The research firm predicts that production of the raw material could rise from 211,000 tonnes in 2019 to a peak of 450,000 tonnes in 2027.

As demand from the electric vehicle (EV) space continues to accelerate, nickel sulfate supply will struggle to meet demand, with output expected to peak in 2027, according to Wood Mackenzie.

The research firm predicts that production of the raw material could rise from 211,000 tonnes in 2019 to a peak of 450,000 tonnes in 2027. The EV sector could drive demand to reach 800,000 tonnes by 2035.

Nickel sulfate is a key element in the cathodes of the lithium-ion batteries used to power EVs, but it has historically been used in solution as the electrolyte in nickel plating. As a more minor application, nickel sulfate is used to manufacture catalysts.

Commenting on prices for nickel sulfate, Woodmac Research Director Andrew Mitchell said existing and would-be nickel producers are being drawn to the possibility of manufacturing sulfate to benefit from perceived premiums payable on nickel sulfate sales.

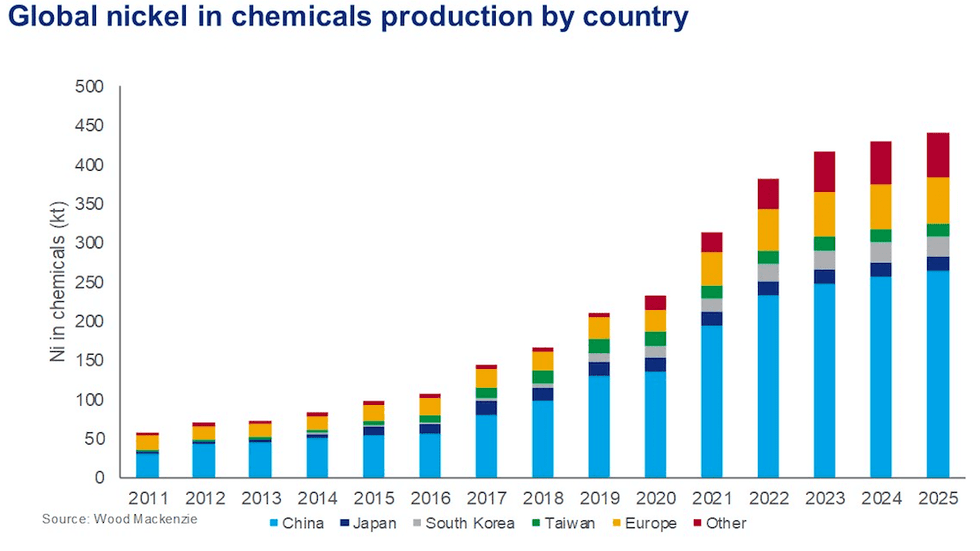

Chart courtesy of Wood Mackenzie.

“While premiums have long been recognized in the plating sector, it is less clear in the EV battery space. The only visibility on pricing is Chinese selling prices,” he said.

A price premium is necessary to cover the additional processing costs to produce the sulfate. According to Woodmac data, net of feed purchase costs, the cost of producing nickel sulfate from mixed hydroxide precipitate averages US$3,500 per tonne nickel, or US$1.60 per pound.

“So, while higher prices for nickel sulfate over SHFE nickel prices can prevail, these may not result in increased margins for the producer,” Mitchell said. “Clearly there is no guarantee that high premiums now equate to similarly high premiums in the future.”

That said, he added that as demand for nickel sulfate from the battery sector is expected to accelerate, it is feasible that premiums will be available in the years ahead. The sector’s requirements for higher-purity nickel sulfate are a key consideration.

For Woodmac, achieving these higher purities will require investment, and the additional costs would have to be passed on to the market and reflected in the pricing of the premium material.

Despite its optimistic outlook for the space, the research firm expects the nickel sulfate market to move into surplus this year, and potentially remain oversupplied through to at least 2025.

Additional material is expected to come from three high-pressure acid leach plants currently under construction by Chinese groups in Indonesia, which have a combined capacity of 160,000 tonnes of contained nickel — all destined to produce nickel sulfate.

However, looking ahead, increased nickel sulfate production will be needed to meet the forecast growth in demand, particularly from the EV sector. Woodmac estimates that around 500,000 tonnes of additional nickel in sulfate will be required over the eight year period from 2028 to 2035.

“Clearly, meeting this rising demand will be a challenge for the industry, but it does provide opportunities for those with nickel projects waiting in the wings to press ahead with development, if funding can be secured,” Mitchell said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.