Gold Price Retreats as Investors Focus on Fed Meeting

Despite starting the week above the US$1,500 mark, the gold price declined to hit a one week low on Tuesday.

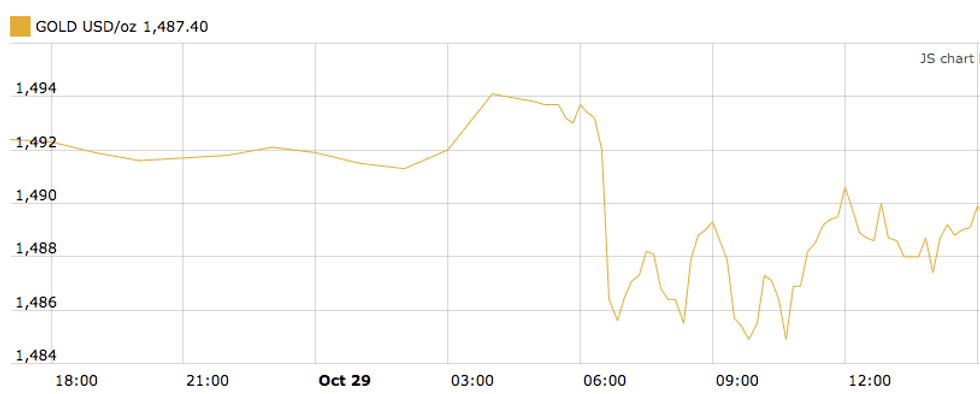

The gold price hit a one week low on Tuesday (October 29) as optimism about a trade deal between the US and China increased risk sentiment among investors.

Despite starting the week above the US$1,500 per ounce mark, the yellow metal had declined more than 1 percent by Tuesday. Gold was trading at US$1,485 as of 3:00 p.m. EDT.

“Gold is still down due to the general positive tone in the markets right now regarding the US-China trade war and Brexit,” said Chris Gaffney, president of world markets at TIAA Bank.

According to Gaffney, an expected interest rate cut could lift gold back above US$1,500.

Chart via Kitco.

The US Federal Reserve is widely expected to announce another 25 basis point rate cut — potentially the third one this year — on Wednesday (October 30) after a two day Federal Open Committee Meeting.

“(The) next big catalyst for gold is (Fed Chairman Jerome) Powell’s speech after the rate decision and any indications of future monetary policy,” James Hatzigiannis, senior strategist at Long Leaf Trading Group, told MarketWatch.

Investors will also be looking for further clues about the outlook for US monetary policy. The Fed pointed to a restrained global growth outlook as motivation for its last rate cut, noting that the step was taken in order to keep the US economy strong.

“The markets have hopes for a rate cut at this meeting, but even if the Fed would take a pause this week, the markets are expecting another cut in this quarter … which is supportive for gold,” Quantitative Commodity Research analyst Peter Fertig said.

That said, in July, when the Fed slashed rates for the first time since the 2008 financial crisis, both gold and silver slipped right after the announcement. The precious metals also suffered in September after the Fed said it was cutting interest rates one more time.

Gold prices tend to trade higher when interest rates are low, as this reduces the opportunity cost of holding the precious metal. Prices trended upwards during the third quarter, increasing from US$1,383.70 to end the quarter at US$1,482.20 — breaking the US$1,550 mark during that period.

“The bullish case for gold is still intact; it’s likely to be in a larger US$1,485-US$1,525 range for the next month or so,” said George Gero, managing director at RBC Wealth Management.

Moving into the final quarter of 2019, analysts polled by FocusEconomics see gold dipping slightly towards the end of the year from its current level and averaging US$1,500 in Q4.

“That said, gold prices will remain high by historical standards, reflecting waning global growth, expectations of further monetary easing by key central banks, ongoing geopolitical uncertainty and negative-yielding sovereign bonds,” notes FocusEconomics.

“Our panel sees gold prices broadly stable through 2020, averaging US$1,494 in Q4.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.