White Gold Corp. Extends High-Grade Mineralization at Golden Saddle 205m from Previous Mineralization and also within the Conceptual Pit Boundary including 3.59 g/t Gold over 68.0m and Identifies Multiple Continuous High-Grade Structures at Vertigo including 11.64 g/t Gold over 5.34m

White Gold Corp. (TSXV:WGO, OTC:WHGOF, FRA:29W) (the “Company”) is pleased to provide an update on its fully funded $13 million 2019 exploration program, announcing initial diamond drilling results on its recent high-grade Vertigo discovery and on its flagship Golden Saddle deposit, located in the prolific White Gold District in Yukon, Canada.

White Gold Corp. (TSXV:WGO, OTC:WHGOF, FRA:29W) (the “Company”) is pleased to provide an update on its fully funded $13 million 2019 exploration program, announcing initial diamond drilling results on its recent high-grade Vertigo discovery and on its flagship Golden Saddle deposit, located in the prolific White Gold District in Yukon, Canada. This first phase of diamond drilling was designed to test the geometry of the Vertigo target and previously underexplored portions of the Golden Saddle deposit and surrounding area. The ongoing 2019 exploration program backed by partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corp (TSX: K, NYSE: KGC) includes diamond drilling on the Vertigo target (JP Ross property), Golden Saddle & Arc deposits (White Gold property) as well as soil sampling, prospecting, GT Probe sampling , trenching and RAB/RC drilling on various other properties across the Company’s expansive land package.

Highlights Include:

- Initial assays from the 2019 drill program present strong first diamond drill results on the Vertigo target and are among the best results to date at the Golden Saddle deposit.

- All Vertigo diamond drill holes to date intersected gold mineralization and have identified a minimum of 6 high-grade mineralized structures. Each structure displays strong continuity from surface to over 250m down-dip and remains open in all directions.

- Diamond drilling on the Golden Saddle locally extended the GS Main zone 205m down dip from historic drilling, approximately doubling the down dip extension in the area which previously only extended to 165m; added additional mineralization above the previously modeled ore body; and infilled several strategic gaps in the resource model. Diamond drilling on the GS West successfully proved continuity of the deposit both along strike and down dip, expanding the modelled mineralization beyond the envelope included in the Company’s 2019 mineral resource estimate.

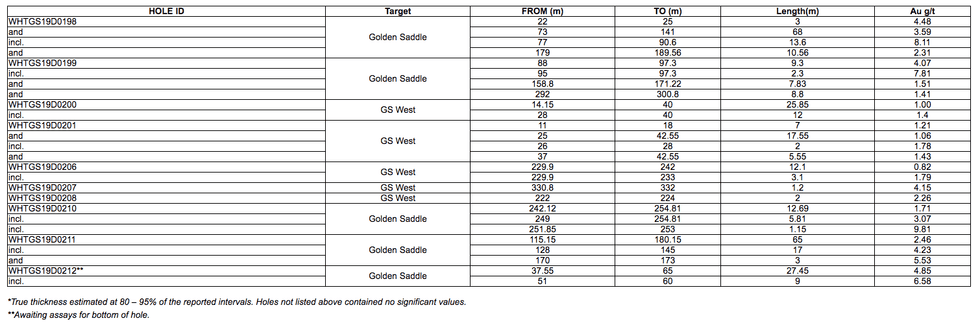

- Golden Saddle: Hole WHTGS19D0198 returned 3.59 g/t Au over 68.0m from 73m depth, including 8.11 g/t Au over 13.6m from 77m depth, and 2.31 g/t Au over 10.56m at 179m depth. Hole WHTGS19D0212 returned 4.85 g/t Au over 27.5m from 38m depth, including 6.58 g/t Au over 9.0m from 51m depth.

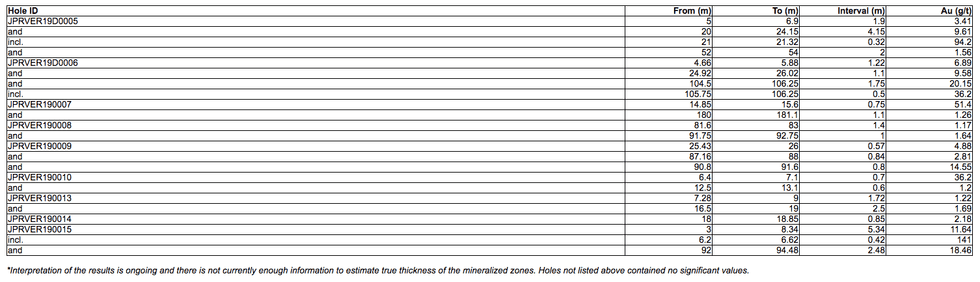

- Vertigo: Hole JPRVER19D0015 returned 0.42m of 141 g/t Au within a broader envelope of mineralization that averaged 11.64 g/t Au over 5.34m from 3m depth and 18.46 g/t Au over 2.48m from 92m depth. Hole JPRVER19D0005 returned 9.61 g/t Au over 4.15m from 20m depth, including 94.2 g/t Au over 0.32m from 21m depth. Hole JPRVER19D006 returned 6.89 g/t Au over 1.22m from 4.66 depth, and 20.15 g/t Au over 1.75m from 104.5m depth.

- Additional exploration activity continues across the White Gold, JP Ross and multiple other regional properties, with related soil sampling, prospecting, GT Probe sampling, trenching and RAB/RC drilling results to be released in due course.

Images to accompany this news release can be found at https://whitegoldcorp.ca/investors/exploration-highlights/.

“We are very pleased with the initial results from our ongoing diamond drill program. At the Vertigo we have confirmed the existence of multiple structures with high-grade gold mineralization that display strong continuity along strike and at depth. These results are very encouraging for an initial diamond drill program and validate our current interpretation for the Vertigo. We look forward to receiving additional results from the Vertigo drill program and from ongoing exploration work on additional targets across the JP Ross property,” stated Jodie Gibson, VP Exploration. “The initial results at Golden Saddle are among the best holes drilled to date and significantly expand the high-grade mineralization within and beyond the current Golden Saddle resource boundary. This is all alongside our regional exploration program, which continues to generate a strong pipeline of exciting new targets further demonstrating the district scale opportunity across our unique portfolio of assets.”

Golden Saddle

The Golden Saddle, including the GS Main, GS Footwall and GS West zones, consists of a series of subparallel zones trending NE-SW and dipping to the NW at approximately 55 degrees with mineralization occurring along faults, fractures and breccia zones in an overall normal to strike-slip structural regime. Together, the zones define mineralization over 1,500m strike length and up to 725m down dip. This includes a continuous high-grade core of mineralization >3 g/t Au on the GS Main that is up to 50m true-thickness and traceable over 500m of strike length and from surface up to 530m down-dip.

Results have been received for 4 infill holes in the central portion of the deposit targeting significant gaps in the resource model on the GS Main zone. The results of the holes received to date show strong potential to refine and add additional tonnage to the existing resource model through strategic infill drilling on the Golden Saddle. Additionally, one step-out hole was drilled on the northwestern margin of the deposit. The reported assay results ranged from trace to 14 g/t Au. Significant results received to date are detailed below.

Drilling Highlights:

WHTGS19D0198

Hole x198 is located between historic holes WD-021, WD-030, and WGGS10D0115 and targeted a gap in the high-grade core (>3 g/t Au) on the GS Main zone. The gap in the model was controlled by adjacent historic hole WD-030, approximately 25m to the southwest of x198. WD-030 returned 2.1 g/t Au over 7m before the mineralization was truncated by a narrow lens of sheared serpentinite at the projection of the GS Main (1). Hole x198 targeted the GS Main adjacent to the sheared serpentinite and intersected 3.59 g/t Au over 68m from 73m depth, including 8.11 g/t Au over 13.60m from 77m depth.

In addition to the GS Main, the hole intersected two additional zones. The upper zone is in the hanging wall above the GS Main and returned 4.48 g/t Au over 3m from 22m depth. The lower zone was within a GS Footwall lens and returned 2.31 g/t Au over 10.56m from 179m depth.

(1) See Underworld Resources News Release dated June 23, 2009. Available on SEDAR.

WHTGS19D0199

Hole x199 is located 52m to the west of x198 and also targeted a gap in the high-grade core on the GS Main associated with historic hole WD-030. Hole x199 intersected 4.07 g/t Au over 9.30m from 88m depth, including 7.81 g/t Au over 2.3m from 95m depth, associated with the GS Main. Two additional GS Footwall zones were intercepted, including 1.51 g/t Au over 7.83m from 158.8m depth and 1.41 g/t Au over 8.8m from 292m depth.

WHTGS19D0210

Hole x210 is located 270m northwest of hole x199 and targeted a down-dip extension of the GS Main in a previous undrilled portion of the Golden Saddle. The hole returned 1.71 g/t Au over 12.69m from 242.12m depth, including 3.07 g/t Au over 5.81m from 249m depth, and expanded the down-dip projection of the GS Main 205m from the limits of historic drilling and beyond the limits of the resource, approximately doubling the down-dip projection in that area.

WHTGS19D0211

Hole x211 is located at the same pad as x199 and drilled at an azimuth of 120o, targeting an especially broad zone of mineralization in the geologic model to better understand the geometry of mineralization in this important portion of the deposit. The hole returned 2.46 g/t Au over 65m from 115.15m depth; including 4.23 g/t Au over 17m from 128m depth and 5.53 g/t Au over 3m from 170m depth refining and increasing the thickness of mineralization in that area.

WHTGS19D0212

Hole x212 is located 90m to the east of hole x198 and infilled an area near the surface projection of the GS Main between historic holes WD-024, WD-038, WD-091, & WD-095. The hole returned 4.85 g/t Au over 27.45m of from 37.55m depth, including 6.58 g/t Au over 9m from 51m depth. The upper portions of the hole were mineralized with anomalous gold grades (>0.1 g/t Au) from surface and incorporating this material the overall composite is 2.27 g/t Au over 64m from 1m depth. The previous geologic model of the GS Main cut by hole x212 underestimated the width of mineralization in the area and excluded up to 25m of >3 g/t Au material from previous resource calculations. To date we have received assays for the upper portion of hole x212 and assays the lower 170m of the hole are in progress.

The results of the holes received to date show strong potential to refine and add additional tonnage to the existing resource model through strategic infill and step out drilling on the Golden Saddle. Continued evaluation of the resource model is in progress and additional infill holes may be recommended on areas with the potential to upgrade the existing resources.

GS West

The GS West was discovered in 2018 and is located approximately 750m west and on trend with the GS Main and contributed an estimated 62,500oz (1,1339,000 tonnes @ 1.45 g/t Au) to the Company’s recently announced resource update(2). The initial 2019 drilling on the GS West was designed to step-out in all directions and evaluate the geometry of the GS West zone beyond the limits of the current resource estimate.

Mineralization on the GS West is hosted within a strongly sheared felsic orthogneiss unit with abundant coarse-grained potassium feldspar augens. The mineralization is similar to Golden Saddle and consists of disseminated to fracture controlled pyrite associated with moderate to strong sericite-clay alteration. Based on the drilling conducted to date the mineralization appears to be strongest near contacts of the orthogneiss of with overlying mafic gneiss/schist units (amphibolite) and/or a lower meta-sedimentary package of banded biotite quartz gneiss. The felsic orthogneiss unit adjacent to these contacts is commonly pervasively sericite altered with localised zones of brecciation and minor quartz veining and up to 5% pyrite mineralization.

(2) See White Gold Corp. News Release dated June 10, 2019. Available on SEDAR.

Drilling Highlights:

WHTGS19D0200

Hole x200 is located on the western end of the GS West and is a 55m step-out along strike to historic hole WGAR11D0025. The hole returned 1.00 g/t Au over 25.85m from 14.15m depth, including 1.40 g/t Au over 12m from 12m depth with anomalous mineralization (>0.1 g/t Au) continuing for an additional 26.88m below the reported intercept. Including this anomalous zone, the hole returned an overall intercept of 0.64 g/t Au over 52.73m from 14.15m depth.

WHTGS19D0201

Hole x201 is located from the same pad at x200 above and returned two closely spaced intercepts of 1.21 g/t Au over 7m from 11m depth and 1.06 g/t Au over 17.55m from 25m depth. The lower 17.55m interval also included intercepts of 1.78 g/t Au over 2m from 26m depth and 1.43 g/t Au over 5.55m from 1.43m depth.

WHTGS19D0206

Hole x206 is located 104m to the northeast of x205 and was targeting the projection of the GS West approximately 140m down-dip of hole WHTGS18D0184. The hole returned 0.82 g/t Au over 12.1m from 229.9m depth, including 1.79 g/t Au over 3.1m from 229.9m depth. This zone occurs within a 43m envelope (210 – 253m) of anomalous mineralization with values ranging from 0.02 – 2.46 g/t Au.

Vertigo

The initial diamond drilling program on the Vertigo consists of 3 widely spaced fences (Sections VER-000, 100W, & 200W) that transect across the core of the Vertigo target area to establish geometry as well as vertical and lateral continuity on mineralized structures, previously intersected by 2018 RAB/RC drilling. The fences consist of 4 – 6 diamond drill set-ups per fence, spaced approximately 110m apart, with two holes drilled per set-up at angles of 45o and -60o. To date, over 5,700m have been drilled on the Vertigo over 23 holes. Results have been received for the first 11 holes (JPRVR19D0005 – 0015) and the drilling results will be discussed per fence/section.

Based on assays received to date, at least 6 subparallel structural zones have been defined and can be traced from surface to over 250m down-dip along individual structural zones. The envelope of alteration and mineralization along the structures varies down dip and ranges from 0.5m – 30m in thickness. The grade profile varies down-dip along individual structures and is anticipated to vary along strike as is common in high-grade, structural controlled, gold deposits. The results are currently being interpreted to project individual zones laterally, across section, and to follow up on interpreted plunge directions on the thickest and highest-grade zones of mineralization.

Gold mineralization on the Vertigo is hosted within a series of high angle, south dipping, structures associated with multiple phases of quartz-sericite-carbonate alteration with quartz veining and brecciation. Disseminated to semi-massive arsenopyrite-galena-pyrite and locally, visible gold occurs with the mineralized zones and the mineralization shows a strong correlation with Ag-Pb-Bi. Assay values for the results received to date range from trace to 141 g/t Au. Select samples from the mineralized intervals have been selected and are currently being re-analyzed using a Metallic-Screen analysis due to the presence of coarse visible gold.

The mineralized structures transect 3 lithologic packages consisting of an upper package of fine-grained biotite-quartz-feldspar gneiss (felsic gneiss) and amphibolite gneiss; a middle package of mafic schist, amphibolite, muscovite schist, and banded quartz biotite gneiss; and a lower unit of medium to coarse grain biotite-quartz-feldspar gneiss. Mineralization currently appears preferential to the upper felsic gneiss package with the highest-grade portions at or near lithologic contacts, however, additional assays are required to fully evaluate this relationship. Significant results are detailed below.

Section VER-000

JPRVR19D0005 & 6

Holes x005 & 6 were drilled from the same pad and are located in the center of the section VER-000. Hole x005 was drilled at a -45o dip and intercepted 4 gold bearing zones with the most significant consisting of 9.61 g/t Au over 4.15m from 20m depth; including 94.2 g/t Au over 0.32m from 21m depth.

Hole x006 was drilled at a -60o dip and intercepted 4 gold bearing zones with the most significant consisting of 6.89 g/t Au over 1.22m from 4.66m depth; 9.58 g/t Au over 1.1m from 24.92m depth; and 20.15 g/t Au over 1.75m from 104.5m depth; including of 36.2 g/t Au over 0.5m from 105.75m depth.

Section VER-100W

JPRVR19D0007 & 8

Holes x007 & 8 were drilled from the same pad and are located 110m to the south of holes x005 & 6 on section VER-000. Hole x007 was drilled at a -45o dip and intercepted 4 gold bearing zones with the most significant consisting of 51.4 g/t Au over 0.75m from 14.85m depth.

Hole x008 was drilled at a -60o dip and intercepted 4 gold bearing zones with the most significant consisting of 1.17 g/t Au over 1.4m from 81.6m depth and 1.64 g/t Au over 1m from 91.75m depth.

JPRVR19D0010 & 13

Holes x010 & 13 were drilled from the same pad and are located 115m to the west of holes x005 & 006 on section VER-100. Hole x010 was drilled at a -45o dip and collared into a 27m zone of strong alteration with 3 gold bearing zones with the most significant consisting of 36.2 g/t Au over 0.7m from 6.4m depth.

Hole x011 was drilled at a -60o dip and collared into a 31m zone of strong alteration with 3 gold bearing zones with the most significant consisting of 3.48 g/t Au over 0.57m from 7.28m depth and 1.69 g/t Au over 2.5m from 16.5m depth.

JPRVR19D0015 & 16

Holes x015 & 16 were drilled from the same pad and are located 105m to the south of holes x010 & 013 on section VER-100. Hole x015 was drilled at a -45o dip and intercepted two zones of high-grade mineralization. The upper zone returned 141 g/t Au over 0.42m from 6.2m depth within a halo of mineralization that averaged 11.64 g/t Au over 5.34m from 3m depth. The lower intercept returned 18.46 g/t Au over 2.48m from 92m depth and projects on trend with mineralization intercept at the tops of holes x010 & x013.

QA/QC

The analytical work for the 2019 drilling program will be performed by ALS Canada Ltd. an internationally recognized analytical services provider, at its Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All RC chip and diamond core samples will be prepared using procedure PREP-31H (crush 90% less than 2mm, riffle split off 500g, pulverize split to better than 85% passing 75 microns) and analyzed by method Au-AA23 (30g fire assay with AAS finish) and ME-ICP41 (0.5g, aqua regia digestion and ICP-AES analysis). Samples containing >10g/t Au will be reanalyzed using method Au-GRAV21 (30g Fire Assay with gravimetric finish).

The reported work will be completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standard, blanks and duplicates into the sample stream.

About White Gold Corp.

The Company owns a portfolio of 22,040 quartz claims across 35 properties covering over 439,000 hectares representing over 40% of the Yukon’s White Gold District. The Company’s flagship White Gold property has a mineral resource of 1,039,600 ounces Indicated at 2.26 g/t Au and 508,700 ounces Inferred at 1.48 g/t Au. Mineralization on the Golden Saddle and Arc is also known to extend beyond the limits of the current resource estimate. Regional exploration work has also produced several other prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Newmont Goldcorp Corporation with a M&I gold resource(3) of 3.4M oz and Western Copper and Gold Corporation’s Casino project which has P&P gold reserves(3) of 8.9M oz Au and 4.5B lb Cu. For more information visit www.whitegoldcorp.ca.

(3) Noted mineralization is as disclosed by the owner of each property respectively and is not necessarily indicative of the mineralization hosted on the Company’s property.

Qualified Person

Jodie Gibson, P.Geo., Vice President of Exploration for the Company is a “qualified person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, and has reviewed and approved the content of this news release.

Cautionary Note Regarding Forward Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “proposed”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include:; expected benefits to the Company relating to exploration conducted and proposed to be conducted at the Company’s properties; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described in the most recently filed management’s discussion and analysis of the Company. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Source: www.globenewswire.com