After enjoying its best start to the year since 1979 with prices coming within sight of $1,400 in July, gold’s gains in 2016 have now been trimmed to 6.8% or an underwhelming $70 an ounce.

Gold eked out small gains not far above 11-month lows on Friday in thin pre-Christmas holiday trade as it attempts to build a base above the $1,130 an ounce level.

The price of gold has lost $200 an ounce since the election of Donald Trump (against almost universal consensus that a victory for the property tycoon would lead to a surge in the price).

After enjoying its best start to the year since 1979 with prices coming within sight of $1,400 in July, gold’s gains in 2016 have now been trimmed to 6.8% or an underwhelming $70 an ounce.

Gold stocks made the most of Friday’s lift in the gold price with gains for all major producers. Shares of top gold miners Toronto’s Barrick Gold and Denver-based Newmont Mining enjoyed 3% gains on the day. Further down the rankings the bump was greater with South Africa’s Sibanye Gold, a top ten producer, gaining 3.4% while Canada’s Iamgold advanced 3.6% and Novagold 3.8%.

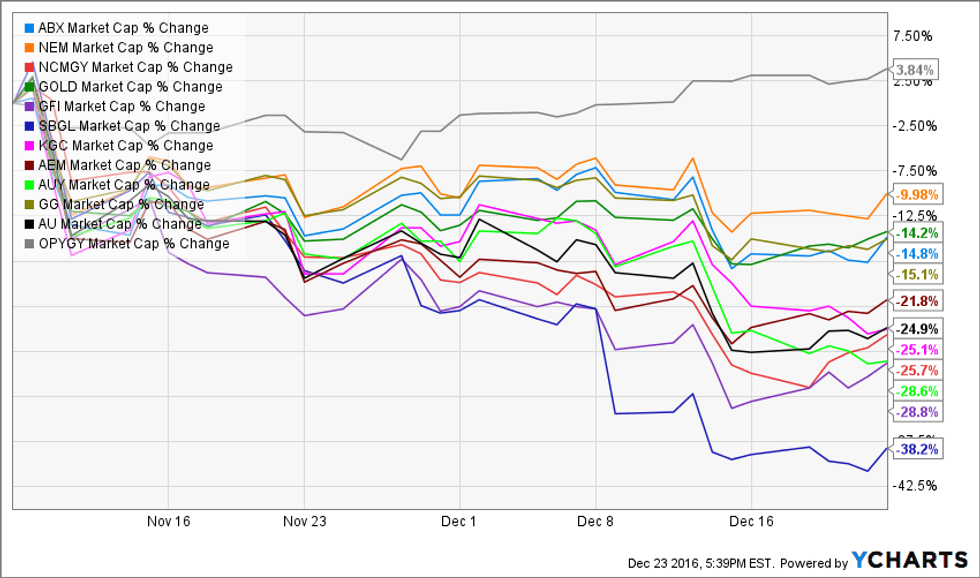

Despite Friday’s positive movements, the damage to the sector since November 8 has been heavy with double digit losses for all the top producers (barring Moscow-based Polyus which is actually up 3.8% since then).

Together the top 12 listed gold mining companies in terms of output lost $18.8 billion in value since the US elections with Australia’s Newcrest losing $3.5 billion alone. In percentage terms Sibanye was hardest hit with a near 40% decline, a move exacerbated by its ill-timed acquisition of Stillwater Mining, the only PGM producer in the US.

The post CHART: Trump devastates top gold mining stocks appeared first on MINING.com.