- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Metallum Resources: Copper and Zinc, CEO Clip Video

Metallum Resources Announces Board Changes

Overview

Market experts believe that global zinc demand is set to outpace production growth in 2021. The zinc market could see upwards of 2.9 percent to 14 million tonnes in production increases as producers worldwide continue to ramp up output in the face of surging demands.

Global zinc production continues to struggle to meet increasing demand. In 2019, 12.8 million tons of zinc was mined, with 33.7 percent of that coming from China. Companies operating advanced, high-quality zinc production assets in the West present investors with an opportunity to satisfy growing global demand without the same level of exposure to geopolitical risk.

One such company is Metallum Resources (TSXV:MZN), which acquired the Superior Lake zinc project from Superior Lake Resources (ASX:SUP). Superior Lake has a prospective JORC-compliant bankable feasibility study. Highlights from the report include an IRR of 31 percent (pre-tax), 9-year mine life with current reserve/resources.

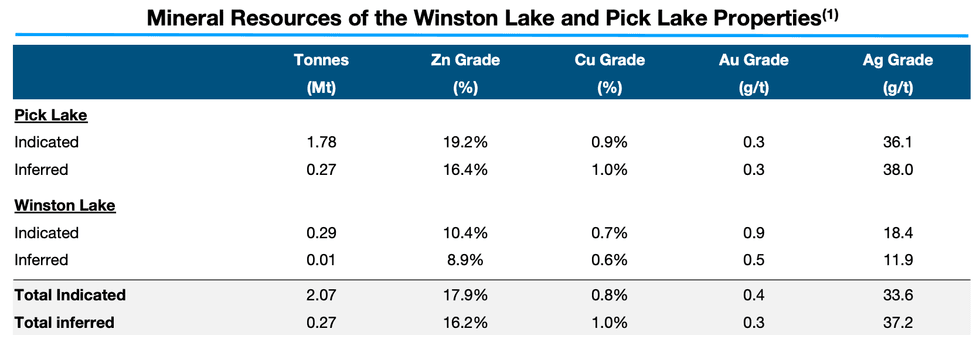

The Superior Lake zinc project consists of two high-grade resource targets: Winston Lake and Pick Lake. Winston Lake produced historic average recoveries at 93.7 percent zinc and 78.3 percent copper, 37 percent Ag and 38 percent Au with approximately 900 Mlbs Zn, 53.7 Mlbs Cu, 1,172 koz Ag, 51.17 koz Au. Likewise, Pick Lake hosts highlighted drilling results of zinc grades up to 40.6 percent over 0.51m and 30.47 percent over 13.4m.

With most major permitting in place, the company plans to commence an extensive drilling campaign and further its established exploration programs to identify additional targets across the Superior Lake property. Existing infrastructure and historic revitalization of the project present the company with fast-tracked and lower-cost development conditions.

Metallum Resources has advantageous positioning in the space of zinc developer valuation. Compared to other players in the market, Metallum Resources presents an excellent CAD$21 million market cap with a robust post-transaction share distribution portfolio. The company has no material debt.

Metallum Resources’ management team has a proven track record of bringing shareholder value. The company is part of the Gold Group, a winning team of results-driven leaders with world-class expertise in mine building, resource expansion and established stakeholder value.

Company Highlights

- Metallum Resources’ flagship Superior Lake zinc project is near-production, with all infrastructure in place, in the mining-friendly jurisdiction of Ontario, and is one of the highest-grade zinc development resources in North America.

- Current resources estimates place Superior Lake with upwards of 2.07 million indicated tonnes of zinc at 18 percent zinc grades. The current mine life of Superior Lake stands at nine years and the asset has the potential for resource expansion with additional exploration.

- The Lower Pick Lake massive sulphide Deposit has exceptional historic intercepts but is still largely untested, leaving huge potential for undiscovered, high grade massive sulphide mineralization that is close to existing underground development.

- The Superior Lake zinc project’s 2 deposits, Winston Lake and Pick Lake, are both highly prospective VMS deposits that host very rich zinc and other metals mineralization.

- Superior Lake Resources released a JORC-compliant (but not NI 43-101 compliant) Bankable Feasibility Study for the Superior Lake Zinc Project in 2019. Highlights from the report include an IRR of 31 percent (pre-tax), 9-year mine life with current reserve/resources, at 3 percent cut off grade.

- The company is a significant proponent of stakeholder participation and mining best practices. It boasts strong relationships with community and local skilled workforces and emphasizes safety and sustainability while providing exceptional economic and project development potential.

Get access to more exclusive Zinc Investing Stock profiles here