The Core Shack Dozen: Seabridge Adds Deep Kerr and Lower Iron Cap to KSM

Seabridge found two deep, high-grade zones at Deep Kerr and the Iron Cap Lower Zone at its KSM project in Northern BC. Wayne Hewgill, a geologist, weighs in.

The “Drill Tracker” highlights early stage drilling and trenching results, giving a metric to evaluate exploration results and compare them against their peer group. In this report we highlight a dozen exploration companies displaying their projects in the Core Shack at the AME BC Roundup held in Vancouver between January 26 and 29, 2014.

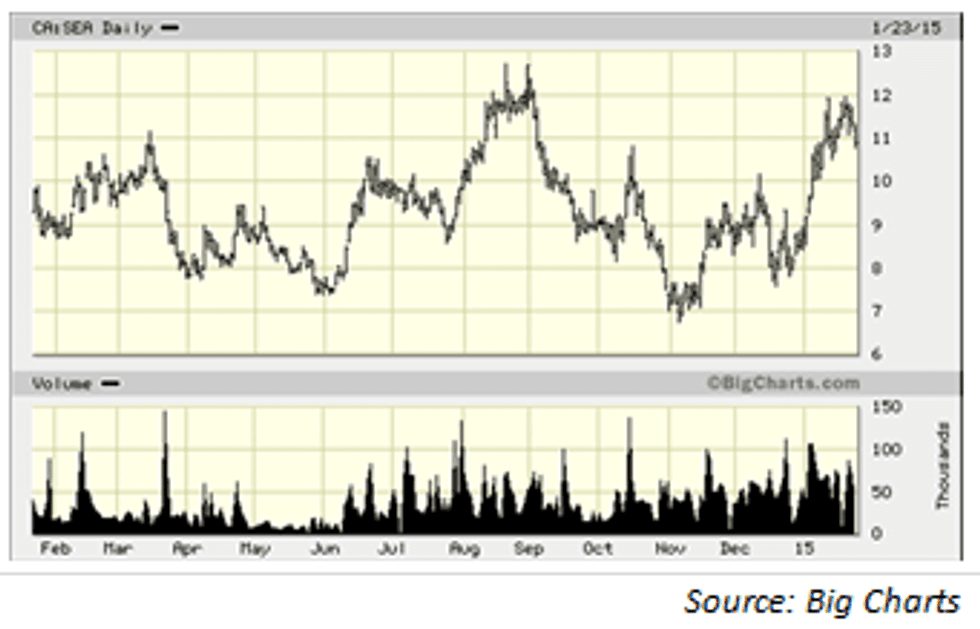

Seabridge Gold (TSX:SEA)

Price: $10.87

Market cap: $548 million

Cash estimate: $15 million (working capital)

Project: Kerr-Sulphurets-Mitchell (KSM)

Ownership: 100 percent

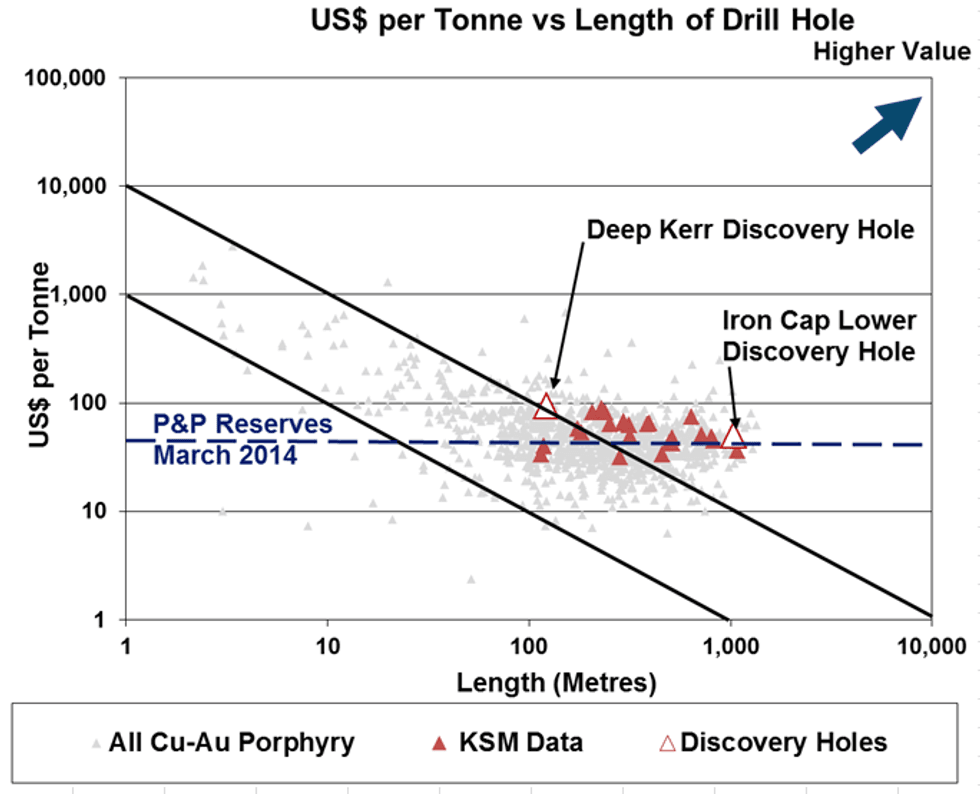

- In August 2013, Seabridge announced the discovery of two deep, high-grade zones at Deep Kerr and the Iron Cap Lower Zone at the KSM project in Northern BC. Notwithstanding the logistical challenges of the project, the two deep discoveries have perhaps laid to bed the notion that BC porphyries are low grade and do not have deep roots.

- Highlights from the deep drilling include:

- Deep Kerr discovery hole: 296.2 meters at 0.4 g/t gold, 0.73 percent copper and 1.15 g/t silver

- Iron Cap Lower Zone discovery hole: 1,032 meters at 0.77 g/t gold, 0.24 percent copper and 5.15 g/t gold, including:

- 207 meters at 1.22 g/t gold, 0.73 percent copper and 1.15 g/t silver

- 592 meters at 1.14 g/t gold, 0.37 percent copper and 3.7 g/t silver

- 228 meters at 0.96 g/t gold, 0.72 percent copper and 2.6 g/t silver

- The remote KSM deposit incorporates four separate, large porphyry deposits over 10 kilometers from north to south, including; Iron Cap, Mitchell, Sulphurets, Kerr and the higher-grade Deep Kerr. A preliminary feasibility study envisions both open-pit and underground mining, and a set of twin 23-kilometer tunnels to move crushed ore to processing facilities near Highway 37 and the new Northwest Power Transmission Line. A 2012 feasibility study envisions a $5.3-billion capital cost, a $3.5-billion NPV (5 percent) and a 10.4-percent IRR over a 55-year mine life; that’s all using a $1,320 gold price and $3 copper. The new deep zones are yet to be incorporated into a mine plan. The company received BC environmental approval in July 2014 and received federal approval in December 2014.

Project status: Feasibility and permitting

Resource: 2.1 billion tonnes at 0.55 g/t gold, 0.21 percent copper and 2.74 g/t silver in proven and probable reserves

Catalysts: Federal environmental assessment approved December 2014

Disclosure: I, Wayne Hewgill, certify that the information in this report is sourced through public documents that are believed to be reliable, but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report.

At the date of this release the author, Wayne Hewgill, owns shares in the following companies:

This report makes not recommendations to buy sell or hold.

Wayne Hewgill is a geologist with extensive knowledge of the global mining industry gained through 30 years of diversified experience in mineral exploration and new business development in Canada, as well as 10 years living in Africa, New Zealand and Australia. He was previously senior research officer at BHP Billiton, an executive with an exploration company working in Argentina and a mining analyst at three Vancouver-based financial groups where he developed the Drill Tracker database in 2006. He holds a B.Sc. in Geology from the University of British Columbia and is registered as a Professional Geoscientist (P.Geo) with APEGBC.