Beating Inflation With a Pocketful of Gold

History shows that inflation and interest rates both have a pronounced impact on the gold price. How can investors use that to their advantage?

When inflation rears its ugly head, as it inevitably does, gold can be one of the more useful assets to protect investors' money. This is because inflation and the gold price share a direct relationship; when inflation rises, so does the price of gold.

Inflation, put simply, is when prices for goods and services increase over a period of time. Things become more expensive, which means income doesn't stretch as far.

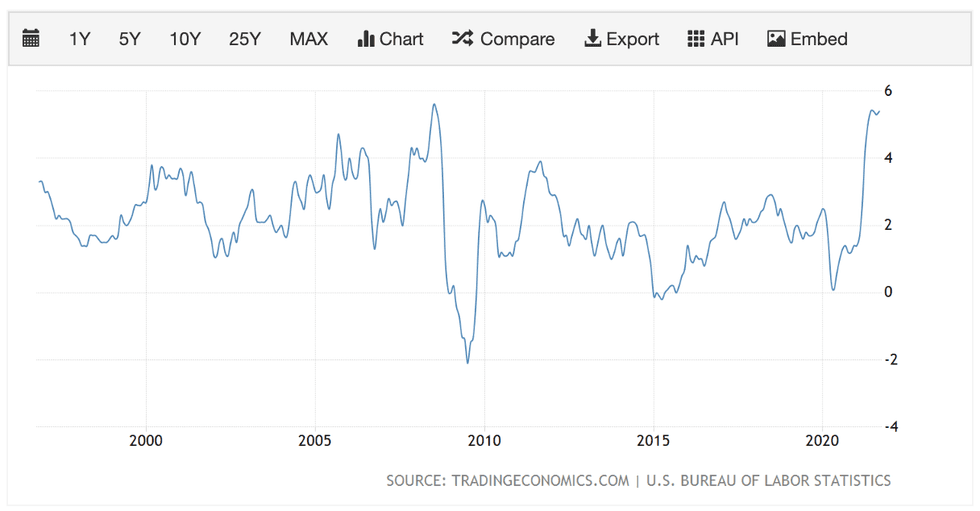

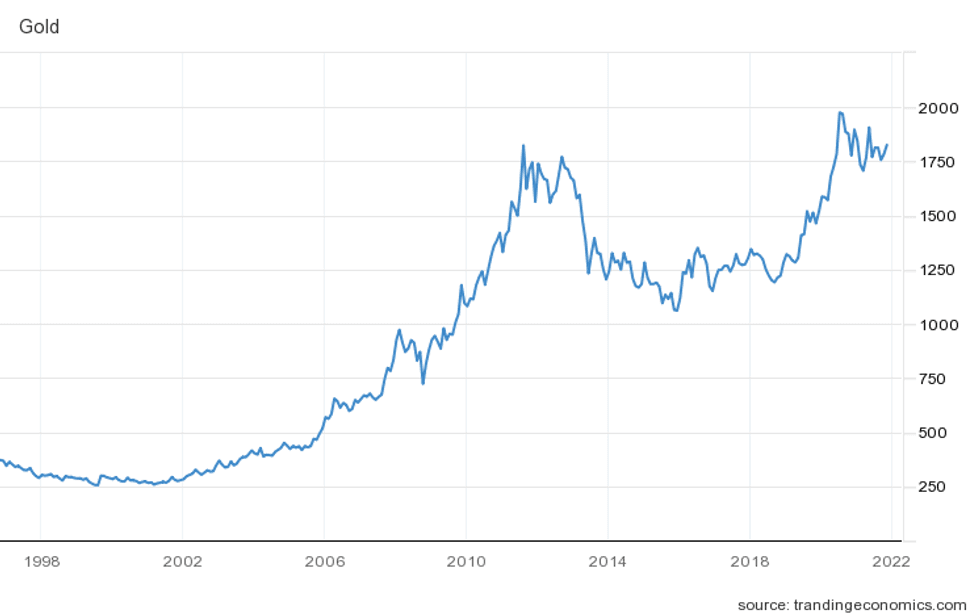

While gold has generally risen over the last 25 years, troughs in the price tend to correlate to falls in inflation.

A good example of this is what happened in 2020, when the coronavirus pandemic wrecked the economy, forcing lockdowns, which in turn affected demand for goods and led to a fall in inflation — and a similar fall in the price of gold.

The chart below shows annual inflation rates in the US in the last 25 years.

And the following chart shows the price performance of gold in the same period.

Gold and inflation: Why does inflation affect the gold price?

Because inflation makes the money you have tomorrow worth less than the money you have today, it becomes attractive to change money into other assets whose intrinsic value appreciates in the long term.

Gold has this intrinsic value for several reasons. It's a scarce metal, but abundant enough to be mined, and it doesn't corrode easily. Additionally, humans have an emotional connection to it because of its shine and hue.

It's also considered a "safe haven" asset because of its ubiquitous acceptance, especially in times of turmoil and political, social or economic unrest. It's this human connection (both individual and societal) that makes gold valuable, and explains why it's always in demand, even while supply has been relatively stable.

So when inflation rises and investors look for assets to protect their money, gold becomes an option, driving up demand and thus its price.

However, inflation also leads to rising interest rates, which are used to curb inflation; in turn, higher interest rates generally lead to gold price falls. As interest rates rise, the return on investments in other assets (like bonds) also rises, pulling in capital from investors abroad. As a result, the US dollar strengthens, increasing its purchasing power and making gold a less attractive investment option.

Gold and inflation: Using gold as a hedge

A "hedge" is when investors use other strategies and investments to offset the risks of price movement in a particular investment. Investors can hedge against many things: currencies, commodities and even inflation.

To hedge against inflation, the strategy should be to invest in such a way that you receive returns even after inflation has eroded the value of the investment.

It then becomes obvious why gold makes for a decent hedge against inflation. Because inflation increases prices for all things, its effect is felt on the price of gold as well — the yellow metal becomes more valuable in comparison to the currency it's priced in.

Buying gold in anticipation of inflation means that when inflation does hit, the investment will give you a positive return. There are many ways to invest in gold, as listed here.

However, buying gold when inflation warning bells have already rung would be akin to buying it at a high, and then watching the price fall as monetary policy kicks in to manage the inflation.

Gold is also not a perfect hedge against inflation. In fact, other assets are equally viable, from commodities (like oil) to equities and even real estate. Data suggests that gold has, at best, a mixed track record as a hedge, especially in the short to medium term.

Gold and inflation: What’s the outlook on gold?

Gold has risen more than 400 percent in the last 30 years, but also has a mixed track record in the last 10 years (only up 1.5 percent), so holding it for the long term would be the safest way to play the asset.

After its steady rise during the past year, the yellow metal has begun cooling off. Interest rate action by the US Federal Reserve will be a key trigger for the price going ahead, along with more potential economic shocks if coronavirus variants cause further lockdowns.

If interest rate hikes do come, analysts expect gold to fall further, but not significantly enough to be termed a rout. Keen-eyed investors may want to pick up gold then and hold on to it as a long-term allocation in their portfolio.

Don't forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Pallavi Rao, hold no direct investment interest in any company mentioned in this article.

- The Silver Edge to Inflation Hedging | INN ›

- Inflation Data Not Telling Whole Story, Kazatomprom's Uranium Update | INN ›

- 3 Things Warren Buffett Has Said About Gold | INN ›

- Trump and the Gold Standard | INN ›

- Volatile Gold Breaks US$1,970 as Russia Begins Assault on Ukraine | INN ›

- Geopolitical Risk Pushes Gold Above US$2,000, Oil and Palladium Hit Fresh Highs | INN ›

- Alluvial Mining: Gold, Diamonds and Platinum | INN ›

- Satellite Imagery and Gold Exploration | INN ›

- Expert Panelists Agree — “Gold is Absolutely on Sale Now” ›

- Inflation High, Markets Volatile — Experts Talk Strategies for Tough Times ›