Thomson Reuters GFMS: Gold to Average $1,170 in 2015

The firm sees the gold price averaging $1,170 per ounce in 2015. It also said in its annual gold survey that it expects “modest strength” in 2016 with a base case of $1,250 per ounce.

While the gold price has certainly had its ups and downs, looking at the bigger picture and understanding what’s driving trends gives investors interested in the the yellow metal a chance to better understand the space.

Here are some highlights from the survey, including what happened with supply and demand in the gold space in 2014 and what Thomson Reuters expects to see in the future.

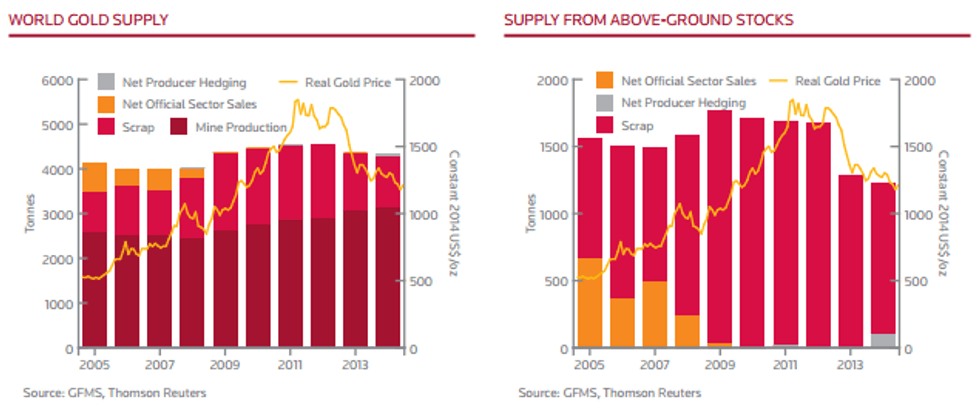

Supply in 2014

One of the most notable things that happened with gold supply in 2014 was an increase in mine production to an all-time high of 3,133 tonnes.

Here’s a look at a few other key points about gold supply mentioned in the report:

- 2014 was only the second year of net producer hedging since 1999, with 103 tonnes of accelerated supply generated for the year.

- All-in costs fell by 25 percent, to $1,314 per ounce, as impairment charges fell back from heightened levels in 2013. Meanwhile, excluding impairment charges, costs averaged $1,208 per ounce, a 2.3-percent decrease.

- Global scrap supply declined by 13 percent in 2014 to a seven-year low of 1,125 tonnes, mainly as a result of a weaker dollar and an improved economic environment.

Looking at supply for this year, Thomson Reuters expects a production growth halt. It’s basing that prediction on the fact that capital investment in the development of new projects remained constrained in 2014; there were also cuts to greenfield exploration expenditures.

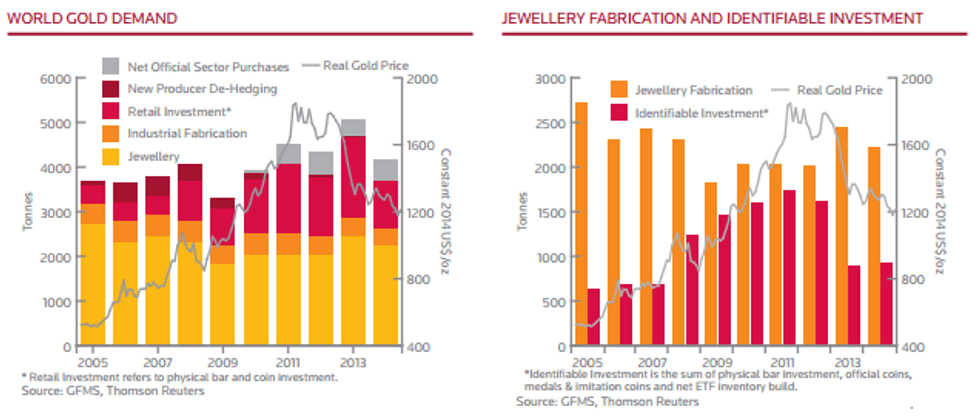

Demand in 2014

Interestingly, while gold mine production was up in 2014, total physical demand for the metal fell by 18 percent, hitting a four-year low of 4,158 tonnes. All areas recorded year-on-year declines, with the exception of official sector purchases.

Here’s a brief overview of the other demand trends mentioned by the firm:

- Despite lower gold prices in US dollar terms, jewelry demand dropped by 9 percent in 2014, mainly due to a sharp decline in Chinese offtake.

- Industrial fabrication fell last year by 4 percent, to 400 tonnes, due to weakness in all major sectors; that’s the lowest level since 2003.

- Total identifiable investment, which includes physical bar investment, all coins and ETF inventory build, increased by 3 percent, primarily due to the slower pace of ETF sales last year.

- Retail purchases of gold bars and coins slumped by nearly 40 percent, largely due to a lack of interest from key Asian markets.

- Net official sector buying went up by 14 percent, to 466 tonnes, the second-highest annual total since 1964.

Price outlook

According to Thomson Reuters, this year the gold price has been reacting to movements in the dollar and to investors second guessing when the Federal Reserve will increase interest rates. Those factors have seen the gold price suffer because a healthy US economy and higher rates imply better returns from fixed income and equity markets.

Moving forward, the firm sees the gold price averaging $1,170 per ounce in 2015. It expects “modest strength” in 2016 and an average price of $1,250 per ounce as buying in Asian markets picks up and “institutional investment demand in these markets also serves to offset the recent decline in OTC gold demand in the West.”

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading: