Drill Tracker Weekly: Dalradian Intersects High-grade Gold at Curraghinalt Project

Dalradian Resources announced results from the ongoing underground infill drill program at its Curraghinalt project in Northern Ireland.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Dalradian Resources (TSX:DNA)

Price: $0.87

Market cap: $141 million

Cash estimate: $45 million

Project: Curraghinalt

Country: Northern Ireland

Ownership: 100 percent

Resources: 2.98 Mt @ 10.34 g/t Au indicated

Project status: Prefeasibility underway

- Dalradian Resources announced results from its ongoing underground infill drilling program on its 100% owned Curraghinalt project in Northern Ireland. Dalradian acquired the project in December 2009 and subsequently raised $39 million in 2010 through an IPO.

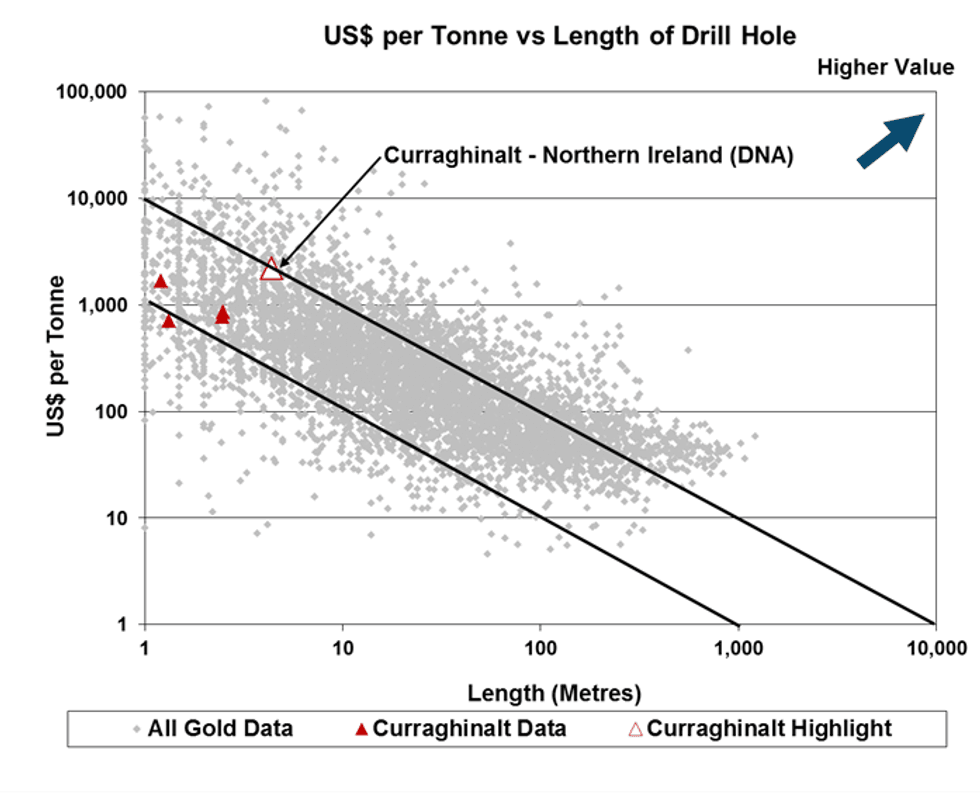

- Highlights from the current infill drilling within the central part of the known Curraghinalt deposit include 4.40 metres grading 54.84 g/t Au in the 106-16 vein and 4.74 metres of 15.26 g/t Au from the No.1 vein. The 1,100 metres underground development and 20,000 metre infill drilling program is designed to upgrade the inferred resource into the indicated class and to increase the confidence in the continuity of the nine principle veins. The known mineralization occurs as narrow veins over an area of approximately 1.7 kilometres of the 12 kilometer Curraghinalt trend.

- In January 2014, the Company announced an updated 43-101 compliant indicated resource estimate of 2.98 million tonnes grading 10.34 g/t Au with an additional 8.01 million tonnes of 9.67 g/t Au in the inferred class. The Company expects to complete an updated resource estimate by Q4/2015 with a subsequent prefeasibility by year end. With $45 million in cash, the Company is well funded to complete the necessary drilling and prefeasibility study.

- The October 2014 PEA outlined a low capital cost, high-margin project with a post-tax NPV (8%) of $366 million and an IRR of 29.9% using a $1,024 gold price. At a $1,200 gold price the NPV (8%) increases to $504 million and the IRR to 36.2%. Including a $48 million contingency, the project is projected to come in at a relatively low $249 million capital cost with a 2.6 year payback. The cash operating costs are projected at $485 per ounce gold.

Curraghinalt history: First gold reported nearby in 1652. Rio Tinto explores for base metals (1970s). Dalradian acquires in 2009 after 56 historical holes.

Current drilling: 4.40 metres @ 54.84 g/t Au; 4.74 metres @ 15.26 g/t Au.

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report:

- Integra Gold Corp. (ICG) is currently under coverage at Mackie Research Capital by analyst Peter Campbell.

- In March 2014, Peter Campbell visited the Lamaque Gold Project in Val-d’Or, Québec. Travel to and from the site in Val d’Or were paid by Integra Gold Corp.

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.