Where Does Tesla Get its Lithium?

Explore where Tesla gets its lithium, including its deals with lithium and battery suppliers, and the company's upcoming lithium refinery.

As the energy transition continues to unfold, US electric vehicle (EV) pioneer Tesla (NASDAQ:TSLA) has been making moves to secure supply of the raw materials it needs to meet its production targets.

Lithium in particular has been top of mind for CEO Elon Musk. Back in 2020, the battery metal had a spotlight moment at Tesla’s Battery Day, when Musk shared that the company had bought tenements in the US state of Nevada, and was looking for a new way to produce lithium from clay — a process yet to be proven at commercial scale.

Lithium prices went on to hit all-time highs, but swiftly declined in 2023 and continued on a downward trend in 2024. Prices for other key battery metals have also decreased as EV sales growth has fallen across most global markets in the face of economic uncertainty and higher interest rates. According to Goldman Sachs research, EV battery costs are at record lows and are forecasted to fall by 40 percent between 2023 and 2025.

In a mid-2023 Tesla earnings call, Musk seemed relieved to see prices for the battery metal had declined. “Lithium prices went absolutely insane there for a while,” he said. Lower battery prices will bring EVs closer to cost parity with internal combustion engines vehicles, leading to wider adoption and increased demand.

During the 2024 US presidential election, Musk threw his support behind Republican candidate and former president Donald Trump, who has been historically critical on electric vehicles and subsidies. Following Trump's election win on November 5, AP News reported that these stances could support Tesla as they would be more likely to harm smaller competitors who were less established than the EV giant. Tesla's share price shot upwards in response to the election outcome.

In the spring of 2024, Musk invited Argentine President Javier Milei to the Tesla factory in Austin, Texas, where the two reportedly discussed the investment opportunities in Argentina's lithium sector. As a prominent member of the prolific Lithium Triangle, the South American nation is the fourth leading lithium producer by country.

Australia's hard-rock deposits and Chile's brines are also top sources for the world's lithium supply. But lithium refining is dominated by China, which accounted for 72 percent of global lithium processing capacity in 2022.

With the limelight on Musk and Tesla, investors should know where the electric car company sources its lithium.

Read on to learn more about where Tesla gets its lithium, how much lithium is in a Tesla battery and what the EV maker is doing to better secure its lithium supply chain.

In this article

Which lithium companies supply Tesla?

Tesla has deals with multiple lithium suppliers, some that are already producers and some that are juniors developing lithium projects.

At the end of 2021, Tesla inked a three-year lithium supply deal with top lithium producer Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460), and the Chinese company began providing products to Tesla starting in 2022. Major miner Arcadium Lithium (NYSE:ALTM,ASX:LTM), which is set to be acquired by Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO), also has supply contracts in place with the EV maker.

China’s Sichuan Yahua Industrial Group (SZSE:002497) agreed to supply battery-grade lithium hydroxide to Tesla through 2030. Under a new, separate agreement finalized in June 2024, Yahua is set to supply Tesla with an unspecified amount of lithium carbonate between 2025 and 2027, with the option to extend the contract by another year.

Liontown Resources (ASX:LTR,OTC Pink:LINRF) is set to supply Tesla with lithium spodumene concentrate from its AU$473 million Kathleen Valley project. The deal is for an initial five year period set to begin this year, and production began in July 2024.

In January 2023, Tesla amended its agreement with Piedmont Lithium (ASX:PLL,NASDAQ:PLL), which now supplies the US automaker with spodumene concentrate from its North American Lithium operation, a joint venture with Sayona Mining (ASX:SYA,OTCQB:SYAXF). The deal is in place through the end of 2025.

Even though Tesla has secured lithium from all these companies, the EV supply chain is a bit more complex than just buying lithium directly from miners. Tesla also works with battery makers, such as Panasonic (OTC Pink:PCRFF,TSE:6752) and CATL (SZSE:300750), which themselves work with other chemical companies that secure their own lithium deals.

What are Tesla batteries made of?

Tesla vehicles use several different battery cathodes, including nickel-cobalt-aluminum (NCA) cathodes and lithium-iron-phosphate (LFP) cathodes.

Tesla is known for using NCA cathodes developed by Japanese company Panasonic. This type of cathode has higher energy density and is a low-cobalt option, but has been less adopted by the industry compared to the widely used nickel-cobalt-manganese (NCM) cathodes. Aside from that, South Korea's LG Energy Solutions (KRX:373220) supplies Tesla with batteries using nickel-cobalt-manganese-aluminum (NCMA) cathodes.

As mentioned, it wasn’t just lithium that saw prices climb in 2021 — cobalt doubled in price that same year, and although it has declined since then, the battery metal remains essential for many EV batteries. Most cobalt mining takes place in the Democratic Republic of Congo, which is often associated with child labor and human rights abuses, fueling concerns over long-term supply.

That said, not all Tesla’s batteries contain cobalt. In 2021, Tesla said that for its standard-range vehicles it would be changing to lithium-iron-phosphate (LFP) cathodes, which are cobalt- and nickel-free. At the time, the company was already making vehicles with LFP chemistry at its factory in Shanghai, which supplies markets in China, the Asia-Pacific region and Europe.

In April 2023, Tesla announced that it planned to use this type of cathode chemistry for its short-range heavy electric trucks, which it calls "semi light." The company is also looking to use LFP batteries in its mid-sized vehicles.

At the top of 2024, Tesla made moves to produce LFP batteries at its Sparks, Nevada, battery facility in reaction to the Biden Administration's new regulations on battery materials sourcing, especially on those sourced from China. Reuters reports Tesla battery supplier CATL will sell idle equipment to the car maker for use at the plant, which will have an initial capacity of about 10 gigawatt hours.

What company makes Tesla’s batteries?

Tesla works with multiple battery suppliers, including Panasonic, its longtime partner, as well as LG Energy Solutions, the second largest battery supplier in the world. They supply the EV maker with cells containing nickel and cobalt.

China's CATL has been supplying LFP batteries to Tesla for cars made at its Shanghai plant since 2020. It’s also been reported that BYD Company (OTC Pink:BYDDF,SZSE:002594) is supplying Tesla with the Blade battery — a less bulky LFP battery — which the car manufacturer has used in some of its models in Europe.

Additionally, BYD is set to work with Tesla on its battery energy storage systems (BESS) in China, with a plan to supply 20 percent of Tesla's anticipated BESS manufacturing capacity, with CATL expected to cover 80 percent. The factory, which began production at the close of 2024, uses the companies' LFP batteries.

How much lithium is in a Tesla battery?

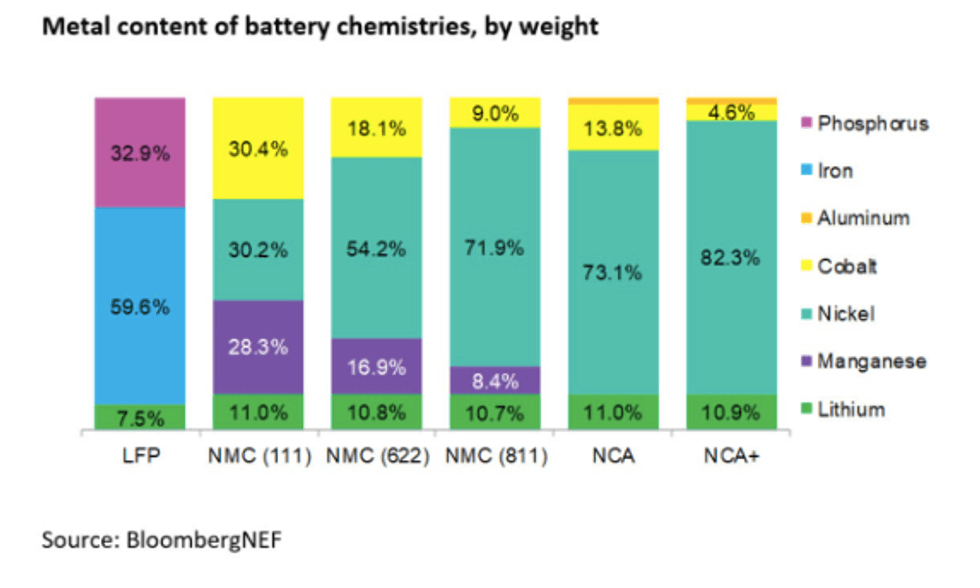

How much lithium do Tesla batteries actually contain? That question is tricky because many factors are at play. Typically, it depends on battery chemistry, as demonstrated by the chart below, as well as battery size.

For example, the standard Tesla Model S contains about 138 pounds, or 62.6 kilograms, of lithium. It is powered by a NCA battery, which has a weight of 1,200 pounds or 544 kilograms.

The amount of lithium in a Tesla battery can also vary based on model and year as the battery chemistries and weights are often changing with each new iteration.

Back in 2016, Musk said batteries don't require as much lithium as they do nickel or graphite — he described lithium as "the salt in your salad." As the chart below shows, the metal only makes up about a 10th of the materials in each battery.

Metal content of battery chemistries by weight.

Chart via BloombergNEF.

But a key factor to remember is volume — given the amount of batteries Tesla needs to meet its ambitious goals, it could hit a bottleneck if it can’t secure a steady supply of raw materials. Of course, this is true not just for Tesla, but for every carmaker producing EVs today and setting targets for decades to come.

For that reason, demand for lithium-ion batteries is expected to soar in the coming years. By 2030, Benchmark Mineral Intelligence forecasts that demand will grow by 400 percent to reach 3.9 terawatt-hours. Over the same forecast period, the firm sees the current surplus in the lithium supply coming to end.

Will Tesla buy a lithium mine?

For carmakers, securing lithium supply to meet their electrification goals is becoming a challenge, which is why the question of whether they will become miners in the future continues to come up.

But mining lithium is not easy, and despite speculation, it's hard to imagine an automaker being involved in it, SQM’s (NYSE:SQM) Felipe Smith said. “You have to build a learning curve — the resources are all different, there are many challenges in terms of technology — to reach a consistent quality at a reasonable cost,” he noted. “So it's difficult to see that an original equipment manufacturer (OEM), which has a completely different focus, will really engage into these challenges of producing.”

Even so, OEMs are coming to the realization that they might need to build up EV supply chains from scratch after the capital markets' failure to step up, Benchmark Mineral Intelligence’s Simon Moores believes. Furthermore, automotive OEMs that are making EVs will in effect have to become miners.

“I don't mean actual miners, but they are going to have to start buying 25 percent of these mines if they want to guarantee supply — paper contracts won't be enough,” he said.

However, Musk has made it clear to investors that Tesla is more focused on developing its lithium refining capabilities, rather than getting into the mining game.

Where is Tesla's lithium refinery?

Tesla broke ground on its in-house Texas lithium refinery in the greater Corpos Christi area of the state in 2023. Tesla's lithium refinery capacity is expected to produce 50 GWh of battery-grade lithium per year. Construction of the lithium refinery is nearly completed with full production anticipated in 2025.

Tesla's Texas lithium refinery was facing an obstacle in obtaining a contract for the 8 million gallons of water per day needed to run the plant, as the region of South Texas is in the middle of a serious drought and water supplies are tight.

"In December, South Texas Water Authority passed an infrastructure deal that will allow Nueces Water Supply to sell rights to the pipe Tesla will need to obtain water, which was one of the hold-ups for a water deal," Bloomberg BNN reported in early January.

This is an updated version of an article first published by the Investing News Network in 2022.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Which ASX Battery Metals Companies Have Supply Deals with Tesla? ›

- VIDEO - Simon Moores: Insights on Tesla, EV Supply Chains and Battery Metals ›

- Is Now a Good Time to Buy Lithium Stocks? ›

- 11 Lithium Stocks Betting on Direct Lithium Extraction ›

- Top 9 Lithium-producing Countries ›