Silver Outlook 2020: Will Silver be a Better Buy Than Gold?

What’s the silver outlook for 2020? Overall market watchers are calling for higher prices as the white metal follows gold upward.

Click here to read the latest silver outlook.

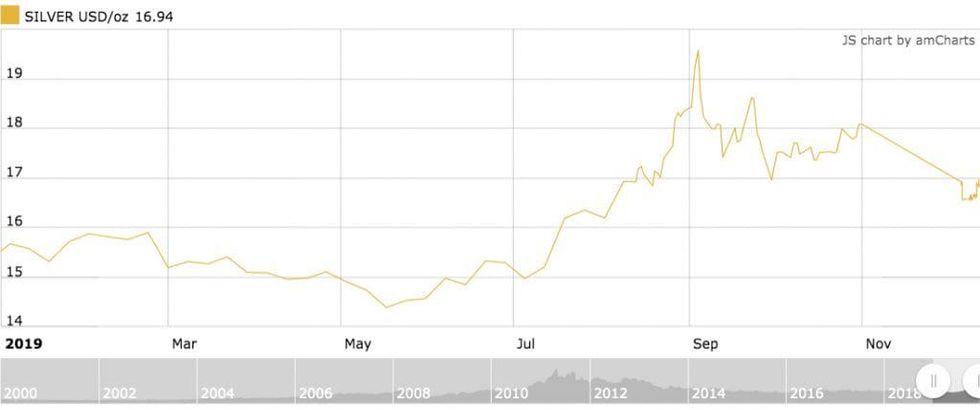

The price of silver has rebounded from its 2018 losses over the past 12 months, ending the year up about 7 percent. The precious metal trended to a three year high of US$19.57 per ounce in the last half of 2019 before retreating to a range of US$16.50 to US$17.

The third quarter of the year proved the most eventful for the white metal, when it surged from US$16.18 at the beginning of August to US$19.57 on September 4, a near 21 percent increase.

Ongoing geopolitical strife between China and the US, turmoil between the US and Mexico and issues in the Middle East have all helped silver grow this year, despite its gains being smaller than gold‘s.

Three interest rate cuts by the US Federal Reserve also proved advantageous for the versatile metal, with its three year high coming between the first cut in July and the second in September.

With the start of 2020 just around the corner, many investors are now wondering what will happen to silver next year. Here the Investing News Network (INN) looks at silver’s price performance in 2019 and what companies and analysts expect for the silver outlook in the year ahead.

Silver outlook 2020: Price performance review

The currency metal, which trended lower for the second part of 2018, started 2019 much the same way — locked in below US$16 for the first six months of the year.

The price hit its year-to-date low on May 17, when it was trading for US$14.38, weighed down by a strong US dollar and easing geopolitical tensions, specifically between Washington and Beijing.

In contrast, silver hit a three year high of US$19.57 in early September, bolstered by the Fed’s two interest rate cuts and increased hostility regarding geopolitics across the globe.

Chart via Kitco.

The year’s midpoint brought a 20 year high in the gold-silver ratio. The discrepancy in the price ratio for the sister metals prompted analysts to point to the upside presented in the silver sector.

“(The gold-silver ratio) got as high as 90 something percent in 2019, which even for me was a surprise,” said David Morgan of the Morgan Report.

“I didn’t think we would get above 80 and we did, and not only did we get above 80, we stayed there for quite some time, and that is very discouraging for silver investors — but for those that aren’t already invested it’s a heck of a bargain. Silver is probably the most underpriced monetary asset you can buy right now,” he continued.

Despite the skewed ratio, silver investors haven’t come flocking to the white metal, a trend that doesn’t surprise Morgan.

“But people don’t buy bottoms. They say they buy low, but they don’t. Believe me, there will be more silver sold above US$20 than there was below US$20,” he said.

While investors have been slow to purchase, there was growth in the other areas this year.

“While longer-term investors were avoiding buying physical silver, beginning in late June we witnessed increased volumes of silver futures, options and forwards being bought on the CME’s COMEX exchange and in London,” said Jeffrey Christian, managing partner at CPM Group.

“Industrial demand, especially in solar panels and electronics, continued to rise,” he added.

Silver exchange-traded products (ETPs) saw a rise in engagement and interest as well.

“We saw record numbers of silver going into ETPs,” the Silver Institute’s Michael DiRienzo said. “Net investment in ETPs is going to be up quite dramatically this year. I think people are positioning themselves within the investment complex, whether that be physical or that be ETPs, and also the mining company stocks are faring very well this year compared to last year or the year before.”

As the value of precious metals moved higher in the latter portion of the year, miners began seeing some optimism in investor sentiment, which posed its own challenges due to timing.

“The first half of the year not a lot was happening, not a lot of investor interest — the spike in the gold price changed that,” explained Alex Heath, director of corporate development and investor relations at Great Panther Mining (TSX:GPR,NYSEAMERICAN:GPL), an intermediate precious metals miner with projects in Mexico and Brazil.

“But then the window for doing financing or anything like that is pretty short-lived. You have to be ready if you want to raise capital,” he said.

For Chile-focused junior Aftermath Silver (TSXV:AAG,OTCQB:FLMZF), the mid-year price growth was a welcome reprieve for silver investors who may have shied away over the last year due to low prices.

“I think psychologically the move was important to the market, and we saw it reflected in our financing. It was almost akin to pushing a rock up a hill for the first half of the year,” said Chairman Michael Williams.

“The second half of the year the rock’s been rolling down and I’m trying to catch it. We had too many shareholders asking if they could participate in the various financings, which is a nice problem to have.”

These sentiments were reflected sector wide, according to the Silver Institute’s DiRienzo.

“I think on the mining side, the mining equities, which are a key component of overall silver investment or a marker, have been very strong,” he said.

Silver outlook 2020: Supply/demand fundamentals still key

Production remains a key factor in the silver sector, and as with the gold space high-grade resources are becoming more difficult to access, foreshadowing a potential decline in output in the future.

“The last few years, silver production has started to taper off and the overall grade on average is decreasing on that basis,” said Morgan. “That means you are getting less ore per shovelful on average.”

An increasing reduction in output will be further compounded by increasing demand in the industrial, currency and jewelry sectors.

“It looks like we are going to have a small, maybe less than 1 percent, decline in mine production again in 2019, and that’s following some consecutive years where we have seen lower mine production,” DiRienzo said. “We do think that industrial fabrication (demand) is going to grow; we also think it is going to grow within the automotive sector and in photovoltaics; two very important end use centers for silver.”

He also expects a 3 percent increase in demand from the jewelry sector and a 4 percent boost in calls for the white metal from the silverware space.

For Morgan, India coming back to the silver market will create increased demand, as will a steady growth trend in the automotive and solar panel sectors.

He also foresees web-savvy millennials embracing silver-backed crypto currencies, which will undoubtedly influence the silver market.

Despite higher-than-expected market volatility this year, Christian anticipates a “small pickup in physical silver purchase volumes by investors, and modest growth in fabrication demand,” in the new year.

Silver outlook 2020: Price gains ahead?

While silver production is slipping in the US, it has remained relatively steady in Mexico and South America, where Aftermath and Great Panther are focused.

“2020 is going to be a big year for us, because we are going to have drills turning in the project — and as we like to say in the industry, the drills are the truth machines — so we are going to see if our thesis of where we think the ore is in fact there,” explained Aftermath’s Williams. “If it is, then I think we could demonstrate to the market we could get rerated.”

In the new year Great Panther will set its sights on gold production, with silver remaining a by-product of the process.

“We have big expectations for the price of gold; we’re more focused on gold now just because it’s 85 percent of our production,” said Heath. “(For silver) fundamentally there will be an increase even if the price of gold doesn’t go up as much — but we still see lots of upside.”

In the year ahead, the Silver Institute expects ongoing geopolitical issues to benefit silver. It also sees a tightening of the gold-silver ratio.

Additionally, the international association is looking forward to seeing what role silver will play in the global rollout of 5G technology and integration.

A small decrease in mine production and an estimated 9 percent increase in the silver price is in the cards for the 2020, according to CPM Group’s Christian.

However, the head of the commodities research firm advises keeping an eye on investor participation and the state of the world.

“For 2020 I see (silver) picking up momentum. I see a high of US$22, which is about a 30 percent gain from where we have been in 2019,” said Morgan.

He also pointed to widespread political uncertainty around the globe as a driving factor for the silver price, as well as the strength of the US dollar.

In the long term, Morgan foresees solar and electric vehicles as fundamental drivers in the silver sector, with demand tripling over the next five years.

“Now, longer term I still will hold about a US$100 silver price, but that’s far out in the future. I really think we will get to that level by 2024 to 2025,” he said.

When INN spoke with the Independent Speculator’s Lobo Tiggre in August, he said silver will go “bananas” when gold does. At November’s New Orleans Investment Conference, Tiggre, who is CEO of Louis James LLC, said he still believes in silver’s ascent.

“We haven’t quite slipped on the banana peel yet,” he said. “Silver typically lags gold and then it catches up with gusto.”

Tiggre also noted that the white metal had not gained as much from its bottom as its sister metal, making silver the better buy, and said he wanted to purchase more bullion for his own portfolio.

“I am not too religious about silver versus gold — they’re pretty interchangeable — but silver is just a better deal right now.”

Conversely, Rick Rule of Sprott (TSX:SII) sees silver as less of a value play in the traditional sense. Instead, he noted that the metal has speculative upside.

“In the last 40 years gold has led, silver has followed. But silver has gone further beyond that when the silver price begins to validate the silver thesis and the money moves from the bullion to the equities,” the sector veteran told INN at the New Orleans Investment Conference.

He continued, “High-quality silver equities are extremely rare — there’s probably only 10 or 11 in the world — and when money floods into silver equities, which it does periodically about once a decade, the upside associated with those is extraordinary.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.