Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain Strong

What’s in store for nickel in 2022? Experts share their nickel outlook, from supply and demand dynamics to price predictions.

Click here to read the latest nickel outlook.

Nickel’s price performance surpassed expectations in 2021, with the metal rallying above US$20,000 per tonne as demand showed signs of recovery.

The base metal’s main demand driver will continue to be stainless steel for some time, but interest in nickel’s use in electric vehicle (EV) batteries continues to pick up pace.

As the year comes to a close, the Investing News Network (INN) asked analysts in the field for their thoughts on what’s ahead for the base metal. Read on to find out what they had to say.

Nickel outlook 2022: Price performance review

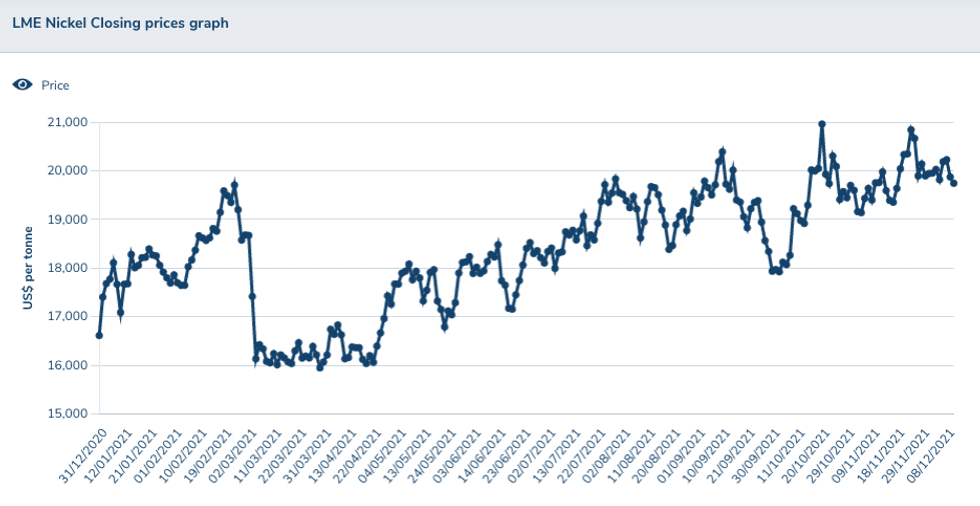

Volatility reigned in the nickel market in 2021, but it's difficult to deny the metal had an outstanding year. Prices increased over 16 percent, breaking the US$20,000 mark and hitting a more than seven year high.

“The biggest surprise was the price performance of nickel,” Marta Dec of CRU Group told INN.

“We were not expecting a big price drop for 2021, but I don't think anyone anticipated just quite how high the price was going to go,” she added.

Kicking off 2021 on an already bright note after a 2020 that saw prices fall sharply, nickel opened the year at US$17,344. The COVID-19 pandemic hurt the base metal as it did many other markets, but speculation around demand for nickel in EV batteries helped prices rebound in 2020.

The reopening of economies after strict restrictions due to COVID-19 supported prices in the first quarter of 2021 as well. In Q2, following news from top producer Tsingshan that eased concerns over a supply shortage, prices experienced a steep decline.

However, before the second quarter finished, nickel bounced back, performing in a choppy fashion, but increasing to end the year trading above US$20,000.

Sharing his thoughts with INN, Andrew Mitchell, Wood Mackenzie's head of nickel research, said that, broadly speaking, the nickel market performed as expected. His firm started the year with a 2021 price forecast of US$19,400, with prices now likely to average around US$18,500 for the year.

Nickel outlook 2022: Supply and demand dynamics

Looking back at how analysts thought market dynamics would develop in 2021, many anticipated a strong demand recovery. However, Mitchell said both demand and supply were stronger than expected at the start of the year.

“The increase in production in Indonesia has been nothing short of astounding, but also the rebound from the COVID hit in 2020 in terms of demand has also been much stronger than expected,” Mitchell said.

At the end of 2020, CRU was expecting a balanced market; however, in 2021 nickel is looking to end up in a deficit.

“I think that's definitely something we didn't entirely expect back in 2020,” Dec said. “Perhaps we underestimated the recovery of the demand, as well as we didn't expect some ex-nickel pig iron (NPI) underperformance this year.”

In fact, major producers Norilsk Nickel (MCX:GMKN) and Vale (NYSE:VALE) have reported lower output this year.

For its part, Russian nickel and palladium miner Norilsk Nickel experienced disruptions at its Oktyabrsky and Taimyrsky underground mines and concentrator. Meanwhile, Brazil-based Vale’s production of finished nickel was hit mainly due to the labor disruption at Sudbury, with the company also lowering its guidance for 2022 on the back of disruptions and license issues at Onca Puma.

As 2022 kicks off, all eyes will continue to be on the world's biggest nickel-producing countries: Indonesia and the Philippines. In 2020, Indonesia produced 760,000 metric tonnes of nickel, while the Philippines' output hit 320,000 metric tonnes, according to the US Geological Survey.

Commenting on the challenges miners in these top-producing countries face going forward, Mitchell said they are essentially to do with local legislation related to environmental, social and governance issues, as well as limiting the export of semi-finished materials.

“Indonesia has been talking about banning exports of nickel products containing less than 70 percent nickel, and the Philippines has recently relaunched a bill to possibly phase out ore exports in the same manner as Indonesia did to encourage domestic processing,” he said. “Either of these could have a significant impact on nickel supply.”

Another factor to watch for in these countries is the heavy rain months, which can cause disruptions to supply.

“We do see quite often lower production rates during the heavy rain months,” Dec said. “It’s the period of the year that is normally prone to lower production.”

Looking ahead, Mitchell pointed out the need for new supply to come online into the market.

“But even at current elevated nickel prices we are not seeing any rush in lending to develop new nickel projects,” he said, adding that funding will remain a significant challenge for junior miners entering 2022.

When asked about which regions she is keeping an eye out for, CRU’s Dec said she is watching projects in Brazil and the Americas, mentioning Sibanye-Stillwater’s (NYSE:SBSW) investment in the Santa Rita nickel mine in Brazil as an interesting development for the space.

“I think the financing of such operations in that region is definitely the biggest challenge for juniors,” she said. “So somebody with the size of Sibanye’s wallet could definitely make them happen.”

Another region CRU is paying attention to is Australia, in particular Sunrise Battery Metals' (ASX:SRL) Sunrise operation. The project is a high-pressure acid leach (HPAL) operation that is set to have on-site production of nickel sulfate — the material required to make battery precursors.

“It sounds like a great solution to not have to send out material for further processing elsewhere, but to keep the value chain in one place,” Dec said.

Looking over to demand side of the story, the battery segment has received a lot of attention in the past year due to nickel's use in cathodes for EVs. However, not all cathodes use nickel. In fact, during 2021 there was a resurgence of interest and use of lithium-iron-phosphate (LFP) cathodes — mainly in China — which has brought some concerns for nickel and cobalt investors.

“The resurgence of LFP is predominantly a China story for the present, but elsewhere, ternary batteries remain favored,” Mitchell said. “In the near term in China, LFP will potentially reduce nickel demand, but longer term there is still a growth story.” Wood Mackenzie expects LFP to continue to take about 25 percent of market share.

But Dec pointed out that LFP cathodes are already accounting for more than two-thirds of the top 10 EV models.

“It's quite natural that when you have a much lower-cost solution, it is always going to be a threat to a nickel-rich battery chemistry,” she said. “However, we do see this developing where a lot of the original equipment manufacturers will offer LFP cathodes for the standard range and nickel-cobalt-manganese cathodes for the longer range and higher price, so there will be this differentiation,” she added.

“As time goes by, it will be up to the consumers — but there is a differentiation, they are not used for the same type of vehicle, they provide two different things.”

That said, it is important for investors to keep in mind that, despite the future demand expected from batteries, stainless steel remains the main driver of nickel demand, and will continue to be key for the market into 2022.

“While there is much excitement about the energy transition and vehicle electrification, stainless remains the primary demand area for nickel, and this is continuing to grow in output, particularly in China and Indonesia,” Mitchell explained in conversation with INN.

According to the International Nickel Study Group, global demand for nickel is expected to increase to 3.04 million tonnes in 2022 from 2.77 million tonnes in 2021.

Overall, CRU expects to see steady demand in 2022. “We don't see a deficit. We do see a relatively balanced market,” Dec said. Wood Mackenzie also expects to see a balanced market for 2022 currently, with the risk on the oversupply depending on the growth in new capacity in Indonesia.

Nickel outlook 2022: What’s next?

Commenting on catalysts to keep an eye out for in 2022, Mitchell said recycling will be a key focus area.

“Recycling developments are gaining pace, and these ventures will be key to augmenting nickel supply in the future,” he said. “But all eyes will be on the HPAL and repurposed NPI lines to produce matte in Indonesia and how they perform. And what happens with the Filipino move to gradually cease ore exports.”

Speaking specifically about junior miners in 2022, Dec emphasized the need for funding as a key challenge.

“I think this remains the problem: Perhaps producers or those that could be funding them need to believe that the nickel price is sustainable to enter an investment to get such exposure,” she said.

Another challenge for miners is trust — in particular related to venturing into new technologies.

Looking over to prices, Wood Mackenzie expects nickel prices to remain strong at about US$19,800 in nominal dollar terms. Similarly, CRU expects prices to remain at high levels.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Nickel Trends 2021: Nickel Prices Soar, Demand Shows Signs of Recovery | INN ›

- Ways to Invest in Nickel | INN ›

- 10 Top Nickel-producing Countries | INN ›

- Iron Outlook 2022: Prices Under Pressure on Bearish Demand Outlook | INN ›

- Lead Outlook 2022: Demand to Recover, Prices Likely to Remain High | INN ›

- 5 Top Weekly TSX Performers: Nickel and Cobalt Producer Sherritt Up Over 35 Percent | INN ›

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Commodities Outlook: Blackrock Expects Prices to Remain High for Decades | INN ›

- VIDEO - CRU Group: Coronavirus Uncertainty to Impact Nickel Outlook | INN ›

- Private Placements Explained | INN ›

- Nickel Price Hits Record US$100,000 on Short Squeeze, LME Suspends Trading | INN ›

- Nickel Price Forecast | INN ›

- LME Halts Nickel Trading Again on Technical Issue Soon After Reopening | INN ›

- Top Nickel Reserves by Country | INN ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated February 2022) | INN ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated February 2022) ›

- Nickel Price Update: H1 2021 in Review | INN ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated March 2022) | INN ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated April 2022) ›

- Nickel Price Update: Q2 2022 in Review ›

- Nickel Price Update: Q1 2022 in Review ›

- Nickel Price Update: Q1 2022 in Review ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated June 2022) ›

- Nickel Price Update: Q2 2022 in Review ›

- Scaling Up Nickel Supply in North America is Not Going to Be Easy ›

- Nickel Price Update: Q3 2022 in Review ›

- Top 5 Nickel Stocks on the TSX and TSXV (Updated August 2022) ›