It was an interesting and no doubt busy year for the gold price. Here’s what some experts in the industry had to say about its movement in 2016.

At the end of 2015, gold analysts projected the price would fall anywhere between $1,382 per ounce and sub-$1,000 per ounce throughout 2016.

That being said, the yellow metal had a stronger push to the year than expected, rising from $1,076.30 per ounce at the end of the year to $1,259.10 per ounce by March.

In May, its price briefly hit the $1,300 mark, but it wasn’t until the Brexit decision at the end of June when the gold price really took off. Following Britain’s decision to leave the European Union, the gold price was trading hands at $1,365.40.

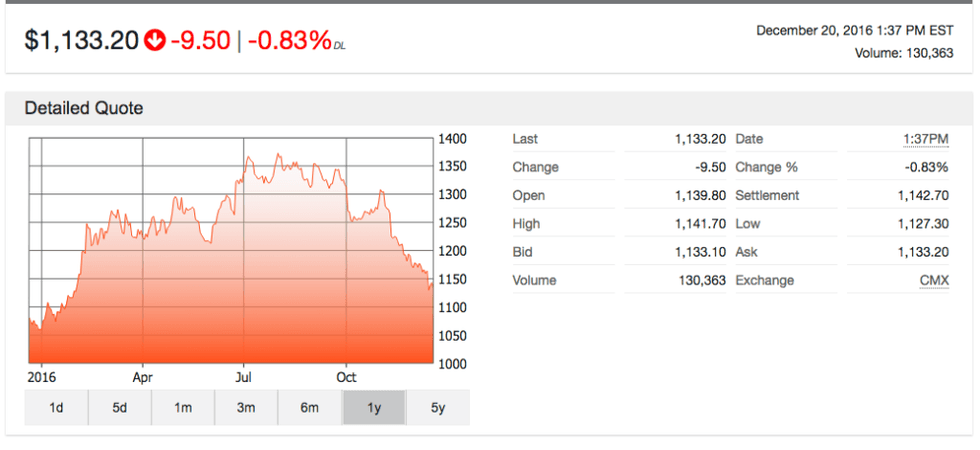

While the gold price is still ahead of where it was this time last year, it’s tapered off significantly in the last several months (not withstanding a quick spike following the US election). As of 2:10 p.m. EST on December 20, the yellow metal was priced at $1,138.90 per ounce–an overall increase of 6.15 percent year-to-date.

In terms of price, the chart below is indicative of the gold overview throughout 2016.

To get more insight as to what pushed gold in 2016, the Investing News Network (INN) spoke with Jeffrey Nichols, senior economic advisor at Rosland Capital LLC, Terry Yaremchuk, investment advisor and futures trading representative with the Chippingham Financial Group, and Erica Rannestad, a senior precious metals analyst at Thomson Reuters GFMS.

Gold overview 2016: price fluctuation

As mentioned, the gold price saw a steady increase during the first half of the year, with most of the ramifications felt as a result of the Brexit decision in June. Elaborating, Rannestad said Britain’s decision to leave the European Union “lead to increased uncertainty” in the market. With that in mind, investors tend to flock to precious metals–such as gold–during these times, causing the prices to increase.

From November 2015 through to February 2016, Yaremchuk said the gold price put in a “really unique rounded bottom” which was indicative the yellow metal was possibly coming out of a bear market.

“Sure enough, [the gold price] put in a higher high,” he said. “There was a little bit of consolidation and another push. Gold almost made it as high as $1,400 an ounce.”

To that end, Yaremchuk said he was surprised by the strength of the move in the gold price, noting it was stronger than he expected.

“I expected that we would see $1,300 as a high, and then I expected we would see a little bit of a correction before advancing,” he said.

Still, for Nichols the price didn’t move quite as high as he initially anticipated.

“I was much more bullish in the market,” he noted. “I thought we would see a bigger increase in prices as gold began its next wave or typical upswing.”

Although the gold price did see a surge throughout the summer and even early in the fall, Nichols said he was surprised by its “failure to move substantially higher.”

On that note, a strong US dollar has also put pressure on the gold price in the last couple of months of 2016. In November, CNN Money reported that the dollar climbed to a 13-year high as investors were hopeful the Federal Reserve will raise interests rates sooner rather than later.

That changed in late November as the dollar backed off 0.26 percent to 101.240, according to the Economic Times.

“Gold has been sensitive to the US monetary policy and dollar movements,” Mark To, head of research at Hong Kong’s Wing Fung Financial Group told the Times. “Inflation as well as pace of interest rate hike expectations among the investors are increasing along with the opportunity cost of holding gold.”

As such, the gold price hasn’t been able to recover since the election. Following the Federal Reserve’s announcement they would be hiking interest rates, the precious metal bombed to 10-month lows. The US dollar also continues to put pressure on the yellow metal as the end of the year draws near.

As such, Nichols said he didn’t expect it to drop off as much as it did in the last couple of months of 2016, but agreed with Rannestad that Trump’s election victory had significant implications on the gold market and, indeed, the resource sector in general.

“His statements over the course of his campaign were all contradictory so we don’t really know where he stands on a lot of issues,” he noted.

Similarly, Sam Bloom over at Sprott’s Global Resource Investments wrote that Trump’s victory has “been negative for gold,” at least in the short term. Since then, the precious metal has been trading in a strong downtrend, which he writes isn’t generally the case during a bull market correction.

“On the one hand, momentum in the gold price itself is firmly to the downside and we’ve yet to see any buying support during this selloff that followed Trump’s election,” the report reads.

Gold overview 2016: low demand

Looking over to demand for the yellow metal, Thomson Reuters reported that, for the third consecutive quarter–Q3 2016–physical demand “remained at pitiful levels.” According to the report, demand dropped 30 percent year-on-year in Q3 as a result of higher prices at the beginning of the quarter following the Brexit vote.

In terms of world gold supply and demand, 822 tonnes of gold was mined in the third quarter–a 2.1 percent loss year-on-year. The report notes the loss of production was a result of cuts in capital expenditures and miners is feeding through into fewer new projects, and output is dropping at existing operations.

On the contrary, World Gold Council noted that gold demand in Q3 2016 was 992.8 tonnes, with most of that coming from China and India. Still, the report noted that a combination of high and fluctuating prices, low income and increased regulation put pressure on the market India.

Jewellery consumption reportedly dropped 41 percent year-on-year to 107.6 tonnes in the third quarter of 2016, while investment demand dropped by 60 percent to 22 tonnes. However,with Diwali in October, demand saw a bit of a recovery and World Gold Council suggests there will be a positive end to 2016.

In China, Thomson Reuters noted that demand also fell in the third quarter of 2016, with jewellery falling 29 percent year-on-year. However, investment demand rose 11 percent year-on-year.

As the year comes to a close, Thomson Reuters expects gold demand to pick up in the last quarter as a result of seasonal demand impact ahead of the Chinese New Year in January.

Gold overview 2016: companies at a glance

As 2016 draws to a close, Yaremchuk said one company that stood out was Detour Gold (TSX:DGC), who he said is sensitive to the gold price.

“When the gold price was weak, they took a beating. When the turnaround came, they really performed well,” he said. “If I’m bullish on gold, I want to be in a company that’s highly leveraged to the price of gold.” However, Yaremchuk said, that’s not to say that Detour is a better gold companies than others, simply that it’s sensitive to the fluctuation of the gold price.

Bearing that in mind, Detour’s shares have seen a year-to-date increase of 10.27 percent to $15.89.

Other gold companies that performed well, according to Haywood Securities’ Junior Exploration Q4 2016 Report, include the following:

- Cardinal Resources (ASX:CDV): Cardinal Resources owns a 100 percent interest in the mineral rights around the Namdini project in Northern Ghana. The company ramped up its exploration and resource drilling program during 2016. What’s more, Cardinal has furnished a resource estimate showing a deposit with at lest 4 million ounces of gold. Year-to-date, shares of the company have increased 67.86 percent to $0.235

- IDM Mining (TSXV:IDM): IDM Mining is focused on the Red Mountain project located in British Columbia. The company has the option to earn a 100 percent interest by paying $2 million in staged payments. The flagship project has a resource estimate of 441,500 ounces of gold. Recently, IDM completed its drill program at the project and is awaiting the assay results, while a feasibility study ie expected to be completed in the second quarter of 2017. With that in mind, shares of IDM have seen an increase of 47.06 percent year-to-date to $0.125

- Nighthawk Gold (TSXV:NHK): Currently, Nighthawk Gold is advancing its 100 percent owned Indin Lake Gold property in the Northwest Territories, which has a resource estimate of 39.81 million tonnes with an average grade of 1.64 g/t gold for 2.10 million ounces of gold. Shares of Nighthawk Gold spiked 546.15 percent year-to-date to $0.420.

- Orex Minerals (TSXV:REX): Orex Minerals has an interest in two gold/silver/base metal projects in Mexico: the Sandra Escobar project–with a 65 percent earn-in–and the Coneto project–with a 45 percent interest. Additionally, the company has a 100 percent interest int he Jumping Josephine project in British Columbia. At the Coneto project, Orex announced in November the commencement of a 5,000 meter drill program, and a 4,000 meter drill program at Sandra Escobar. Shares of Orex have jumped 66.67 percent year-to-date to $0.25.

- Pure Gold Mining (TSXV:PGM): Currently, Pure Gold owns a land package covering 45 square kilometers in the Red Lake district in Ontario, making it the third largest land owner in that vicinity. Pure Gold is conducting an expanded 2016 drilling program, and is also planning on reopening the underground portal in the fourth quarter of 2016 to enable underground drilling. Year-to-date, shares of Pure Gold have seen a rise of 260.87 percent to $0.415.

- Rupert Resources (TSXV:RUP): Rupert Resources is an exploration and development company that has recently completed the acquisition of the Pahtavaara gold mine and mill in Finland for $2.5. million. On that note, the company expects to commence Phase 1 of its exploration program in the new year. Shares of Rupert have seen a significant rise of 1,933.33 percent year-to-date to $0.61.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Related reading:

Gold Outlook 2017: Analysts Call for Price Increase