Nickel Trends 2021: Nickel Prices Soar, Demand Shows Signs of Recovery

What nickel trends drove prices in 2021? We run through top supply, demand and price catalysts in this overview of the space.

Click here to read the previous nickel trends article.

The COVID-19 pandemic hit the nickel market hard in the first few months of 2020, but a sharp rebound in prices in the second half set the tone for what nickel would experience in 2021.

The base metal traded below the US$16,000 per tonne mark for only a few days throughout the 12 month period as demand in key markets rebounded and concerns over supply in the last quarter of the year grew.

For investors interested in nickel, here the Investing News Network (INN) looks back at nickel trends for 2021, including supply and demand dynamics, how the metal performed and what analysts said quarter by quarter.

Nickel trends Q1: Prices tumble as supply fears ease

Nickel started the year trading at US$17,344 following an uncertain 2020 that saw the metal fall in Q1, but bounce back by the end of the year. Speculation surrounding demand for electric vehicle (EV) batteries drove prices last year, with many analysts agreeing that the metal’s valuation was not reflecting market fundamentals.

During the first three months of 2021, prices hit their lowest point of the quarter, trading at US$15,907 in early March just a few days after hitting their highest level of the period in late February at US$19,689.

Nickel had been on the rise, supported by concerns over high-grade nickel supply shortages. However, prices tanked after Tsingshan, the world’s top nickel producer, announced that it would convert nickel pig iron (NPI) into nickel matte to serve the battery sector, Jack Anderson of Wood Mackenzie told INN back in July.

At the time, the Chinese stainless steel maker said it also planned to expand its investments in Indonesia, and expected its nickel equivalent output to reach 600,000 tonnes this year, 850,000 tonnes in 2022 and 1.1 million tonnes in 2023. However, these numbers may change as the company stated it will adjust output of nickel matte and NPI based on demand and prices.

Further explaining the news and its impact on the sector, Karen Norton of Refinitiv said that this raised concerns that potentially a substantial amount of the country’s vast NPI industry could adapt to satisfy demand for both the stainless steel and battery sectors.

“Production of matte via this route is not the cheapest (and) has yet to be proven on a commercial scale, but at the very least it might provide a short-term solution to an anticipated supply crunch in nickel sulfate,” she noted.

This potential solution eased fears over a possible shortage, resulting in nickel prices tumbling to their lowest level of the quarter, just below US$16,000. That said, prices were still up almost 35 percent compared to Q1 2020.

Nickel trends Q2: Nickel demand recovers

Nickel continued to perform in a choppy fashion throughout the rest of the first half of 2021, and ended the second quarter trading above US$18,000.

“(This was due to) strong demand from the stainless steel and battery sectors,” Anderson told INN. “The narrative for strong nickel demand from batteries amid President (Joe) Biden’s US Green New Deal for an economic recovery, and general tightness in the nickel market, has also helped to support prices.”

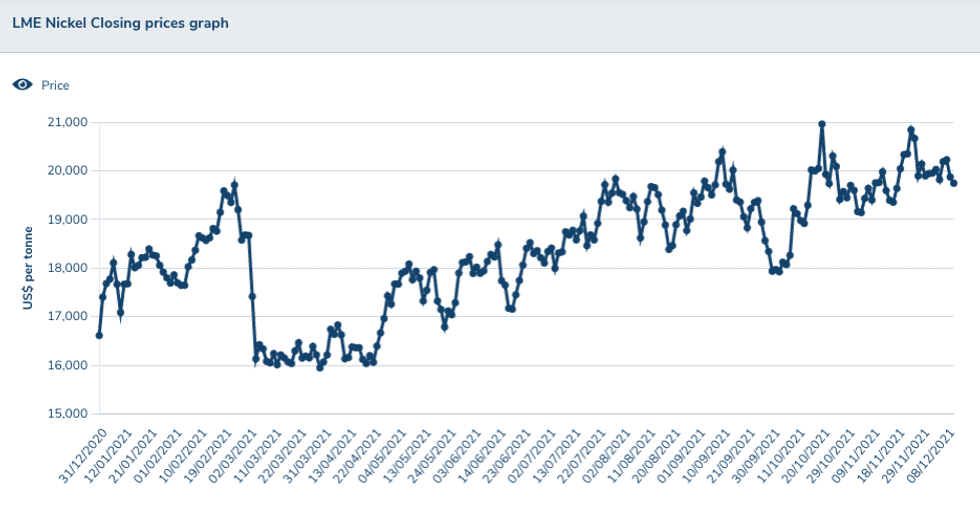

Nickel's 2021 price performance.

Chart via the London Metal Exchange.

Nickel is a key element used in cathodes for electric car batteries, and many believe demand from this sector will increase significantly in coming decades.

Despite the speculation around demand from the battery segment, production of stainless steel, which accounts for around 70 percent of nickel demand, will be the key driver for years to come, Norton said.

“Indeed, stainless output in both China and Indonesia has grown strongly in the first part of 2021,” she said. “In China, the picture benefits in part from comparison with the COVID-19-related decline in the early months of 2020, while Indonesia’s still fairly nascent stainless sector continues to ramp up.”

During the second quarter of the year, sentiment around base metals improved as economies continued their vaccination efforts around the world and demand forecasts improved.

Nickel ended the first half of the year hovering around the US$18,000 per tonne mark, to end at US$18,214.

Nickel trends Q3: Nickel hits seven year high

Q3 of this year also saw volatility in prices, with nickel trading between the range of US$18,000 to US$20,000.

“Nickel prices reached a near seven-year high at the end of July, supported by solid demand for stainless steel — the main end-use of nickel — particularly from China,” a FocusEconomics report from August reads.

“This, coupled with shortages of ferroalloys due to the country’s output curbs, sent Chinese stainless steel futures flying, buoying nickel prices in turn.”

In early September, nickel tested the US$20,000 level for the first time in the year, reaching its highest point of the quarter, and a seven year high, on September 10, when it was trading at US$20,392.

Supply shortages created by a sharp rise in demand from stainless steel mills and EV battery makers, along with sliding stocks, supported the rise in prices.

“Stainless steel production, the main use of nickel, is set to grow by 16 percent this year, adding 250,000 tonnes to nickel demand. Nickel used in batteries is set to grow by 100,000 tonnes this year to around 290,000 tonnes,” Jim Lennon of Macquarie told Reuters back in September. “The nickel market has swung into a large deficit … despite large growth in Indonesian nickel supply of over 300,000 tonnes this year.”

However, after their steep rise, nickel prices tumbled by the end of the quarter, pulling back to end the period trading at US$17,936.

Nickel trends Q4: Uptrend continues

The last quarter of the year kicked off with prices trading around the US$18,000 level. Although far from the U$20,000 mark reached in July, it represented a 25 percent increase year-on-year.

“August data released by the World Steel Association revealed that global output tumbled for the first time since July 2020, chiefly owing to China’s production curbs in line with its emission targets,” FocusEconomics analysts explained back in October. “This, coupled with power restrictions at Chinese mills for stainless steel further sparked concerns of waning demand from the Asian giant and weighed on prices in turn.”

Nickel prices rebounded throughout the quarter as downbeat output data from key producers sparked concerns over supply. By mid-October, prices reached their highest level of the year so far, trading at almost US$21,000.

In November, the International Nickel Study Group released a report saying that in the first nine months of the year, the nickel market saw a deficit of 174,900 tonnes versus a surplus of 88,000 tonnes in the year-ago period.

“The global nickel market deficit narrowed to 5,200 tonnes in September from a shortfall a month earlier of 14,600 tonnes,” the report states.

Nickel prices have maintained their uptrend so far this quarter, despite performing in a choppy fashion, supported by persistently low London Metal Exchange stock levels. On December 7, nickel prices were trading at US$20,189.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Nickel Outlook 2021: Strong Demand Recovery Ahead, Supply to ... ›

- Ways to Invest in Nickel | INN ›

- Nickel Price Hits Record US$100,000 on Short Squeeze, LME Suspends Trading | INN ›

- LME Halts Nickel Trading Again on Technical Issue Soon After Reopening | INN ›