Crypto Market Update: Stablecoin Market Passes US$300 Billion in Fastest Growth Since 2021

In other crypto news, Samsung and Coinbase are joining forces to bring easy crypto trading to handheld devices.

Here's a quick recap of the crypto landscape for Friday (October 3) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

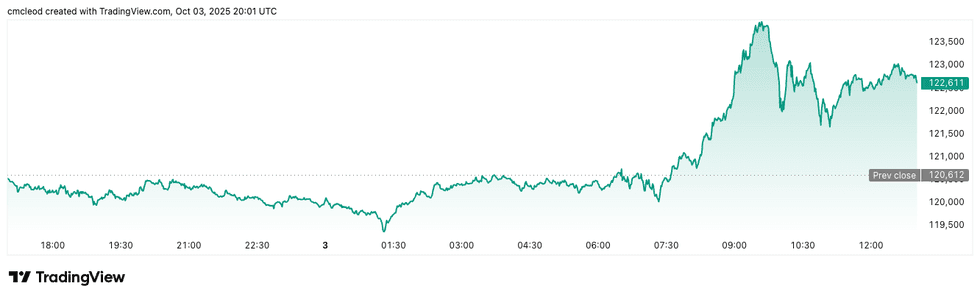

Bitcoin (BTC) was priced at US$122,720, up by 1.6 percent in 24 hours. Its lowest valuation of the day was US$120,045, and its highest was US$123,855. It has gained over 11 percent this week.

Bitcoin price performance, October 5, 2025.

Chart via TradingView.

Bitcoin may hit US$200,000 to US$500,000 in five years, predicts Bitget Chief Analyst Ryan Lee, due to institutional inflows and mainstream adoption, with over 20 percent of global financial institutions likely to integrate Bitcoin.

Regulatory clarity from the US Securities and Exchange Commission and the EU's MiCA is vital for reducing uncertainty and encouraging participation, potentially unlocking trillions in capital.

At the moment, accumulation by major holders is fueling a strong bull phase for Bitcoin, pushing it past a key resistance zone toward a higher target around US$124,000. Positive macro and technical signals point toward a possible price breakout above US$125,000, but record futures open interest near could fuel a potential squeeze.

Short positions around US$118,000 to US$120,000 could face losses, fueling further upside.

Bitcoin dominance in the crypto market now stands at 55.43 percent.

Ether (ETH) has closely followed Bitcoin's upward price movement, rising by roughly 8 percent since Wednesday (October 1) and nearly 12 percent for the week. It was priced at US$4,520.73, a 0.6 percent increase in 24 hours.

Its lowest valuation of the day was US$4,446.20, and its highest was US$4,583.39.

Altcoin price update

- Solana (SOL) was priced at US$233.55, an increase of 0.3 percent over the last 24 hours. Its lowest valuation on Friday was US$228.01, and its highest valuation was US$236.41. CME open interest for SOL hit a record high above US$2 billion, signaling strong institutional activity.

- XRP was trading for US$3.04, down by 1.8 percent over the last 24 hours. Its lowest valuation of the day was US$3.02, and its highest was US$3.09.

Derivatives trends

Bitcoin liquidations reached US$106.79 million in the last four hours, with shorts making up US$68.19 million of that total, potentially foreshadowing short-seller pressure and short squeezes.

Ether liquidations were US$41.75 million, reflecting active trader repositioning amid bullish price movements.

The funding rates at 0.008 for Bitcoin and 0.002 for Ether show continued demand for long positions, suggesting that traders remain confident in further gains despite elevated market risks.

Meanwhile, futures open interest for Bitcoin stands at US$89.63 billion, down 0.52 percent over the last four hours, signaling moderate profit taking or position adjustments after recent price advances. Ether futures open interest declined more sharply by 1.99 percent, to US$60.4 billion, which may imply cautious trading.

Bitcoin's relative strength index near 76 signals that the asset is approaching overbought territory, which could lead to increased volatility or a potential short-term pullback despite strong upward momentum.

Next week, markets will be watching for updates from the Federal Deposit Insurance Corporation’s board of directors, which is set to review proposed rules regarding "prohibition on use of reputation risk by regulators.”

Today's crypto news to know

Stablecoin market passes US$300 billion

The stablecoin market has climbed past a US$300 billion valuation for the first time, but analysts caution that current momentum may not be enough to meet future targets.

Coinbase Global (NASDAQ:COIN) projects the market will reach US$1.2 trillion by 2028, while Standard Chartered Bank (LSE:STAN) pegs it closer to US$2 trillion and Citigroup (NYSE:C) expects over US$4 trillion by 2030.

Growth this year has averaged about US$10 billion in new issuance each month — a pace that would take over five years to meet the lower end of forecasts.

Tether’s USDT remains the clear leader, holding 58 percent of supply and adding USD$2.6 billion in circulation this week. Circle Internet Group's (NYSE:CRCL) USDC and Ethena’s USDe also expanded, while BlackRock’s USD and PayPal Holdings' (NASDAQ:PYPL) PYUSD posted some of the strongest percentage gains.

The growth streak marks the fastest since early 2021, when the sector ballooned nearly 300 percent in half a year.

Sanctioned rouble stablecoin draws attention at Token2049

A rouble-pegged stablecoin, already under US and UK sanctions, surfaced as a sponsor of the Token2049 conference in Singapore, according to Reuters. The token, known as A7A5, was launched in January by a Russian defense-linked lender and a Kyrgyz payments firm, and has been flagged by western officials as a tool for sanctions evasion.

Despite this, the company behind A7A5 held a booth at the conference, was listed as a platinum sponsor and even saw one of its executives speak on stage before references were removed following media inquiries.

Trading in the token has surged, reflecting rising demand from Russian users locked out of traditional banking systems.

Strategy’s Bitcoin holdings reach record US$77.4 billion

Corporate Bitcoin pioneer Strategy (NASDAQ:MSTR) has disclosed that its Bitcoin holdings are now worth US$77.4 billion, the highest in its history. Led by Michael Saylor, the company first began buying Bitcoin in 2020; at the time, its position was worth about US$2.1 billion and the move was seen as radical.

Since then, its treasury has ridden multiple market cycles, growing to US$5.7 billion by 2021, falling back to US$2.2 billion during the 2022 crash and then steadily building through consistent purchases.

By 2023, Strategy’s holdings were valued at US$8 billion, and by 2024 they had reached US$41.8 billion. The 2025 rally, which has pushed Bitcoin above US$124,000, has nearly doubled the value of its stack in less than a year.

Separately, Strategy secured relief from a looming tax liability after the Internal Revenue Service ruled that unrealized crypto gains will not count toward the 15 percent corporate minimum tax.

Samsung and Coinbase expand partnership

Samsung (KRX:005930) has expanded its partnership with Coinbase Global to bring direct cryptocurrency purchase and management to over 75 million Samsung Galaxy users in the US.

Through the Samsung Wallet app, Galaxy users can now access Coinbase One, a premium subscription service offering zero trading fees on selected assets, boosted staking rewards and exclusive offers.

According to a press release, the partnership aims to provide a seamless, user-friendly crypto experience integrated within Samsung’s platform, with plans for a global rollout in the coming months. This effort is expected to attract mainstream investors by making crypto more accessible on a widely used mobile device ecosystem.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.