U3O8 Price Update: Q3 2022 in Review

The uranium spot price has gained 12 percent since January. Find out what is driving the market, and if experts think more gains are ahead.

Click here to read the previous U3O8 price update.

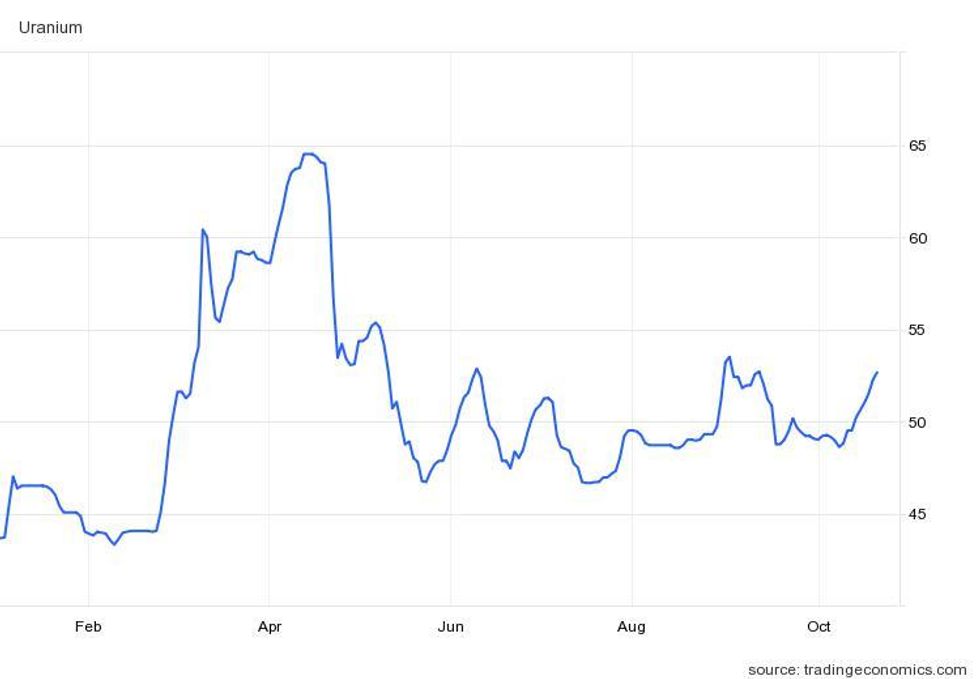

Amid global turmoil and equities market selloffs, the U3O8 spot price was able to mitigate its losses during the third quarter, only shedding 4.47 percent over the three month period.

Holding in the US$51 per pound range in early July, values slipped to US$49.18 by the end of September. While Q3 saw a slight contraction, the energy fuel is one of the few commodities to make an overall gain since January, when it was at US$43.58.

Much of uranium’s 2022 price upside has resulted from a growing supply imbalance that's resulted in current production levels not being able to meet demand. Another factor is the growing list of countries that are planning to extend the lives of their nuclear reactors or erect new ones that will need their own supply of U3O8.

Uranium fundamentals are also being bolstered by ongoing energy security concerns, which reached new heights after the invasion of Ukraine. Additionally, positive sentiment has been growing around nuclear energy as part of the green agenda.

“Global governments have set ambitious climate goals and it has become increasingly clear that these energy transition targets cannot be met without a reliable, low or zero-carbon-based energy source,” states an August uranium report from Sprott (TSX:SII,NYSE:SII) titled “Dawn of a New Nuclear Renaissance."

It continues, “Nuclear power has the potential to fill this need, given that it has the highest capacity factor versus both traditional and alternative energy sources. In addition to providing a highly reliable source of electricity, nuclear power is one of the cleanest energy sources based on CO2 emissions and one of the safest energy sources available.”

U308 price update: Sprott trust purchases offer support

After soaring to an 11 year high of US$64.61 in early Q2, the U3O8 spot price faced pressure brought on by broad market turbulence; by late May, values had declined to US$46.74 — a quarterly low.

U3O8 year-to-date price performance.

Chart via TradingEconomics.

By the beginning of July, values had returned to the US$51 level, but then sank to Q3's low point of US$46.

Notably, July marked the first anniversary of the Sprott Physical Uranium Trust (TSX:U.UN,OTCQX:SRUUF), an investment vehicle for those seeking exposure to physical uranium. Since its market introduction in July of last year, SPUT has raised more than US$1 billion, which it has used to purchase more than 38.5 million pounds of U3O8.

In an August report, UxC notes that in those 12 months, “SPUT has represented just over 37 percent of all uranium-containing spot volume, and if one focuses only on spot U3O8 deals, then the total increases to a little more than 41 percent of the total.”

The SPUT overview goes on to point out that the investment tool has had a significant impact on the U3O8 spot price. “We can see that large capital raisings by SPUT have also overlapped with spot price spikes, which is clearly not a random coincidence,” it reads.

However, according to the UxC report, SPUT has also faced some challenges in the volatile market.

“As the global equity markets have been particularly turbulent over the past few months, this has clearly taken a toll on uranium investments, including SPUT’s shares,” the document explains.

In mid-July, SPUT shares fell to a year-to-date low of C$12.69, but had rebounded to C$16.31 by the end of Q3.

“Whatever happens in the future, SPUT has already had a huge impact in creating a much tighter spot market,” states UxC. “Going forward, this should translate into greater focus on uranium mining while spot prices are likely to remain rather volatile.”

U3O8 price update: Supply shortfall continues to grow

Due to years of output curtailment, total uranium production continues to decline. Since 2015, annual global production has failed to meet overall demand, slipping to only 77 percent in 2021.

During a luncheon at the New Orleans Investment Conference, held in mid-October, Chris Frostad, president and CEO of Purepoint Uranium Group (TSXV:PTU,OTCQB:PTUUF), explained that the supply discrepancy has allowed the market a chance to recalibrate, aiding in 2022's price momentum.

“For the last four or five years, we've actually been producing 20 percent to 30 percent less uranium than we're using in reactors,” he said. “And again, trying to put supply and demand back into balance.”

With a 23 percent imbalance that is increasing, the market is going to need project restarts and additional mines to come online to meet current demand for U3O8 from the 440 nuclear reactors today, as well as the new reactors of tomorrow.

In 2018, market participants referenced a US$50 price point as an incentive level for new production. However, with inflation and the rising cost of energy, that marker has changed.

“The price of uranium is now returning to or heading towards incentive levels,” said Frostad, noting that the current spot price is about US$50. “You really need to get up to US$65 to US$70 before new mines will be starting to get built, or ones that are shut down get turned back on again," he noted, adding that he sees prices gradually increasing for another year.

U3O8 price update: Clean energy and national security long term drivers

By the end of August, the spot price had climbed to a Q3 high of US$53.27, a US$10 increase from January. While both gold and silver were not up year-to-date by the end of the third quarter, U3O8 ended the nine month period 12.85 percent higher.

“Uranium, both the physical spot price and uranium mining equities, had standout performance in August,” reads Sprott's August uranium report. “Uranium’s strength provided a notable divergence from the weak performance of the broader markets.”

Although uranium saw tailwinds throughout August, the Sprott Uranium Miners ETF (ARCA:URNM) failed to register gains.

“Still, by contrast, the performance of uranium miners remains in the single digits,” wrote Jacob White, senior analyst at Sprott. “We believe that the current demand for uranium conversion and enrichment, coupled with a shift away from Russian suppliers supports an increase in the U3O8 uranium spot price, which is ultimately supportive for uranium miners.”

Japan’s late August announcement that it will begin restarting additional nuclear reactors is another bullish sign.

“We are seeing this push and drive towards nuclear power as a source of electricity moving forward, and that only helps with the return to the good times in the uranium business,” Frostad said.

After rallying to a Q3 high of US$53.27 at the end of August, September saw the U3O8 spot price contract, ending the month and the quarter at US$49.18, a 4.47 percent drop. Uranium wasn’t the only commodity to struggle in September — a report from Sprott notes that the S&P 500 (INDEXSP:.INX) shed 4.88 percent over the third quarter.

“It is also worth noting that the fundamentals of the uranium market continue to strengthen, spurred by growing acceptance among global governments that nuclear power supports the world's energy transition from dependence on fossil fuels and helps ensure higher energy security,” White wrote in the monthly uranium report.

U3O8 price update: More project restarts

With the price of U3O8 holding above the US$50 level for much of the last 10 months, and demand looking positive, uranium miners have begun the process of restarting projects. These previously operational mines were shuttered due to the low spot price.

Cameco (TSX:CCO,NYSE:CCJ) announced earlier this year that it plans to resume operations at its McArthur River and Key Lake properties — located in Saskatchewan — during the fourth quarter.

This news follows the uranium company’s decision to restart its Cigar Lake operation in April 2021. In its preliminary Q3 overview, Cameco reported the production of 2 million pounds for the three month period.

In early October, Cameco announced plans to form a strategic partnership with Brookfield Renewable Partners (TSX:BEP.UN,NYSE:BEP) to acquire Westinghouse Electric Company.

The US$7.8 billion purchase will see the partnership take control of “one of the world’s largest nuclear services businesses.” According to a statement, Westinghouse services approximately half the nuclear power generation sector and is the original equipment manufacturer to more than half of the global nuclear reactor fleet.

The purchase will help Cameco build its North American vertical integration, which comes at a time when American dependency on foreign sources across the nuclear fuel cycle is coming under scrutiny.

Particularly in question is the role Russia and its allies play. In 2020, Russia accounted for one-third of conversion output globally. That number jumps to 43 percent in the enrichment category, one of the final steps in the nuclear fuel production cycle.

“Where we've always tended to look at supply and demand of uranium on a global basis, it's now becoming a little more dangerous to do so,” Frostad said during the lunch presentation. "And there's a lot of effort, certainly in the US, to start shoring up that supply. They're looking at a lot of new projects in Colorado, Utah, Wyoming.”

Frostad went on to say that France plans to grow its conversion capacity, and while the US hasn’t made any official announcement, he wouldn’t be surprised if the country started to build its capacity as well.

“Uranium is on the strategic, critical metals list, and there's a lot of money now being poured into ways of shoring up the supply.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Purepoint Uranium is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top Uranium Stocks on the TSX and TSXV | INN ›

- When Will Uranium Prices Go Up? | INN ›

- Uranium Outlook 2022: Prices Have Broken Out, How High Will They Go? ›

- Justin Huhn: Uranium Set for Strong Q4 After Summer Doldrums ›

- Better Fundamentals Make This Uranium Bull Market Different ›

- Uranium Price Forecasts & Outlook For 2022 ›