Silver Price Surges to US$36, Marking 13 Year High

Silver's rally was prompted by growing economic uncertainty, geopolitical tensions and the escalating trade war.

Overshadowed by gold in recent months, silver claimed the spotlight on Thursday (June 5).

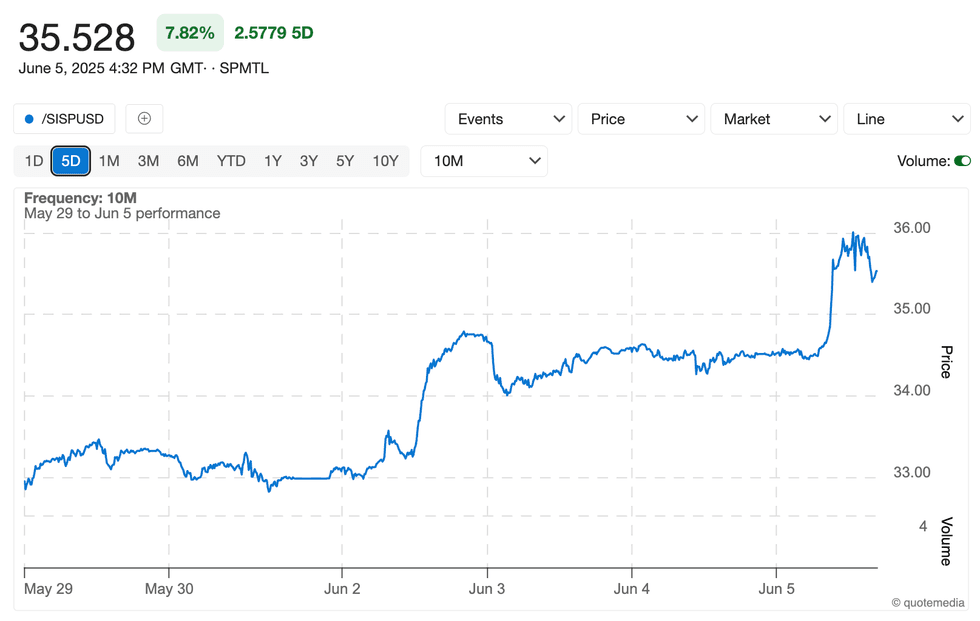

The white metal's price rose as high as US$36.03 per ounce in early morning trading, a 13 year high, before retreating toward the US$35.50 mark as US markets began their sessions.

Recent economic and geopolitical events have raised analysts’ expectations of a September rate cut from the US Federal Reserve, helping to fuel safe-haven buying of silver and gold.

The central bank has held its benchmark rate at 4.25 to 4.5 percent since November 2024.

Silver price, May 29 to June 5, 2025.

Chart via the Investing News Network.

CME Group's (NASDAQ:CME) FedWatch tool shows half of market respondents predict a 0.25 percent cut at the Fed's September meeting, while the other half is split on the Fed holding the line and a deeper 0.5 percent cut.

Silver's spike also comes after a phone call between US President Donald Trump and Russian President Vladimir Putin. Following the discussion, Trump said a near-term ceasefire between Russia and Ukraine is unlikely, noting that Putin has vowed to respond to recent attacks by Ukraine that destroyed more than 40 nuclear-capable aircraft.

On the economic data front, the US released its weekly unemployment insurance report on Thursday. It shows that the advance figure for seasonally adjusted initial claims was 247,000 for the week ended on May 31. The four week average has been pushed to 1.9 million, the highest level since November 27, 2021.

The US Bureau of Labor Statistics reported more data to suggest a slumping US economy in a Thursday report focused on Q1. In its release, the bureau said that nonfarm labor productivity decreased 1.5 percent in the first quarter of the year as output decreased 0.2 percent and hours worked increased 1.3 percent.

The labor news comes as the Trump administration ratcheted up tariffs on steel and aluminum products to 50 percent this week, raising the possibility of a deepening trade war, and putting greater pressure on the global economy.

Elsewhere, gold and equity markets weren’t faring as well on Thursday.

Gold was off by 0.5 percent in morning trading, falling to US$3,353.66 per ounce.

The metal has surged more than 25 percent this year, setting a slew of new price records, and has continued to trade in elevated territory, fueled by the same conditions as silver’s recent run.

The S&P 500 (INDEXSP: INX) was flat, recording a 0.14 percent decline to 5,961. The Nasdaq-100 (INDEXNASDAQ: NDX) was the sole gainer in morning trading, rising 0.24 percent to 21,776, and the Dow Jones Industrial Average (INDEXDJX: .DJI) was unchanged at 42,422.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

- Silver Price Today | Live Silver Price Chart & Historical Data ›

- When Will Silver Go Up? ›

- US$200 Silver? 3 Experts Talk Price, Supply and Demand ›

- Could the Silver Price Really Hit $100 per Ounce? ›

- Silver Price Update: Q1 2025 in Review ›

- Silver Price 2024 Year-End Review ›