June 23, 2022

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce results from recent drilling targeting extensions to the mineralisation at the Company's flagship Hualilan Gold Project, in San Juan Argentina. The results include the first drill holes that were not included in the Company’s recent maiden 2.1 million ounce AuEq1 Mineral Resource Estimate (MRE) which includes a high-grade core of 1.1 Moz at 5.6 g/t AuEq1 .

Highlights

- First drilling post the CEL's 2.1 million ounce (AuEq)1 MRE significantly expands mineralisation, particularly the high-grade core of 1.1 Moz at 5.6 g/t AuEq1 , in multiple directions.

- Significant intersections outside the current MRE boundary include (see Table 1):

- 28.5 metres at 5.3 g/t AuEq (5.0 g/t Au, 23.9 g/t Ag, 0.02 % Pb, 0.03 % Zn) - (GNDD-530) Extends the Verde Zone 60 metres below the current resource boundary and GNDD-500 (40 metres at 0.8 g/t AuEq) and demonstrates significantly improved grades at depth

- 2.4 metres at 64.7 g/t AuEq (60.8 g/t Au, 53.4 g/t Ag, 0.04 % Pb, 7.1 % Zn) - (GNDD-520) Confirmed a high-grade zone at depth in the Verde Zone that remains open at depth and along strike and, based on recent drilling (assays pending), has significant upside potential

- 6.6 metres at 6.4 g/t AuEq (4.2 g/t Au, 50.0 g/t Ag, 0.01 % Pb, 3.4 % Zn) - (GNDD-536) 24.2 metres at 0.9 g/t AuEq (0.7 g/t Au, 1.7 g/t Ag, 0.02 % Pb, 0.2 % Zn) Intersected a new zone of near surface mineralisation (24.2m at 0.9) and extended the Verde Zone 200 metres below the current MRE boundary (6.6m at 6.4 g/t AuEq)

- 15.0 metres at 3.9 g/t AuEq (3.9 g/t Au, 3.7 g/t Ag, 0.03 % Pb, 0.2 % Zn) - (GNDD-547) 3.7 metres at 8.5 g/t AuEq (2.6 g/t Au, 50.5 g/t Ag, 4.9 % Pb, 9.3 % Zn) Extends the Gap Zone mineralisation to near surface and intersected a new zone of high grade mineralisation (3.7m at 7.3 g/t AuEq) 50 metres east of the current MRE boundary

- 14.4 metres at 2.1 g/t AuEq (1,2 g/t Au, 69.4 g/t Ag, 0.06 % Pb, 0.1 % Zn) - (GNDD- 532) 37.0 metres at 1.4 g/t AuEq (1.3 g/t Au, 8.6 g/t Ag, 0.01 % Pb, 0.1 % Zn) 10.9m metres at 2.6 g/t AuEq (2.0 g/t Au, 14.8 g/t Ag, 0.2 % Pb, 0.9 % Zn) Returned significantly higher grades than surrounding holes and intersected a new zone of higher-grade Verde style mineralisation 125 metres below the current MRE boundary

- The maiden MRE was based on 125,700 metres and the Company has now completed 197,000 metres with assays to be received progressively as core is sampled and sent for assay.

Commenting on the first drilling results after the resource, CEL Managing Director, Mr Kris Knauer, said

“We indicated when we released our Maiden Resource Estimate at Hualilan it was very much an interim and we expect it to increase significantly. It was based on 126,000 metres of our 204,000 metre drill program and 2.2 of the 3.5 kilometres of strike, over which the high-grade mineralisation has been intersected. These first results following the Mineral Resource Estimate confirm this.

All the more exciting, is that if assays confirm what we have logged in several recent holes, we have some significant new zones to follow up in addition to the areas we are currently targeting. It now firmly appears that mineralisation at Hualilan will remain open at the end of the current 204,000 metre program."

The MRE was based on 125,700 metres of the Company's 204,000 metre diamond core drill program. The current holes that were not included in the MRE comprise an additional 13,800 metres of drilling. As of this morning the Company has completed 197,000 of the 204,000 metres with results for the next 64,500 metres in the 204,000 metre program expected progressively over the next 4 months.

The results continue to exceed the Company's expectations and confirms that mineralisation remains open in all directions, the majority of the new mineralisation is high-grade, and there is clear potential for the MRE to grow significantly via extension and infill drilling. Several recently completed holes (assays pending) have opened new high-grade targets for extension drilling and the Company believes that Hualilan will remain open in all directions at the completion of the current 204,000 metres.

In addition to the strong results from drilling designed to extend the mineralisation outside the interim MRE boundary several infill holes, often between holes with minimal grade, have returned significant high grade results which is enormously encouraging.

SIGNIFICANT INTERSECTIONS RECEIVED AFTER THE MRE CUT-OFF DATE

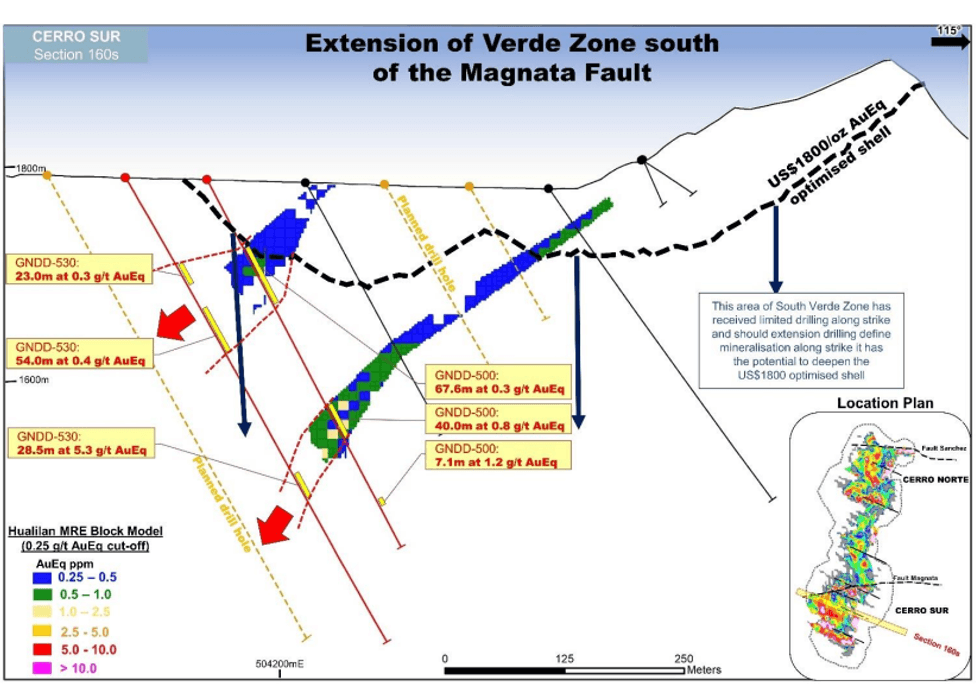

GNDD-530 - Verde Zone (South of the Magnata Fault)

GNDD-530 was a test for extensions of the Verde style mineralisation, south of the Magnata Fault, at depth. The hole was collared to test 80 metres below GNDD-500 which intersected 67.6 metres at 0.3 g/t AuEq from 81.5m and 40.0 metres at 0.8 g/t AuEq from 267.0m. GNDD-530 intersected three zones of mineralisation - 28.5 metres at 5.3 g/t AuEq (5.0 g/t Au, 23.9 g/t Ag, 0.02 % Pb, 0.03 % Zn) from 357.5m, 23.0 metres at 0.3 g/t AuEq (0.3 g/t Au, 1.2 g/t Ag, 0.01 % Pb, 0.02 % Zn) from 107.0m, and 54.0 metres at 0.4 g/t AuEq (0.3 g/t Au, 2.0 g/t Ag, 0.01 % Pb, 0.06 % Zn) from 159.0m.

All three intersections extended the mineralisation 80 metres down dip of the current MRE boundary with the deepest intersection (28.5m at 5.3 g/t AuEq) demonstrating significantly improved grades at depth which is becoming common in the Verde Style mineralisation at depth. The second intersection (54.0m at 0.4 g/t AuEq) significantly expanded the width of the mineralisation.

Figure 1 shows the MRE block model in section and GNDD-530. On this section the mineralisation below the US$1800 optimised pit shell was not included in the MRE as it has a grade of less than the 1.0 g/t AuEq cut off used for reporting the underground component of the MRE. This area of the MRE is relatively lightly drilled with additional drilling planned along strike and both up and down-dip. The higher grade mineralisation intersected at depth in GNDD-530, and any additional high-grades in infill and extensional drilling, has the potential to significantly deepen the US$1800 optimised pit shell which would provide a material increase to the current MRE.

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

3h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

4h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

4h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

9h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00