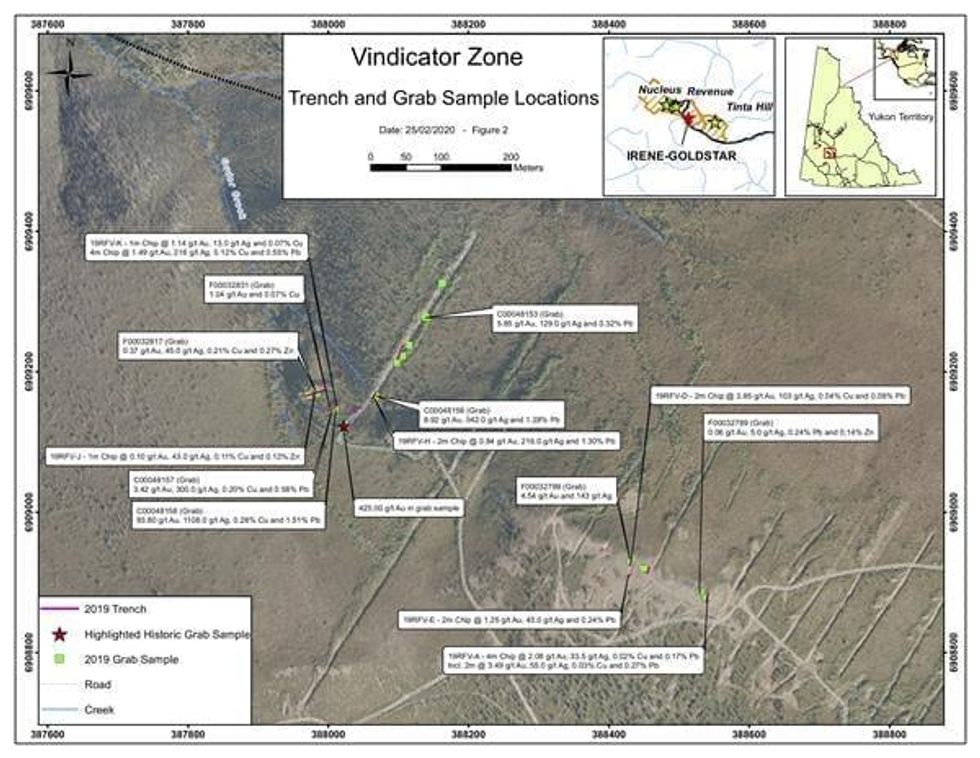

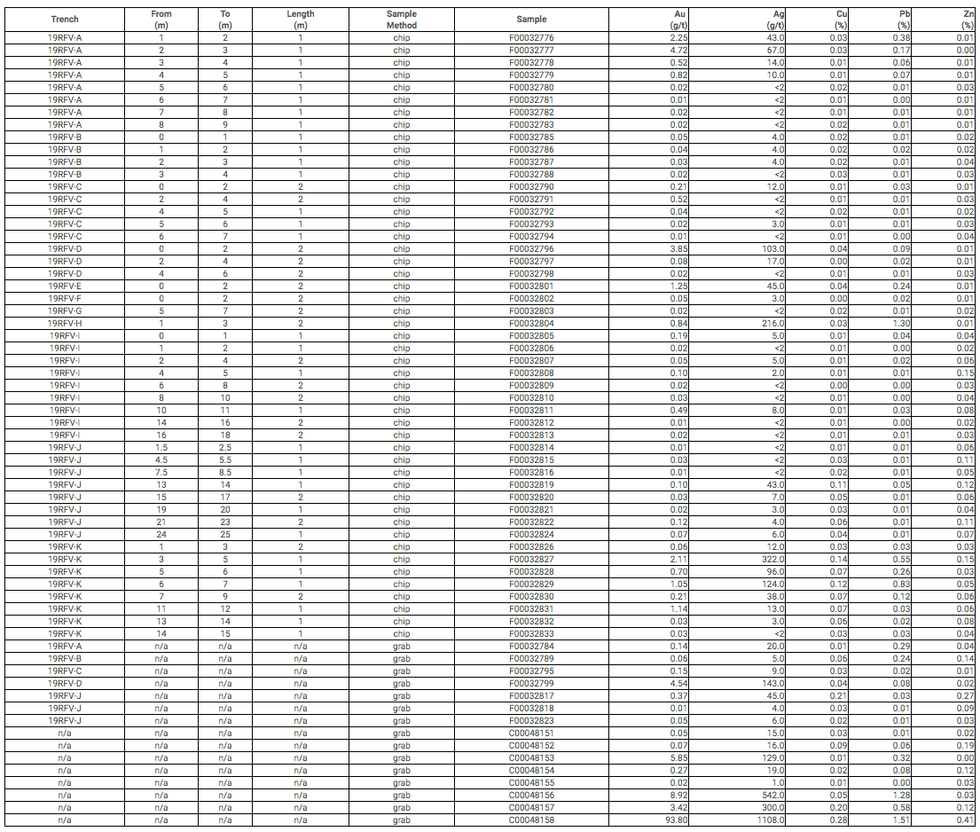

Refer to Table 1 for a list of significant grab sample assays and length-weighted chip sample assays. Figure 2 depicts the locations of these assay highlights. Table 2 presents all 64 assay results from the Vindicator Zone (Figure 1).

Table 1: Highlights of 2019 chip and grab samples from within or close to trenches along the Irene-Goldstar Epithermal Gold-Silver Corridor

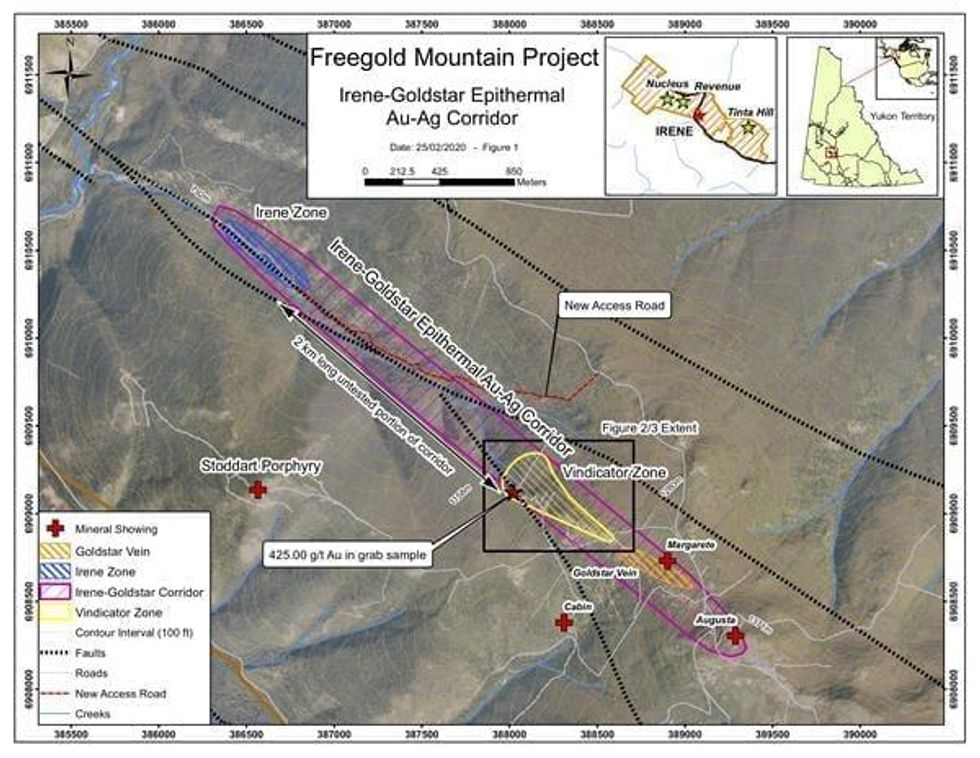

The Irene-Goldstar Epithermal Gold-Silver Corridor is a 3.7 kilometre long zone of epithermal-related gold-silver and base metal mineralization that extends from the historic Goldstar Vein and Skarn system near the Mount Freegold summit and continues through the Vindicator Zone to the Irene Zone in Guder Creek at the bottom of the mountain (Figure 1). The corridor is associated with a major splay of the regionally important Big Creek Fault. In 2018, eleven shallow drill holes targeted the Irene Zone and resulted in numerous intercepts of quartz veins with precious and base metals that graded up to 20.7 g/t Au over 0.70 metres (see PR#19-02 dated January 24, 2019). The 2018 drill program at Irene defined a mineralized strike length of 450 metres that is open to the northwest and to the southeast, where the Vindicator Zone is found 2000 metres away.

The Vindicator Zone has seen sporadic and poorly-documented exploration since the 1960’s. The Goldstar Vein has been extensively trenched and was tested with approximately twelve shallow drill holes. In 1989, C.A. Main estimated a mineral inventory at the Goldstar Vein with 123,000 tonnes of 4.21 g/t Au and 47.2 g/t Ag contained within a shallow pit approximately 250 metres long by 60 metres deep; this historical estimate should not be relied upon, as a Qualified Person has not done sufficient work to classify the estimate as a current mineral resource. Triumph Gold geologists believe the mineralization at the Goldstar Vein and the Vindicator Zone are parts of a much larger mineralized system termed the Irene-Goldstar Epithermal Gold-Silver Corridor.

Between 2005 and 2007, sixteen grab samples were collected from subcrop at the Vindicator Zone returning gold assays ranging from 0.015 g/t Au and 0.2 g/t Ag to 425 g/t Au and 321 g/t Ag. The location of the historic high-grade gold sample is shown in Figure 2. The locations of the 2005 and 2007 samples have not been verified by Triumph.

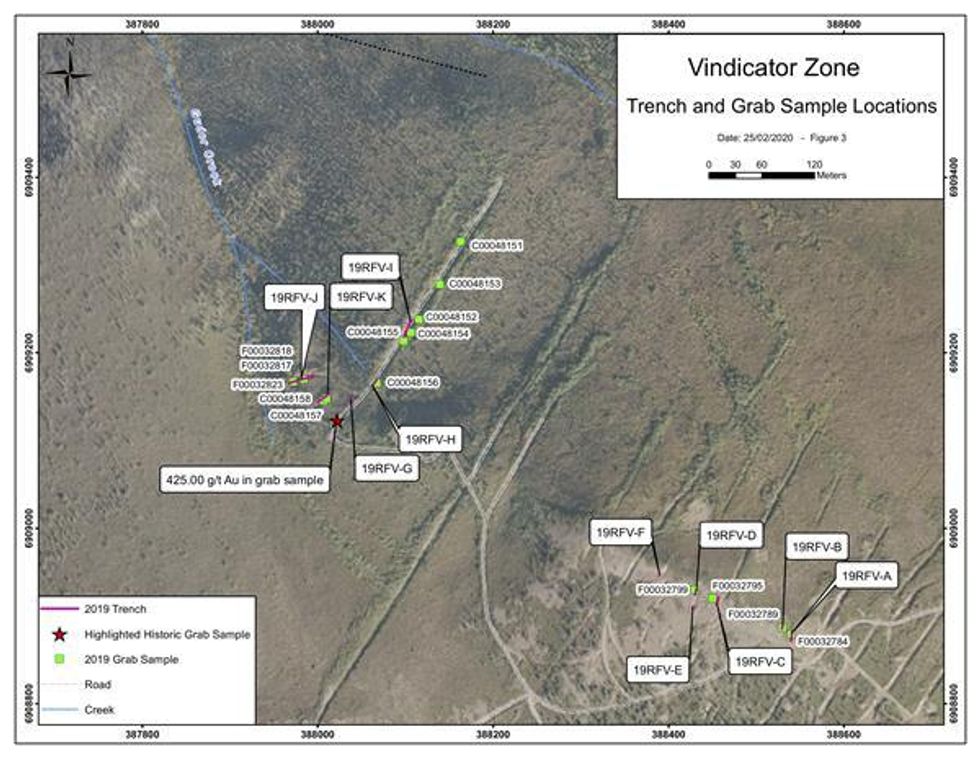

The 2019 sampling program at the Vindicator Zone aimed to confirm historic high-grade samples, characterize the contained polymetallic mineralization, and generate grade and thickness data. A total of 49 linear chip samples and seven grab samples were collected from trenches at the Vindicator Zone. An additional eight reconnaissance-style grab samples were collected throughout the Vindicator Zone (Tables 1, 2, Figure 3). Several areas adjacent to the highest grading samples were not sampled due to the depth limitations of hand-trenching.

Geology of the Vindicator Zone and Goldstar Zone

The Vindicator Zone is hosted in gossanous, schistose to gneissic metasedimentary rock of the Yukon Tanana Terrane. Mineralized domains up to 8 metres in width have been documented in eleven trenches spanning a 600 metre strike-length. Mineralization is associated with 1 to 15 centimetre thick epithermal quartz veins and adjacent domains of sericite-altered wall rock. Sulphides, including pyrite, chalcopyrite, galena and sphalerite, occur in quartz veins and disseminations in wall rock but are rarely preserved in hand sample due to surface weathering and oxidation.

Triumph Gold is planning a machine trenching and diamond drilling program for the Vindicator Zone in 2020, as well as a diamond drilling program designed to close the 2000 metre gap between the Vindicator and Irene Zones along the 3.7 kilometre long Irene-Goldstar Epithermal Gold-Silver Corridor.

Figure 1: Freegold Mountain Project, Irene-Goldstar Epithermal Au-Ag Corridor

Figure 2: Vindicator Zone, Trench and Grab Sample Highlights

Figure 3: Vindicator Zone, Trench and Grab Sample Locations

Sampling, Assaying and QAQC

Subhorizontal linear chip samples ranged between one and two metres in length. All chip samples were collected with a rock hammer. Chip and grab samples were analyzed by SGS Canada of Vancouver, British Columbia. Samples were prepared for analysis according to SGS method PRP89: each sample was crushed to 75% passing 2 millimetres and a 250 gram split was pulverized to P85 75 micron. Gold was tested by fire assay with atomic absorption finish on a 30 gram nominal sample (method GE FAA30V5), samples that tested over 10 grams per tonne gold were retested using a 50 gram sample with gravimetric finish (method GO FAG50V), and samples testing over 100 grams per tonne silver were retested using an adjusted sample weight and final solution volume ratio (method GO ICP42Q100). An additional 33 elements were tested by ICP-AES using a four-acid digestion (method GE ICP40Q12). Quality assurance and control (QAQC) is maintained at the lab through rigorous use of internal standards, blanks and duplicates. An additional QAQC program was administered by Triumph Gold: at minimum three quality control samples, consisting of blanks and certified reference standards, were blindly inserted into the trench sample batch. QAQC samples that return unacceptable values trigger investigations into the results and reanalysis of the samples that were tested in the batch with the failed QAQC sample.

Table 2: Assay results of all 2019 Vindicator and Goldstar chip and grab samples

Notes

* Grab samples are selective in nature, therefore reported mineralization and assay results may not be representative.

** Length refers to sample length. True widths have not been determined.

*** Coordinates are given in UTM coordinates, NAD83, Zone 8.

Qualified Person

The technical content of this news release has been reviewed and approved by Jesse Halle (P.Geo.), Vice President Exploration for the company and qualified person as defined by National Instrument 43-101.

About Triumph Gold Corp.

Triumph Gold Corp. is a growth oriented Canadian-based precious metals exploration and development company. Triumph Gold Corp. is focused on creating value through the advancement of the district scale Freegold Mountain Project in Yukon. For maps and more information, please visit our website www.triumphgoldcorp.com

On behalf of the Board of Directors

Signed “Tony Barresi”

Tony Barresi, President

For further information please contact:

John Anderson, Executive Chairman

Triumph Gold Corp.

(604) 218-7400

janderson@triumphgoldcorp.com

Nancy Massicotte

IR Pro Communications Inc.

(604)-507-3377

nancy@irprocommunications.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectation. Important factors – including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities – that could cause actual results to differ materially from the Company’s expectations are disclosed in the Company’s documents filed from time to time on SEDAR (see www.sedar.com). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.