Goldcorp has made it’s move into Canada’s Yukon. What does that mean for the Yukon as a whole?

Goldcorp has made it’s move into Canada’s Yukon. What does that mean for the Yukon as a whole?

On a recent media tour of mining exploration and development sites in Canada’s Yukon, INN was lucky enough to visit the Coffee project, acquired by Goldcorp through a takeover of Kaminak Gold this summer. It was quickly obvious why Goldcorp chose Coffee and Kaminak to make its entrance into the north.

The camp was exceptionally clean and smoothly run, and all Kaminak geologists and staff–many of whom will be kept on at the project by Goldcorp—were extremely professional and knowledgeable.

Tim Smith, vice president of exploration for the project, took us through a broad overview of Coffee from discovery to feasibility. Standing on top of the Supremo deposit listening to Smith deliver an excellent overview of the property, Byron King of Agora Financial leaned over and whispered, “you’re watching why Goldcorp bought this company right now.”

Kaminak made its discovery at Coffee in 2010 and quickly advanced the project, putting out a preliminary economic assessment in 2014 and advancing straight to the feasibility stage, releasing its study in early January 2016. Several months later, Goldcorp announced it would buy Kaminak in an all-share deal valued at C$520 million.

The feasibility study envisions an open-pit heap-leach operation with a ten-year mine life, an after-tax net present value of $455 million and an internal rate of return of 37 percent with a payback period of two years.

Smith stated that Kaminak made a conscious decision to focus on oxide mineralization. “You mine from the top down, you explore from the top down, it’s cheaper all around and faster that way,” he said. “I certainly view the 10 year base case mine plan as very much base case. There’s a lot of opportunity for ongoing accretive exploration.”

Similarly, while flying over the Coffee site in a helicopter, former Kaminak Chairman John Robbins explained that the location of the heap-leach facility at Coffee was chosen such that it would potentially be central to further discoveries at the project.

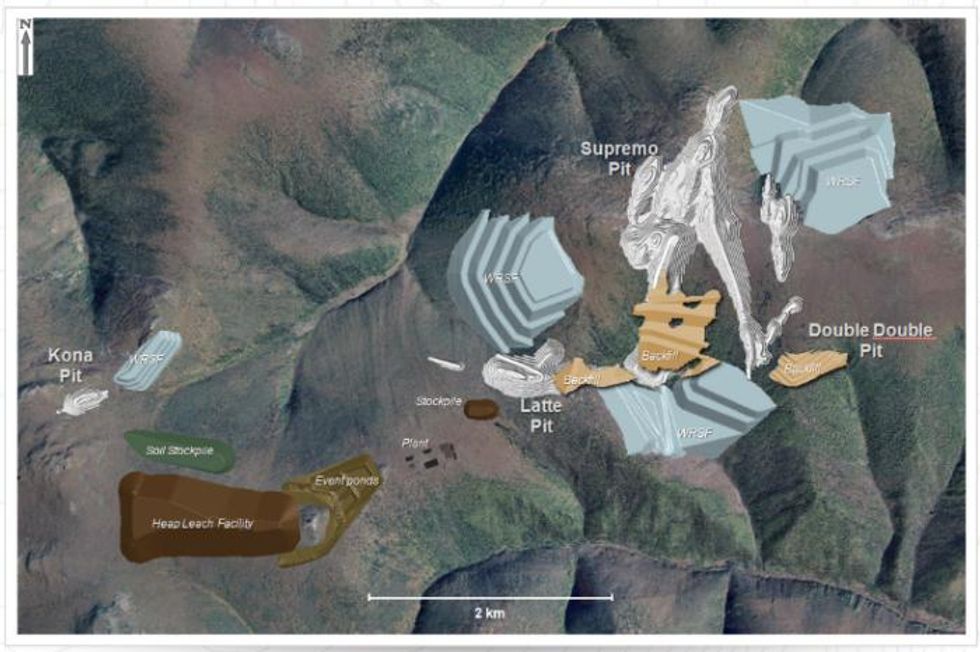

The Latte, Supremo, and Double Double pits are relatively close together at Coffee, but the smaller Kona pit sits out to the west.

“Kona, for me is proof of concept. It’s the tip of the iceberg there,” Smith said. “It’s a pretty small pit, but I think it’s a sign of the potential to continue developing resources and reserves out to the west.”

Certainly, Goldcorp is also planning to move beyond the 10-year base case mine plan at Coffee.

“The acquisition of Kaminak is very consistent with our strategy of partnering with junior mining companies to make sure that we’re identifying and developing districts with significant exploration potential,” said Brent Bergeron, executive vice president of corporate affairs and sustainability at Goldcorp, during a presentation. “It’s consistent also, with us looking at a specific project, growing the potential for exploration of that project but also looking at it in terms of an overall camp.”

Beyond its plans to expand the Coffee project, Goldcorp has also bought a 19.9 percent stake in Randy Turner’s Independence Gold (TSXV:IGO) in late June. Independence holds the Boulevard project, located adjacent to Coffee.

In terms of investing in the Yukon, Ben Kramer-Miller of Mining Wealth, points out that there are still significant infrastructure requirements for new projects in the territory. “Goldcorp has only changed market perception at this point,” he writes. “[T]here is nothing tangible in its work at Coffee to suggest that it has made life easier for other mining companies in the Yukon.”

Still, being home to the Klondike gold rush and the still-yet-to-be-found Motherlode, mining runs deep in Yukon history, and it is certainly a jurisdiction that is supportive of mining projects.

It will be interesting to watch the Coffee project move forward. Bergeron praised Kaminak’s hard work building strong relationships with local First Nations and other stakeholders, and stated that Goldcorp looks forward to building on that foundation.

“I think a lot of the work that’s been done up front and investing in that will allow us to have a permitting timeline that’s going to be much more ‘aggressive,’ if I could use the word,” he stated.

Shares of Goldcorp are up 48 percent year-to-date, trading at $23.75 on Tuesday.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.