Gold Demand Falls 14 Percent in First Half of 2017

Global gold demand fell in the first half of 2017 due to a sharp drop in ETF purchases, the World Gold Council says.

Global demand for gold dropped 14 percent in the first half of the year due to a sharp fall in ETF inflows, the World Gold Council (WGC) said on Thursday (August 3).

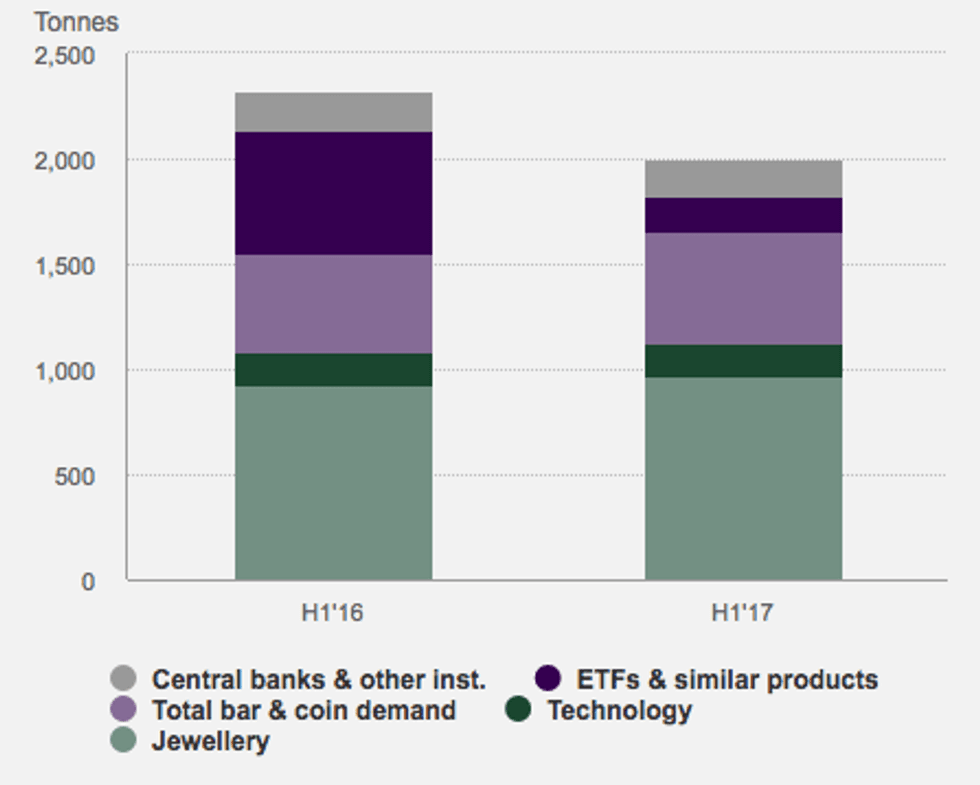

Total global demand for gold reached 2,003.8 tonnes in January-June, down from 2,318.7 tonnes in the same period last year. For the second quarter alone, demand was 953 tonnes, the lowest quarterly total in two years.

A significant slowdown in ETF purchases over the period drove the weakness, with Q2 gold-backed ETFs falling 76 percent year-on-year to 56 tonnes. This was because prices increased at a lower rate than last year, up only 8 percent compared to 30 percent in the first half of 2016.

That said, purchases of bars and coins rebounded from very low levels, gaining 11 percent for the period, as demand in China, India and Turkey increased.

Jewellery also had a strong first half, gaining 8 percent in Q2, supported by a rebound in buying in India and Turkey.

Similarly, technology demand surged and registered its third consecutive quarter of growth. As the chart below shows, central banks continued to buy gold but at a more modest pace.

Chart via WGC

“This year demand is a little more balanced,” said Alistair Hewitt, the WGC’s head of market intelligence. “While we saw huge inflows into ETFs last year, the physical markets of jewelry, bars and coins slumped to multi-year lows.”

According to the report, total gold supply declined by 8 percent in the second quarter, as mine production remained steady but recycling levels continued to drop.

What’s ahead?

Looking ahead, there are a few things to watch out for in the rest of the year in terms of global gold demand.

“Inflation data out of the US looks soft and markets have pushed out their expectations for a rate rise,” Hewitt said.

“The monsoon is looking good in India and, providing the market adapts to the new GST, we may see solid demand around Diwali. And as the next generation of smartphones gets rolled out, we may see good support for technology demand.”

Hewitt expects total annual demand to be around 4,200-4,300 tonnes. That would be slightly below last year’s 4,337.5 tonnes, the highest annual level since 2013.

But many analysts remain bullish on gold for the rest of the year. In a recent interview with the Investing News Network, Adrian Day of Adrian Day Asset Management explained why it’s is a very good time to invest in gold. Click here to listen to the interview.

Similarly, Andy Schectman, president of Miles Franklin, shared why he thinks the market is setting up for a major gold uptake. Click here to listen to the interview.

On Thursday (August 3), gold prices steadied after nearing a seven-week high on expectations of further Fed rate hikes. As of 3 p.m. EST gold was trading at $1,268.63 per ounce.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.