Silver Price Update: Q3 2021 in Review

What happened in the silver market in Q3? Our silver price update covers supply, demand and other key factors impacting the metal.

Click here to read the latest silver price update.

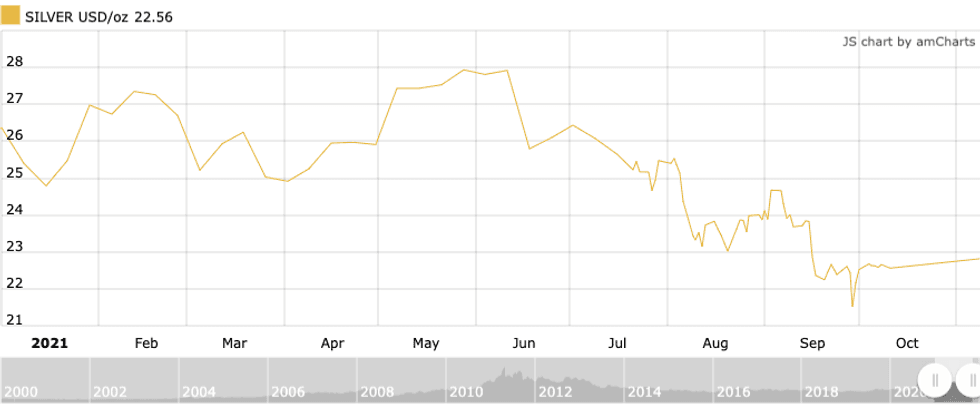

Volatility has been a key factor in the silver market this year, with the precious metal losing more than 16 percent of its value over the third quarter.

The white metal, which held above the US$25 per ounce range between January and the end of July, faced a dramatic decline in August. It fell to US$23.88 by the end of the month, a 9.68 percent decline from the US$26.44 at which the metal started the quarter on July 2.

The Q3 price performance was impacted by seasonal summer doldrums, which were exacerbated by uncertainty around supply chain challenges, new COVID-19 waves and sporadic industrial demand.

Silver price update: The white metal's path in Q3

Tailwinds from potential interest rate hikes and concern around monetary tightening by the US Federal Reserve, which drove silver prices higher during the first half of the year, were unable to counter the decline on the dual metal's industrial side.

Silver price performance, January 2021 to November 2021.

Chart via Kitco.

After reaching a year-to-date high in early June (US$27.92), silver prices continuously trended lower until values slipped to a year-to-date low of US$21.52 (September 29).

As Gareth Soloway, chief market strategist at InTheMoneyStocks.com, explained in late July, the white metal's correlation to gold as a risk mitigation asset wasn't enough to shake off the continued reverberations of the pandemic.

The strategist noted in the July interview that once money saved in 2020 was spent there could be a decline in industrial demand.

"I think (that) is why you're seeing silver underperform with gold and not bounce the same way gold has bounced recently," he said. "I also think that the Delta variant plays into that same factor too; we don't know if there is going to be an added slowdown in the economy because of the Delta variant, which again would then influence the industrial side of the silver."

Watch Soloway discuss the precious metals market's performance.

In terms of catalysts, silver's subpar streak may come to an end as inflation increases.

"Now in all fairness down the line as inflation continues to show itself, which I believe it will, silver will eventually regain steam and break higher," said Soloway, who noted that he believes inflation will not return to 2 percent despite what the Fed says. "But you just got to go through this little period of consolidation and small pullbacks until then."

Silver price update: Inflation yet to move price

The effects of inflation on the silver price and what the Fed would do next continued to be a theme throughout the quarter.

In mid-July, David H. Smith, senior analyst at the Morgan Report, spoke about the growing disconnect between what we see and what the Fed says.

"It seems like they really are a lot less clued in about what's really going on on Main Street," he told the Investing News Network. "They claim that inflation is a little high right now, that it's transitory and a lot of things are just going to be taken care of when the pipeline gets filled."

In terms of indicators that inflation is much more deep seeded and not transitory, the analyst pointed to the price of food "going through the roof," increases in rent and real estate costs, and the service sector.

"The backlog and shipping (and) all of these things are creating what I believe is a perfect storm for inflation that is going to be much higher than most of the people that are investing today have experienced."

Watch Smith delve into the silver market.

Smith also warned of potential stagflation, marked by inflation, economic stagnation and a decline in gross domestic product. The term gained prevalence in the 1970s and 1980s when inflation ballooned to 14 percent, before declining to the 3.5 percent range in the mid-1980s.

"We paid more for just about everything and at the end of that decade it caused one of the biggest boons in history in gold and silver," Smith said. "And of course, very high interest rates, so gold and silver can flourish in a high interest rate environment."

In January 1980 the price of silver topped US$35, a 260 percent increase from June 1979.

Smith does see some positivity in the mining space as a result of the inflationary tone. "I think we're in for times that are more productive for people in the metals and miners than has been the case since 2000, when they had very robust returns."

Silver price update: Demand to overshadow supply

The consolidation of industrial demand is anticipated to be short-lived as economies around the globe return to a sense of normalcy in the months ahead. The US$1 trillion earmarked for infrastructure spending could be a catalyst for the precious metal, which is used in solar paneling and electric vehicle manufacturing.

According to Forbes, "Silver's conductivity and corrosion resistance make it necessary for conductors and electrodes; nearly every electrical connection in an EV uses silver and, in total, the auto sector uses 55 million ounces of it annually."

The rise of connectivity and electrical applications is another forecasted driver of demand.

The Silver Institute's September report on silver demand anticipates annual demand in this space to grow from 2020's 224 million ounces to 246 million ounces in 2025 — a 10 percent increase.

"Each of these connectivity applications will require a huge number and a wide variety of sensors, communication, tracking and monitoring devices; many of these will use silver in their semiconductors, electrical contacts, and elsewhere," notes the report, which was compiled by Cru International. "The underlying infrastructure supporting this connectivity transition, such as the 5G network and the 'internet of things,' will itself contribute to increased demand for silver."

This steady demand will heighten supply disparities, which as Smith explained will grow as the grade of deposits declines and current mines reach end of life.

"(Copper and silver miners are) having to dig up more ore and they're getting less silver out of it," he said. "There haven't been any real large discoveries in recent years, and this is going to go forward as we see the crunch going on (in) the EV market moving forward."

The quality and lifespan of copper mines is important to the silver market, because roughly 70 percent of annual silver production is a by-product of base metals mining, particularly copper mining.

Rising nationalistic sentiments and geopolitical tensions have also led to more jurisdictional risk, which could impede new production.

"There won't be that many deposits coming on because they take a long time to get to the production stage … it can take 15 to 20 years or more to get that from the pre-feasibility stage and the US$2-US$3 billion dollars necessary just to get up into a productive mode," Smith said.

"So those things are going to be coming online less frequently, because many of them are in country risk locales that are questionable now with higher taxes and social governance issues. There are going to be less copper deposits coming on stream over the next 10 to 15 years than many people realize."

For these reasons, Smith believes silver prices should be higher.

Silver price update: Will value break out of slump?

At the end of September, values for the white metal sank to a year-to-date low of US$21.52 (September 29), a 15.93 percent decline from January.

As prices fell, the disparity in the gold to silver ratio grew, reaching a year-to-date high of 80.17 on September 30, a 16.11 point increase from the February low of 64.26.

Silver price performance, Q3 2021.

Chart via Kitco.

However, the September consolidation served as a launching point for the metal's Q4 performance with prices trending higher throughout October.

Widespread inflation, mixed with the Fed's announcement that pandemic aid is ending, worked to move silver more in line with its precious metal sister.

"What tends to happen is when a major resistance area in silver is broken and it tends to lag a gold move then the pyrotechnics get started," Smith explained. "And a lot of people will look at further resistance levels and they'll try to take profits when those levels are hit."

Still, as he noted, it's hard to tell if the white metal will reach the US$50 level.

"Silver likes to slice through those levels so predicting (a price move) is really difficult," he said.

While the US$50 threshold may be hard to forecast, Chris Marchese, chief mining analyst at GoldSeek and SilverSeek, sees the white metal breaching the US$30 range in the near term.

"I'm still very optimistic about silver," he said during a September interview. "Once it does cross that US$30 to US$31 level I believe it will be testing all-time highs within six to eight months after that, maybe less."

Watch Marchese discuss mining stocks.

For Marchese, the move to US$30 needs to happen in a meaningful way.

"Ideally (it happens) on a monthly, maybe quarterly close, on good strong sustained volume, not just (an) intraday hit (where it goes to) US$30.10 then comes back down," Marchese said.

"It can't be like that, it needs to at least close the week, month and quarter above US$30 and once that happens I think all systems are go for US$50 to US$60 silver."

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Silver Trends 2021: Demand Grows as Supply Shrinks | INN ›

- Silver Outlook 2022: Supply/Demand Trends Could Catalyze Price ... ›

- Should You Invest in Silver Bullion? | INN ›

- What Was the Highest Price for Silver? | INN ›

- When Will Silver Go Up? | INN ›