Rare Earths Market Forecast: Top Trends That Will Affect Rare Earths in 2023

What's ahead for the rare earths space? Read on to learn more about the rare earths forecast for 2023.

Pull quotes were provided by Investing News Network clients Aclara Resources and E-Tech Resources. This article is not paid-for content.

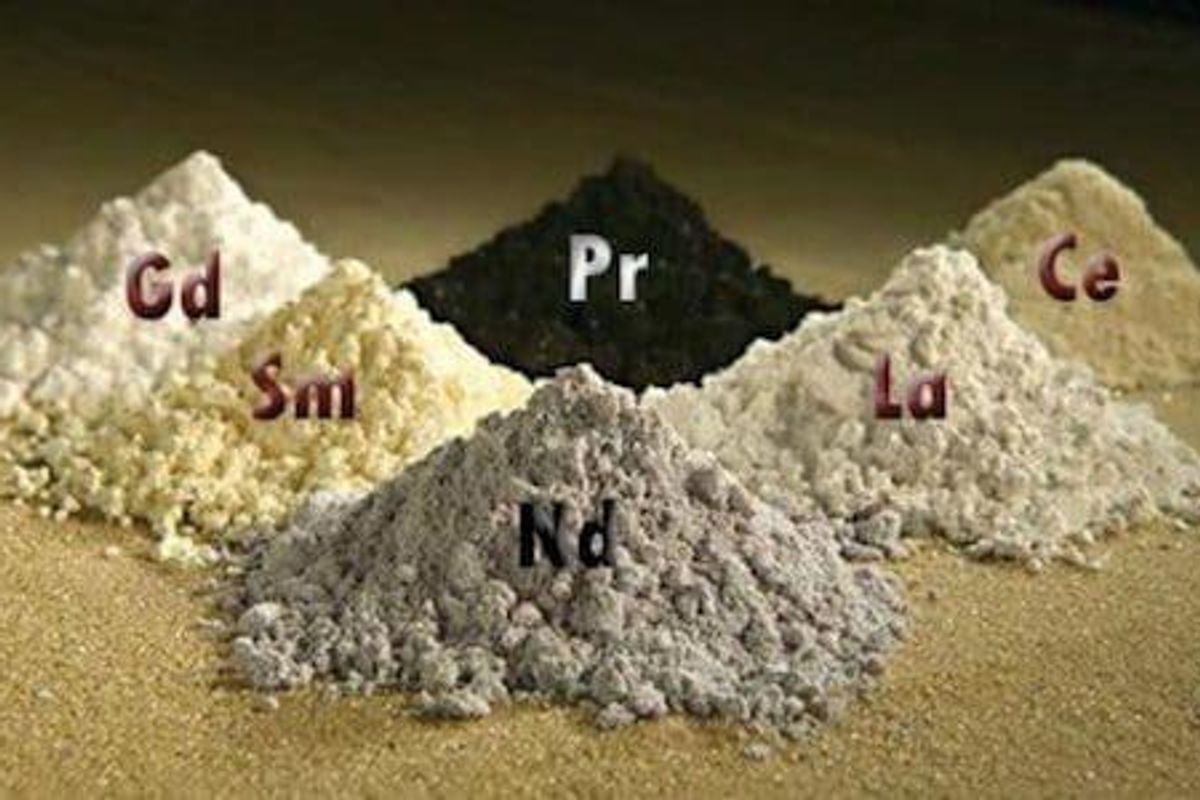

Rare earths are key elements, and demand for this group of critical metals is expected to be strong in the coming decades as governments around the world take steps to meet energy transition targets.

Used in the high-strength magnets found in much of the latest technology, from smartphones to wind turbines to electric vehicles (EVs), rare earths will be an important focus for the resource sector well into the next decade as more countries in the west work to create supply chains that are less dependent on top producer China.

As 2023 begins, what is the rare earths forecast for the year ahead? The Investing News Network (INN) reached out to analysts in the space to find out. Read on to learn what they had to say.

How did rare earths perform in 2022?

In 2021, rare earths supply and demand dynamics were uncertain as the world was just beginning to reopen after the COVID-19 pandemic. However, most analysts were optimistic about the sector moving forward.

Ryan Castilloux of Adamas Intelligence told INN that three main factors impacted the market in 2022.

“The Russia-Ukraine war exacerbated inflation in Europe and North America and fostered a consumer confidence crisis that slowed demand growth for new electronics, consumer appliances, cordless power tools and other uses of rare earth magnets,” he said.

At the same time, strict lockdowns and pandemic control measures in China last year contributed to a major consumer confidence crisis in the Asia Pacific region. This hindered the manufacturing of EVs, mobile phones and everything in between.

“Adding insult to injury, the conventional automotive industry continued to be dogged by microchip and other component shortages, slowing global automobile production yet again, (as well as) demand for rare earth magnets used widely in micromotors, sensors and speakers throughout,” Castilloux said.

For Nils Backeberg of Project Blue, 2022 did not create any major disruptions in the expected growth for rare earths.

“While certain applications will have had a lower-performing year in line with the weak economic sentiment, rare earth magnet markets remained aligned with EV and energy-saving technology growth,” he said.

One surprise in 2022 was the market tightness in H1 for neodymium, the main light rare earth used in the creation of permanent magnets. This was accelerated by above-market Chinese demand investment in neodymium-iron-boron magnet capacity.

“Outside of China, geopolitical interest has seen some projects move into construction in a race to meet limited ex-China demand as sustainable, de-risked, non-Chinese supply takes center stage for critical materials,” Backeberg said.

However, he added, "China’s rare earths industry gave the world a gentle reminder of its leading position by significantly ramping up its mining and refining quotas for the year.” In 2021, the Asian nation produced the most rare earth elements (REEs) at 168,000 metric tons. The second largest producer was the US with only 43,000 metric tons.

In terms of prices, heavy rare earths saw the highest unexpected upside, as supply from Myanmar was restricted for much of the year, according to Project Blue data.

Meanwhile, the ongoing consumer confidence crisis, along with continued automotive industry bottlenecks, led magnet rare earths (neodymium, dysprosium, terbium and praseodymium) prices to be lower than Adamas Intelligence expected at the end of 2021.

“Looking forward, we believe the current market malaise will ease in the coming six to 18 months, steering prices back in line with our existing projections through the medium to long term,” Castilloux said.

What is the rare earths supply and demand forecast for 2023?

As the new year begins, there are key supply and demand dynamics to pay attention to that could impact rare earths.

With a few exceptions, Castilloux expects to see increased demand for nearly all REEs next year, although magnet rare earths demand will see the greatest surge on the back of rising EV sales, wind power installations and more.

“Moreover, should low gas prices persist in Europe and the end of lockdowns in China inspire renewed consumer confidence in these regions in the near term, we could see a latent demand pop in 2023 (as we saw in 2021) as pent up demand from the year prior materializes,” he explained to INN.

Project Blue’s Backeberg agreed, saying most rare earths will continue to see demand growth — even cerium and lanthanum, which are used predominantly in fuel refining and emissions-reducing catalysts.

“In 2023, we may see a relatively boosted demand related to economic recovery after a weak 2022, true for all regions,” he added.

Commenting on REE supply, Backeberg said the biggest risk in the rare earths supply chain is still heavy rare earths mining in Myanmar. The country provides 60 percent of China’s medium to heavy rare earths feedstock.

“The border to China has a history of closing regularly,” he said. “ESG concerns from the western world are still focused on battery materials, but could see a growing focus on EV motor materials sourced from Myanmar.”

Project Blue does not see any tight supply or deficits in 2023, barring unforeseen supply disruptions.

Meanwhile, for Adamas Intelligence, lanthanum and cerium will continue to be oversupplied in 2023 at the global level.

“However, in the US we expect demand will continue to outstrip supply as MP Materials (NYSE:MP) ramps up refined oxide and chemical production,” Castilloux said. “Conversely, the magnet rare earths will continue to face a tight supply/demand balance in 2023, with potential for deficits should consumer confidence bounce back in major markets, fueling a latent demand pop.”

How will the rare earths supply chain change in 2023?

A trend that was accelerated by the COVID-19 pandemic has been the awakening of governments around the world to their supply chain vulnerabilities and their high dependence on countries such as China.

As the new year begins, the next opportunity for miners will be looking at independent ex-China supply chains to feed European and US magnet demand, Backeberg said.

“These markets are still in their infancy and opportunities limited, but geopolitical interest will likely see some growth start to be established,” he said. “It still opens questions about surplus non-magnet REE supply generated in these ex-China supply chains.”

For the Project Blue expert, the non-Chinese value chain will operate at a premium to China, with countries looking at ESG-linked metrics to support the price premiums required to develop ex-China supply.

“The EU and the US will likely continue to see EV-related investments in 2023, which will have a bearing on the opportunities for a rare earth magnet supply chain, while China remains decades ahead and continues to invest in improving its own base,” he said.

Commenting on how countries can compete with China, Castilloux said its cost leadership is becoming easier to challenge as supply chain sustainability, transparency, governance and environmental attributes are prioritized.

“That said, in the case of magnet rare earths and certain battery materials, global demand is growing far faster than China alone can satisfy anyhow — thus regions are not yet in heavy competition per se,” he said.

For Castilloux, it’s encouraging to see governments taking action to support, stimulate and invest in supply chain development.

“While there are risks in doing so, like making the wrong investments or cooking up a political hot potato, the risk of inactivity for Canada, the US, Europe and other resource- and/or demand-endowed nations is far greater,” he said. “The shift to electromobility and renewables truly does present a once-in-a-generation opportunity for these regions.”

For the REE market in particular, geopolitical interest is also slowly waking up to the fact that mining rare earths without a refinery does not establish supply chain independence.

“There are already some processing projects underway with political backing, but there are still more steps in the value chain required to get to EV motors,” Backeberg said.

For Castilloux, what’s needed right now is more investment and government interest in addressing the lack of capacity in the US and Europe to convert magnet rare earth oxides into the metals and alloys needed for magnet production.

“That’s the major gap threatening the up-and-coming magnet supply chains in these regions at the moment,” he said.

What factors will move the rare earths market in 2023?

Even with increased macro uncertainty, Castilloux remains optimistic about the REE market in 2023.

“We see potential for the current market woes to ease faster than some may be anticipating, steering magnet rare earths prices back in line with our existing projections by mid-year,” he said.

For the expert, the so-called magnet rare earths have the biggest upside going into 2023.

“Demand for these elements is growing faster than all others. The supply/demand balance for these elements is already very tight, and their respective prices are already historically high as the market is poised to recover,” Castilloux noted.

“Other REEs used in magnets as additives, such as gadolinium and holmium, are also well positioned as conventional magnet rare earths prices and scarcity increase.”

Similarly, for Backeberg, dysprosium and terbium are the best-positioned elements as 2023 kicks off.

“The market growth remains focused on magnet materials, specifically for rotary magnets using heavy REEs, which, with the supply risk for heavy rare earths, provides the biggest upside,” he said. “The forecast growth for rare earth magnets is expected to continue at pace with limited substitution technologies in place for EV drivetrains.”

In the long term, Project Blue believes that significant forecast demand upside based on the current technology landscape will need to be met by technological developments — with several already in development.

“The current quota level (in China) should see neodymium healthily supplied in 2023; however, further ramp-ups in magnet production ahead of demand could see more upside volatility,” Backeberg said.

On the other hand, heavy rare earths prices remain linked to the volatile supply chain from Myanmar. Project Blue predicts that the supply/demand balance for heavy REEs will start to drive overall rare earths market dynamics, which will limit the upside in neodymium prices over the medium term.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Rare Earth Elements Prices 101 ›

- Ways to Invest in Rare Earths ›

- Rare Earths Market Update: H1 2022 in Review ›

- Rare Earth Reserves: Top 8 Countries ›