What happened to palladium in H1 2019? Our palladium price update outlines market developments and explores what could happen moving forward.

Palladium made huge gains throughout the first half of this year, climbing over 24 percent during H1 2019 thanks to high demand and low supply.

The metal, which overtook gold in December 2018 for the first time in 16 years, continued on a bull streak during H1 thanks to growing demand for more emission-friendly gasoline-powered automobiles. These vehicles tend to use more palladium in autocatalysts compared to diesel vehicles.

Read on for an overview of the factors that impacted the palladium market in H1, plus a look at what investors should watch out for in the months to come.

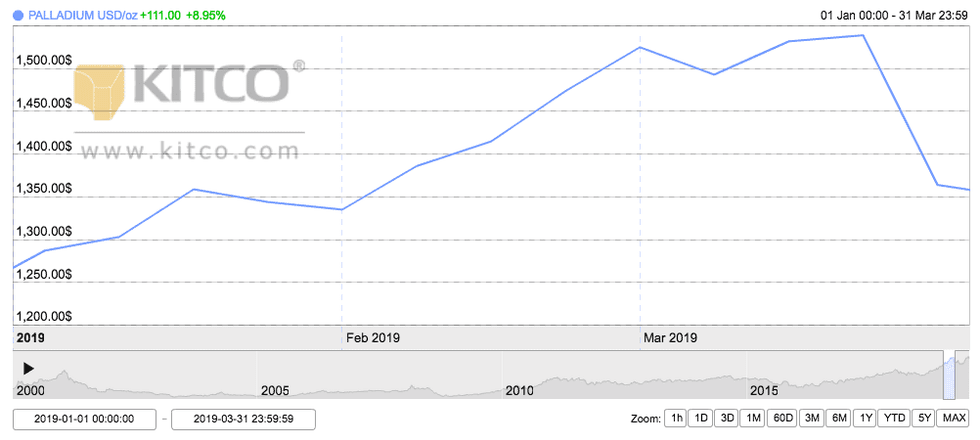

Palladium price update: Q1 overview

Overall, the price of palladium increased by 24.27 percent in the first half of 2019.

The metal made significant gains in the first quarter of the year, when it climbed 8.95 percent. Q1 saw palladium briefly break through the US$1,600 per ounce level on March 19 and then experience its highest closing price three days later. As the chart below from Kitco shows, palladium ended the day at US$1,539 on March 22 as its supply outlook grew tighter.

Price chart via Kitco.

The precious metal hit its lowest point of the period around the beginning of the quarter on January 4, when it closed the day at US$1,287 on the back of a strong US dollar.

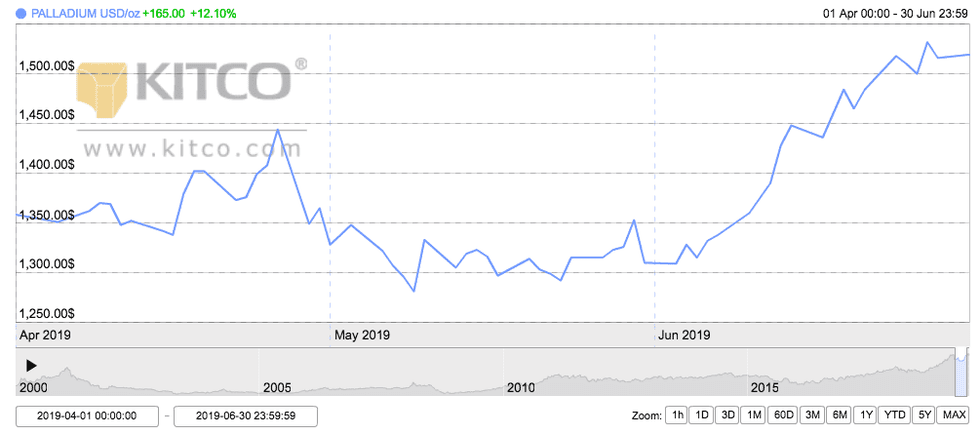

Palladium price update: Q2 overview

Palladium maintained the gains it made in Q1, rising 13.27 percent during the second quarter of this year. As shown in the Kitco chart below, the metal reached its highest level towards the end of June.

Price chart via Kitco.

Palladium rose to its highest point of the quarter on June 27, when it traded at US$1,532. The metal was supported by strong demand and an ongoing supply deficit.

It hit its lowest point around the middle of the quarter, when it changed hands at US$1,281 on May 9. The dip was expected by many market watchers, who speculated that it was due to prices getting ahead of fundamentals.

Palladium price update: Key drivers in H1

As the second half of the year begins, investors interested in the palladium market should be aware of a number of factors that could impact the metal’s price.

Most industry insiders believe a continued supply deficit paired with high demand and issues affecting the greenback will influence the price of the palladium for the remainder of 2019.

As FocusEconomics points out, palladium prices remained high during the second half of H1, receiving a particular boost in June as the dollar declined due to both geopolitical and economic issues.

“Palladium prices were likely supported by a weaker US dollar in June, after the Federal Reserve hinted that interest rate cuts could be on the cards going forward. Moreover, uncertain global economic momentum likely supported safe haven demand,” notes the firm in its latest report.

The report also states that palladium-specific forces were partially responsible for the uptick in prices.

“Palladium-specific factors were also at work. Supply is tight due to a lack of new mining capacity, while tougher global emission standards are supporting automotive demand despite declining vehicle sales so far this year in key markets such as China, the EU and the US,” it explains.

Despite these factors, some with a pulse on the palladium space believe the rally is speculative and nothing more. However, Jim Gallagher, CEO of North American Palladium (TSX:PDL,OTC Pink:PALDF), waved that notion off, telling the Investing News Network (INN), “That price movement is the result of a fundamental deficit in the market, so this is a supply (and) demand thing that is not speculatively driven.”

“Some people have talked about a bubble … but I think all of the experts that really follow palladium, which is actually a pretty small group, really see this as a straight supply (and) demand issue,” he added.

In fact, in Metals Focus’ latest Platinum and Palladium Focus 2019 report, the precious metals consultancy projects that palladium will remain in a surplus this year. The firm is forecasting a supply deficit of 574,000 ounces for the year.

Palladium price update: What’s ahead?

As palladium prices remain strong, industry insiders have begun to debate which side of the rally the precious metal will end up on by year’s end.

Trevor Raymond, director of research at the World Platinum Investment Council, told INN that he does not see an end to palladium’s reign anytime soon, stating, “Over 90 percent of palladium is produced as a by-product, (so) its supply does not respond to price. Consequently, the palladium price should remain elevated or even rise (moving forward).”

However, some of palladium’s gains could be stifled if the auto industry starts to swap it out for its sister metal platinum. “Platinum and palladium can be substituted on a 1:1 ratio in gasoline cars. When the prices differ greatly or availability is uncertain, this substitution is more likely,” he said.

Despite this idea, Gallagher and many other market watchers do not foresee this event taking place. Gallagher stated, “Platinum cannot substitute directly in the same quantities. You would need significantly more — you would need to change the layout, (as the metals) respond differently to heat and chemistry.”

He added, “The real fact is that the palladium market, which is not known by most people, is actually larger than the platinum market. So you would be shifting from a market that is already in deficit to a smaller supply base.”

As mentioned, Metals Focus believes that palladium will continue to gain, forecasting that autocatalyst demand will more than likely rise by 3.6 percent in 2019, setting records at 8.59 million ounces, due to tighter emissions standards that require more output of platinum-group metals for most regions.

But FocusEconomics thinks prices will lose steam moving forward due to slowing global growth.

“However, prices will remain high by historical standards, supported by an ongoing supply deficit and a shift to cleaner vehicles. A potential faster-than-expected economic slowdown and the possible substitution for platinum in vehicles remain key factors to watch,” the firm states.

In terms of price predictions, panelists polled by FocusEconomics believe that palladium will land on an average price of US$1,366 in the fourth quarter of 2019 before slipping to an expected average of US$1,300 in Q4 2020. They estimate that the average palladium price for Q3 2019 will be US$1,400.

The most bullish forecast for the quarter comes from RBC Capital Markets, which is calling for a price of US$1,550; Commerzbank (OTC Pink:CRZBF,ETR:CBK) is the most bearish with a forecast of US$1,250.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.