Silver Price Update: Q1 2025 in Review

The start of 2025 has been volatile for financial markets. This has largely benefited precious metals, including silver, which posted strong gains during Q1.

Gold may be grabbing headlines with record-breaking highs in 2025, but silver is quietly making its own impressive climb, rising 17 percent since the start of the year.

Long supported by industrial demand, the silver market is also benefiting from its reputation as a safe-haven asset. However, mounting economic uncertainty has rattled investors in recent months.

While there are many driving forces behind this uncertainty, the ongoing tariff threats from US President Donald Trump and his administration have spooked equity markets worldwide.

What happened to the silver price in Q1?

After reaching a year-to-date high of US$34.72 per ounce in October 2024, the price of silver spent the rest of the year in decline, bottoming out at US$28.94 on December 30.

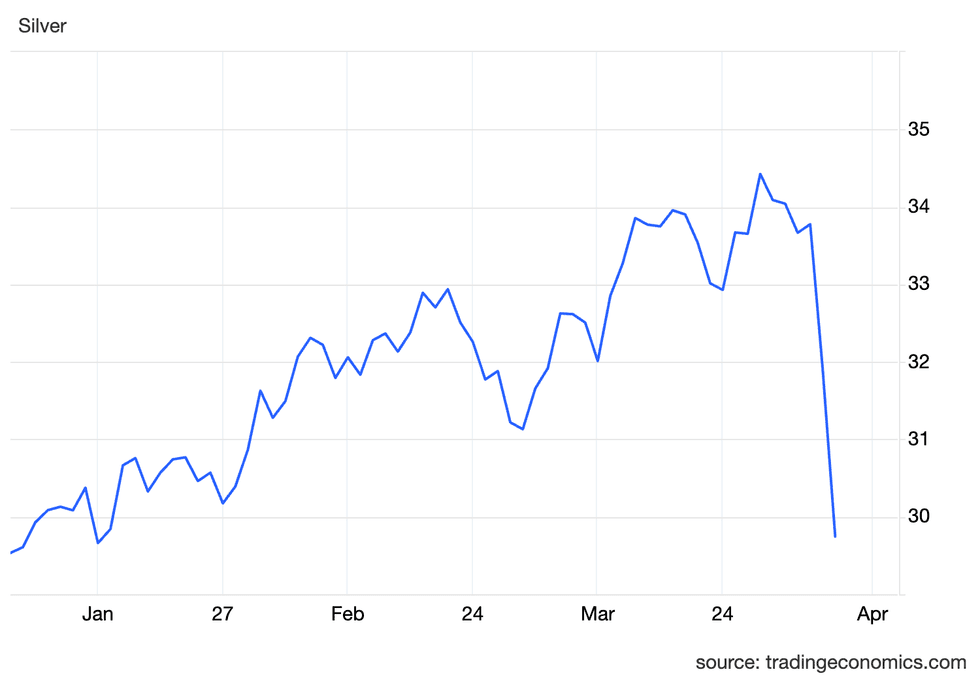

A momentum shift at the start of the year caused it to rise. Opening at US$29.53 on January 2, silver quickly broke through the US$30 barrier on January 7, eventually reaching US$31.28 by January 31.

Silver price, January 2 to April 4, 2025

Chart via Trading Economics.

Silver's gains continued through much of February, with the white metal climbing to US$32.94 on February 20 before retreating to US$31.13 on February 28. Silver rose again in March, surpassing the US$32 mark on March 5 and closing above US$32 on March 12. It peaked at its quarterly high of US$34.43 on March 27.

Heading into April, silver slumped back to US$33.67 on the first day of the month; it then declined sharply to below US$30 following Trump's tariff announcements on April 2.

Tariff fears lift silver, but industrial demand uncertainty looms

Precious metals, including silver, have benefited from the volatility created by the Trump administration’s constant tariff threats since the beginning of the year. These threats have caused chaos throughout global equity and financial markets, prompting more investors to seek safe-haven assets to stabilize their portfolios.

However, there are concerns that the threat of tariffs could weaken industrial demand, which could cool price gains in the silver market. In an email to the Investing News Network (INN), Peter Krauth, editor of the Silver Stock Investor and author of "The Great Silver Bull," said it's too soon to tell how tariffs may affect silver.

“We don’t really have any indication yet that industrial demand has weakened. There is, of course, a lot of concern regarding industrial demand, as tariffs could cause demand destruction as costs go up,” he said.

Krauth noted that for solar panels there is an argument that tariffs could positively affect industrial demand if countries have a greater desire for self-sufficiency and reduced reliance on energy imports.

He referenced research by Heraeus Precious Metals about a possible slowdown in demand from China, which accounts for 80 percent of solar panel capacity. However, any slowdown would coincide with a transition from older PERC technology to newer TOPCon cells, which require significantly more silver inputs.

“This, along with the gradual replacement of older PERC solar panels with TOPCon panels, should support silver demand at or near recent levels,” Krauth said.

Recession could provide headwinds

Another potential headwind for silver is the looming prospect of a recession in the US.

At the beginning of 2024, analysts had largely reached a consensus that some form of recession was inevitable.

While real GDP in the US rose 2.8 percent year-on-year for 2024, data from the Federal Reserve Bank of Atlanta’s GDPNow tool shows a projected -2.8 percent growth rate for the first quarter.

The Bureau of Economic Analysis won't release official real GDP figures until April 30, but the Atlanta Fed’s numbers suggest a troubling fall in GDP that could signal an impending recession.

In comments to INN, Mind Money CEO Julia Khandoshko indicated that a recession may negatively impact the silver market due to the growing demand for silver from energy transition markets.

“When the economy slows down, demand for manufactured goods, including silver, decreases, which means that buying in the next six months is unlikely to be a wise decision,” she said.

Solar panels account for significant demand, with considerable amounts also used in electric vehicles. Tariffs on US vehicle imports and a possible recession could create added pressure for silver.

“Another important factor is silver’s connection to the electric vehicle market. Previously, this sector supported demand for the metal, but now its growth has slowed down. In Europe and China, interest in electric cars is no longer so active, and against the background of economic problems, sales may even decline,” Khandoshko said.

Silver demand from solar panel production stands at 232 million ounces annually, with an additional 80 million ounces used by the electric vehicle sector. A recession could lead consumers to postpone major purchases, such as home improvements or new vehicles, particularly if coupled with the extra costs of tariffs.

Although the impact of tariffs on the economy — and ultimately demand for silver — remains uncertain, the Silver Institute’s latest news release on March 3 indicates a fifth consecutive annual supply deficit.

Silver price forecast for 2025

“I think silver will hold up well and rise on balance over the rest of this year,” Krauth said.

He also noted that, like gold, there have been shipments of physical silver out of vaults in the UK to New York as market participants try to avoid any direct tariffs that may be coming.

“In my view, there’s a strong possibility of witnessing a shock from a severe supply shortage in the silver market within the next six months or so,” Krauth explained to INN.

Khandoshko suggested silver's outlook is more closely tied to consumer sentiment. “The situation may also change when the news stops discussing the high probability of a recession in the US,” she remarked.

With Trump announcing a sweeping 10 percent global tariff along with dozens of specific reciprocal tariffs on April 2, there appears to be more instability and uncertainty ahead for the world’s financial systems.

This uncertainty has spread to precious metals, with silver trading lower on April 3 and retreating back toward the US$31 mark. Investors might be taking profits, but it could also be a broader pullback as they determine how to respond in a more aggressively tariffed world. In either scenario, the market may be nearing opportunities.

“There is some risk that we could see a near-term correction in the silver price. I don’t see silver as currently overbought, but gold does appear to be. I think we could get a correction in the gold price, which would likely pull silver lower. I could see silver retreating to the US$29 to US$30 level. That would be an excellent entry point. In that scenario, I’d be a buyer of both the physical metal and the silver miners,” Krauth said.

With increased industrial demand and its traditional safe-haven status, silver may present a more ideological challenge for investors in 2025 as competing forces exert their influence. Ultimately, supply and demand will likely be what drives investors to pursue opportunities more than its safe-haven appeal.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Silver Price 2024 Year-End Review ›

- Should You Invest in Silver Bullion? ›

- What Was the Highest Price for Silver? ›

- Could the Silver Price Really Hit US$100 per Ounce? ›

- When Will Silver Go Up? ›