Gold Prices See Another Boost on US Trade Deficit and Oil Price Gains

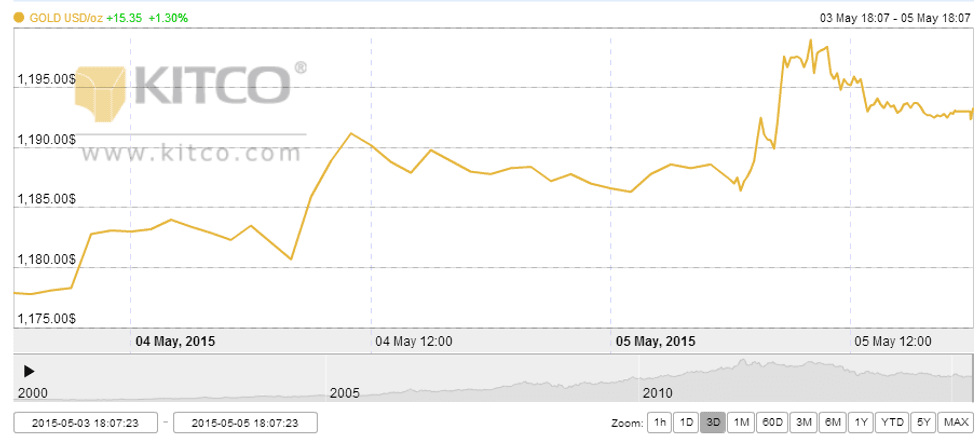

The gold price is on a two-day rally, reaching up to a high of over $1,200 on Tuesday, with the surging oil price and the worst US trade balance in six years being attributed to the boost.

The spot gold price increased by $19.10 on Monday, rising again on Tuesday by 0.44 percent. Driving that was the fact that the US trade deficit hiked up 43.1 percent to $51.4 billion in March, the highest level since October of 2008.

The reason behind the massive trade deficit has been put down to the US dollar rising 12 percent. That strength lead to increased imports as the decreasing cost of imported goods became more and more attractive.

Crude oil also gave a boost to the gold price as geopolitical events rattled the oil market. On Tuesday, WTI crude rose 2.95 percent to $60.64 per barrel after protesters in Libya blocked the main port and stopped over 100,000 barrels per day of crude production according to the Wall Street Journal. Brent crude also saw a boost in price to $67.64 per barrel.

While the gold price is finally looking up, it held below the $1,200 an ounce mark as those interested in the space await the release of the US Labor Department’s report on non-farm payrolls, which comes out this Friday. This information, along with speculation that US inflation will start to pick up following rising energy costs, will likely have a direct affect on when the Federal Reserve decides it will boost interest rates.

Specifically, a median estimate put out in a Bloomberg survey of economists predicts the addition of 230,000 workers in the US last month, up from 126,000 in March. Typically when higher rates are implemented, investors are driven to favor assets that pay interest, giving gold a new found appeal pending interest rate hikes.

Company news

The gold price isn’t the only things that has been seeing good news as of late, gold companies also posted some great results this week as well. One example is Roxgold (TSXV:ROG), which announced a new area of high-grade mineralization was found in its latest drilling at Bagassi South. The news boosted the company’s share price up 6.56 percent on Tuesday to $0.65.

Another gold company that had promising news come down the pipes this week was Kaminak Gold (TSXV:KAM). The company released results from a metallurgical program at its Coffee project in the Yukon on Monday, with 23 out of 26 column leach tests seeing over 90 percent gold recovery.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.

Related reading:

Gold Price at Three-week Low as US Housing Market Gains Strength