Tech 5: OpenAI Closes on US$6.6 Billion in Funding, Cerebras Files for IPO

Elsewhere in the tech space, quarterly results from Elon Musk's Tesla failed to impress market participants.

Geopolitical tension clashed with uplifting jobs data, making for an interesting week on Wall Street.

Meanwhile, the crypto market went on a wild ride along with the greater stock market, and the US Securities and Exchange Commission (SEC) revived a nearly four-year-old case against Ripple Labs.

At OpenAI, a previously announced funding round wrapped up, bringing the company's valuation above estimated projections.

Stay informed on the latest developments in the tech world with the Investing News Network's round-up.

1. OpenAI concludes latest funding round, exceeding target

OpenAI is predicting its revenue will reach US$11.6 billion next year, significantly surpassing the estimated US$3.7 billion it is projected to make in 2024. A Reuters source says this growth will be driven by corporate sales of its AI features and subscriptions to ChatGPT.

Bloomberg reported on September 11 that the company was seeking US$6.5 billion in a new funding round, drawing interest from venture capital investors and industry peers. OpenAI ultimately raised US$6.6 billion, announced on Wednesday (October 2), resulting in a valuation of US$157 billion, according to a press release.

While OpenAI did not disclose the full list of investors, reports indicate participation from Microsoft (NASDAQ:MSFT), NVIDIA (NASDAQ:NVDA) and SoftBank (TSE:9984), along with several venture capital firms. NVIDIA's contribution of roughly US$100 million marks the company’s first investment in OpenAI. Its share price surged over 3 percent from Wednesday’s close on Thursday (October 3) morning. The company gained 5.69 percent this week.

NVIDIA's performance, September 30 to October 4, 2024.

Chart via Google Finance.

While Apple (NASDAQ:AAPL) was rumored to be considering participation in the funding round, the Wall Street Journal reported on Monday (September 30) that the company ultimately decided not to invest.

Its share price is down over 2 percent for the week.

The funding round came in the form of convertible notes, with the stipulation of a successful restructuring to give majority control to a for-profit arm. There is also a clause to remove the cap on returns for investors and a condition that prevents inventors from backing rival companies, such as Elon Musk’s xAI, as reported by the Financial Times.

2. Crypto markets rally, end the week on a high note

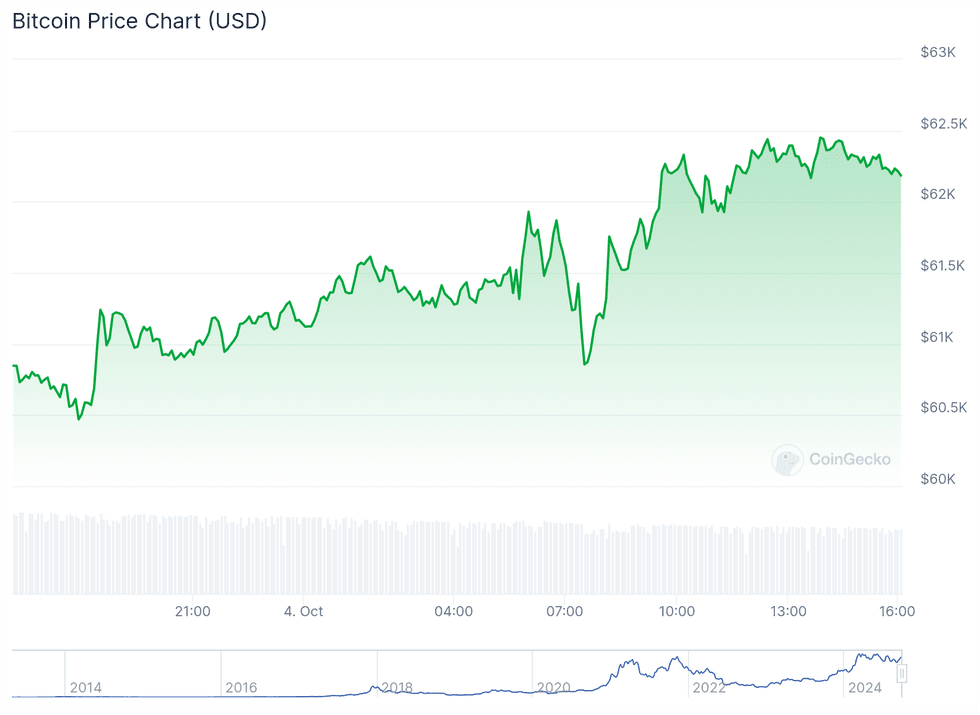

Bitcoin’s record-breaking September came to an abrupt end on Tuesday (October 1), with the cryptocurrency falling 6.8 percent to US$61,279.47 on Friday (October 4) morning from its peak of US$66,078. Ether, Solana, Cardano, XRP and Ton also experienced losses this week, and hefty outflows from spot exchange-traded funds were observed.

10x Research attributes Bitcoin’s initial drop on Monday to overbought conditions and apprehension surrounding Tuesday’s monthly US ISM Manufacturing data, a key economic indicator.

Further losses across the crypto market were fueled by rising tensions in the Middle East and the dockworkers strike along the east coast of the US. These events quickly dashed hopes of a bullish “Uptober,” a term used to describe a historically positive period for cryptocurrency prices in October.

Amid these volatile trading conditions, on Wednesday crypto asset manager Bitwise filed a Form S-1 with the SEC to launch an ETF for Ripple Labs’ XRP token. This move came as the SEC filed a notice to appeal Judge Analisa Torres’ August 7 ruling on Ripple Labs. The ruling states that Ripple Labs was in violation of securities law only when tokens were sold to institutional investors, and the judge ordered the company to pay a fine of US$125 million for improper selling — just over 6 percent of the US$2 billion the SEC was seeking.

In a statement, an SEC spokesperson said, "We believe that the district court decision in the Ripple matter conflicts with decades of Supreme Court precedent and securities laws and look forward to making our case to the Second Circuit."

Bitcoin's 24 hour price performance as of Friday at 4:00 p.m. PDT.

Chart via CoinGecko.

However, the tone shifted again on Friday afternoon as the US Department of Labor reported that the economy added 254,000 jobs in September, much higher than the expected 150,00. This provides a compelling rationale for the Federal Reserve to reduce interest rates gradually, which is good news for crypto markets. Bitcoin and Ether are up 2.3 percent and 3.4 percent, respectively, just after Friday's closing bell, marking the end of a turbulent first week of Q3.

3. California governor vetoes Senate Bill 1047

California Governor Gavin Newsom made a long-awaited decision regarding SB 1047, a comprehensive artificial intelligence policy that would have held developers responsible for “severe harm” caused by their technologies.

Describing the bill as “well-intentioned,” Newsom ultimately decided to veto the bill, authored by Senator Scott Weiner (CA-D). In a statement, the governor said the legislation would have applied “stringent standards to even the most basic functions” and that regulation should be based on “empirical evidence and science”. He also noted that a California-only approach to AI regulation could be warranted, “especially absent federal action by Congress."

However, SB 1047's focus on large, expensive AI models could mislead the public about the level of control over this rapidly evolving technology. It's possible that smaller, specialized models, not covered by the bill, could pose equal or greater risks, potentially stifling innovation that benefits the public.

The idea that overly stringent regulation would stifle progress and innovation in the field was the main argument made by opponents of the bill, which included former House Speaker Nancy Pelosi, Big Tech CEOs and venture capital firm Andreessen Horowitz, which has invested billions in AI.

4. AI startup Cerebras files for IPO

Cerebras Systems, an AI startup that builds specialized computer systems to facilitate deep learning, filed a registration statement for an initial public offering with the SEC on Monday. The company has experienced rapid growth and could one day challenge NVIDIA's dominance in the chip manufacturing industry in the US.

Cerebras' flagship product, the Wafer Scale Engine (WSE), is the largest chip ever made. Unlike traditional graphic processing units (GPUs), including NVIDIA's H100 GPU, which separate processing and memory, the WSE integration is designed to keep data on the chip rather than transferring it to different locations within a system or across a network.

The transfer of data creates what’s often called the Neumann bottleneck, a fundamental limitation that hinders performance by slowing down data access. Cerebras' architecture minimizes the distance data needs to travel, reducing latency and improving performance. This makes it an ideal solution for tasks that require massive data sets, such as genomic research, climate modeling, fraud detection and of course training large language models.

Recent filings show Cerebras' revenue surged nearly 70 percent in 2023 to US$78.7 million, compared to US$24.6 million the previous year. At the same time, losses narrowed from US$4.28 per share to US$2.92.

The company will list its Class A common stock on the Nasdaq under the symbol CBRS. The number of shares and the price range were not determined at press time.

5. Tesla stumbles after auto revenue declines

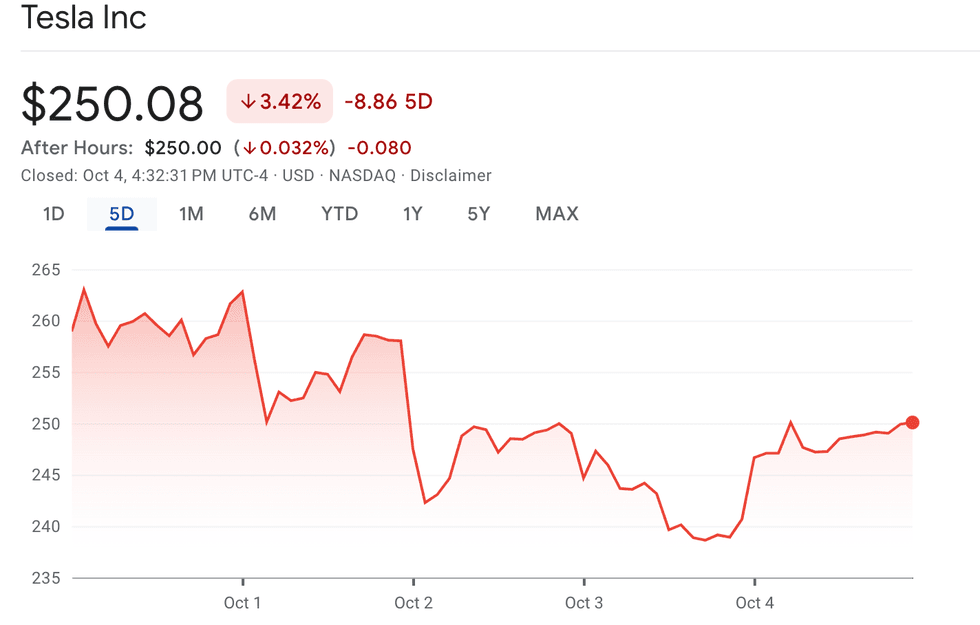

Shares of Tesla (NASDAQ:TSLA) are down 3.78 percent for the week following the company’s release of its Q3 results on Tuesday, which showed the company delivered 463,000 vehicles and produced approximately 470,000.

Tesla also reported a 2 percent increase in annual revenue to US$25.50 billion, topping LSEG estimates of US$24.77 billion. However, auto revenue fell by a whopping seven percent compared to a year ago, topping out at US$19.9 billion. Earnings per share also fell short of estimates, coming in at US$0.52 compared to US$0.62.

The company has had a rocky year, facing increased competition in China and regulatory scrutiny in the US. In July, sources for Bloomberg revealed that time constraints forced the company to delay the unveiling of its highly anticipated robotaxi from August 8 to October 10.

Tesla's performance, September 30 to October 4, 2024.

Chart courtesy of Google Finance

Following the report's release right after Tuesday’s closing bell, Tesla stock fell by over 4 percent in after-hours trading. Its share price slid a further 2 percent after the market’s opened on Wednesday before recovering to around US$250, roughly three percent lower than Monday’s opening price. Tesla closed the week at US$250.08.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.