Silver Price Update: Q1 2024 in Review

Silver started the year flat, but has soared to 11 year highs. Find out what drove its price in the first quarter of the year and what experts think could be next.

2023 was a relatively lackluster year for silver, which largely traded between US$22 and US$25 per ounce.

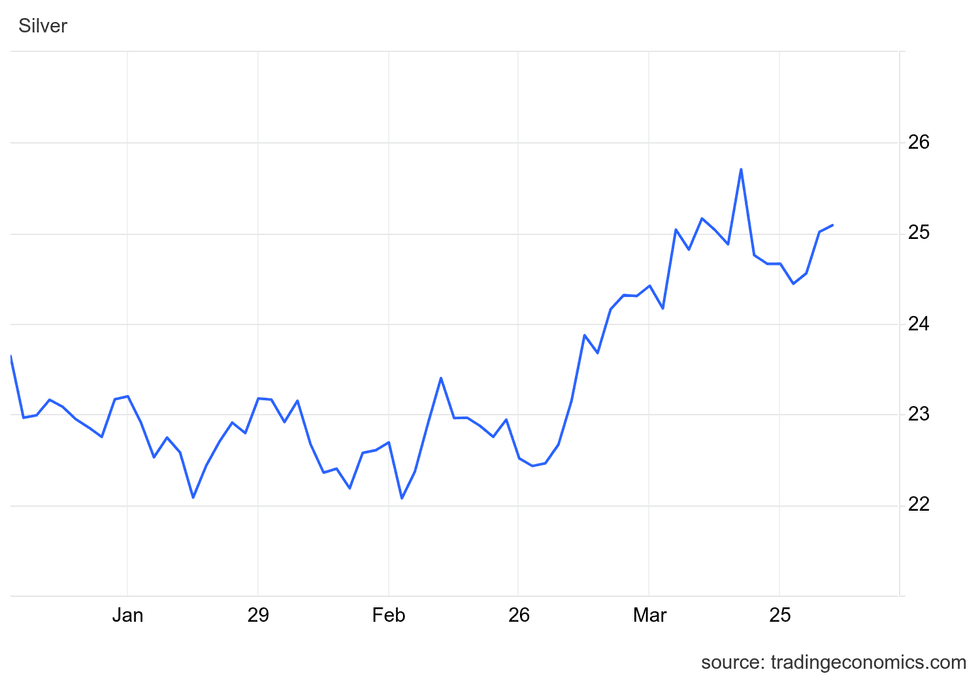

The white metal started 2024 on a similar note, with its price remaining fairly rangebound for the first eight weeks of the year. It dropped to US$22.08 on January 21, marking its quarterly low.

Silver started seeing gains in March on expectations that the US Federal Reserve was getting closer to lowering interest rates. Improving sentiment gave precious metals momentum, causing silver to reach its quarterly high of US$25.62 on March 20; it then continued on to an 11 year high of US$29.26 on April 12.

How did the silver price perform in Q1?

As mentioned, rate cut expectations added fuel to the silver price in early March.

These gains were reinforced by positive language following the Fed's March meeting, when the central bank said inflation was continuing to progress toward its target of 2 percent. Even though it was unwilling to commit to dates, the Fed suggested it was done with hikes and was expecting to make three cuts to its benchmark rate in 2024.

Silver price, Q1 2024.

Chart via Trading Economics.

While gold captured attention as it set price records in March and April, silver has produced better returns for investors. In an April 9 email to the Investing News Network (INN), Peter Krauth, editor of Silver Stock Investor and author of "The Great Silver Bull," commented on the white metal's performance during the quarter.

“Silver also typically lags gold, then catches up and surpasses it. We’re starting to see that happen in spades right now. Since the end of February, gold is up about 15 percent, while silver is up about 22 percent," he said.

Krauth emphasized, "Those are breathtaking gains in just a matter of weeks."

According to Krauth, this rise came alongside decreasing inventories at the COMEX, London Bullion Market Association and the Shanghai Gold Exchange, where stockpiles have dropped 40 percent over the past three years.

“The same has happened to silver exchange-traded funds (ETFs) globally. My view is that large silver consumers are buying long contracts and silver ETFs, then taking delivery," he noted.

"That helps explain why the silver price didn’t rise in the face of ongoing deficits. But these inventories are being drained, and I think there may be 12 to 24 months left before they run out."

Industrial demand for silver increasing

Also helping to draw down inventories is industrial demand for silver. The biggest contributing sectors are related to the energy transition, particularly the production of photovoltaics and electric vehicles.

Krauth pointed to the Silver Institute, a top industry association, which is calling for silver to record a structural deficit for the fourth consecutive year in 2024, with shortfalls to continue for several more years.

In its latest World Silver Survey, the Silver Institute states that in 2024, demand for the white metal is forecast to reach the second highest level on record at 1.22 billion ounces, with industrial demand set to see a 9 percent increase to 710.9 million ounces; that would beat out the record set in 2023 at 654.4. million ounces.

India has been a critical driver of demand, importing 94 million ounces of silver in the first two months of 2024, including 71 million ounces in February alone — that represents nearly an entire month of global mine production.

While the Silver Institute notes that demand for silverware and jewelry in India remains strong, it also says there is growing industrial demand as India sees an increasing focus on infrastructure development.

To support local manufacturing, the Indian Ministry of New and Renewable Energy reimposed its Approved List of Models & Manufacturers for solar modules, effective April 1. With the list in place, certain solar projects in the country will be required to use domestically produced photovoltaics.

This comes as new N-type solar cells, which require greater amounts of silver, enter mass production in 2024.

Silver supply unable to keep up with demand

On the supply side, the Silver Institute is predicting a decline of 1 percent in 2024, with 1 billion ounces being made available. Recycled quantities of silver are expected to remain flat at 178.9 million ounces, while the biggest drop is seen coming from mine production, with an estimated total of 823.5 million ounces in 2024.

This differential suggests a widening deficit of 215.3 million ounces, a year-on-year increase of 17 percent.

Silver is primarily produced as a by-product of gold, lead, zinc and copper, with these mines accounting for 595.2 million ounces in 2023. Meanwhile, primary silver mines produced just 235.2 million ounces.

With a contraction in mine output forecast for 2024 and increasing industrial demand over the next several years, the Silver Institute is projecting more tightness over the next few years.

Krauth sees two standout projects set to add millions of ounces over the next year.

“There are two major primary silver projects that stand out. Endeavour Silver (TSX:EDR,NYSE:EXK) is building its Terronera project in Mexico, which will bring about 7 million silver equivalent ounces per year, starting at the end of this year. Then there’s Aya Gold & Silver (TSX:AYA,OTCQX:AYASF), whose Zgounder mine in Morocco is expanding production from about 1.9 million ounces of silver to 8 million ounces, starting with its commissioning in Q2 this year,” he said.

The Silver Institute also sees supply contributions coming from Newmont’s (TSX:NGT,NYSE:NEM) Penasquito mine, which will return to full production in 2024 following strike action in 2023. Meanwhile, Coeur Mining (NYSE:CDE) is expanding its Rochester mine, and Kinross Gold's (TSX:K,NYSE:KGC) Manh Choh project is coming online.

Even with these additions, the Silver Institute sees steep offsets in silver production, including the loss of 17.9 million ounces out of Peru as Hochschild Mining (LSE:HOC,OTCQX:HCHDF) has placed its Pallancata operation into care and maintenance as it waits for permits for its Royropata deposit.

Investor takeaway

Krauth sees strong upside in silver's industrial applications, although he believes many market participants still see it largely as a precious metal. However, attitudes may be starting to change.

This past January, silver producers penned an open letter to the Canadian government, urging it to include the metal on the country's list of critical minerals. While the government won't make a decision until May, silver companies could see new funding options open up if the metal is added, while permitting could be streamlined.

Krauth thinks such a move would boost silver’s status among investors, and is a point to watch in Q2.

“I, along with the entire sector, will be watching closely to see whether silver makes the list or not. If it does, I think that would be a shot in the arm for silver. The broader investment community would pay more attention to silver’s significant structural supply shortages,” he explained to INN.

Krauth wouldn't be surprised to see a pullback in silver this year, but thinks it is in a sustained bull market. He expects the price to continue to hold at US$28, and probably grow to US$30 in the second half of the year.

As silver sees upward momentum going into the next quarter, it may present opportunities for investors who want an alternative to gold, or are keen to take advantage of the white metal’s increasing role as an industrial metal.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.