Is Now a Good Time to Buy Bitcoin?

10 Biggest EV Stocks to Watch in 2026

Is Now a Good Time to Invest in Oil Stocks?

Overview

Energy Fuels (TSX:EFR,NYSE:UUUU) has been the largest producer of uranium in the United States and an emerging producer of rare earth elements (REEs). The company is also a major producer of vanadium when market conditions warrant. The company’s portfolio of assets positions it to contribute meaningfully to some of the most important challenges faced by the world today - climate change and energy security. Uranium remains the core business for Energy Fuels; however, the company is rapidly expanding its REE capacity, as well.

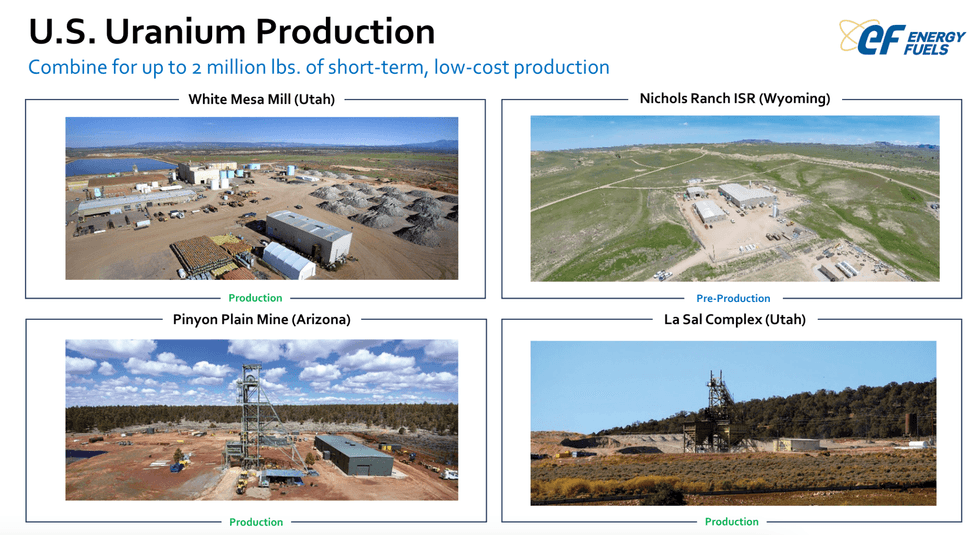

Energy Fuels is the only uranium producer with both conventional production and in-situ recovery (ISR) in the US. Its 100-percent-owned White Mesa Mill is the only conventional uranium mill in the country with a licensed capacity of over 8 million pounds (Mlbs) of U3O8 per year. The company also owns the Nichols Ranch uranium recovery facility in Wyoming, which is a fully permitted uranium ISR facility with a licensed capacity of 2 Mlbs of U3O8 per year. The Nichols Ranch project is currently being maintained on standby.

Favorable uranium market conditions prompted Energy Fuels to ramp up uranium production at three permitted and developed uranium mines in Arizona and Utah. Once production is fully ramped up at Pinyon Plain, La Sal and Pandora, the company expects to produce uranium at a run rate of 1.1 to 1.4 million pounds per year. Ore mined from the three sites in 2024 will be stockpiled at the White Mesa Mill in Utah for processing in late-2024 or 2025.

The company is also preparing the Whirlwind and Nichols Ranch mines to commence uranium production within one year, potentially increasing uranium production to over two million pounds of U3O8 annually starting in 2025.

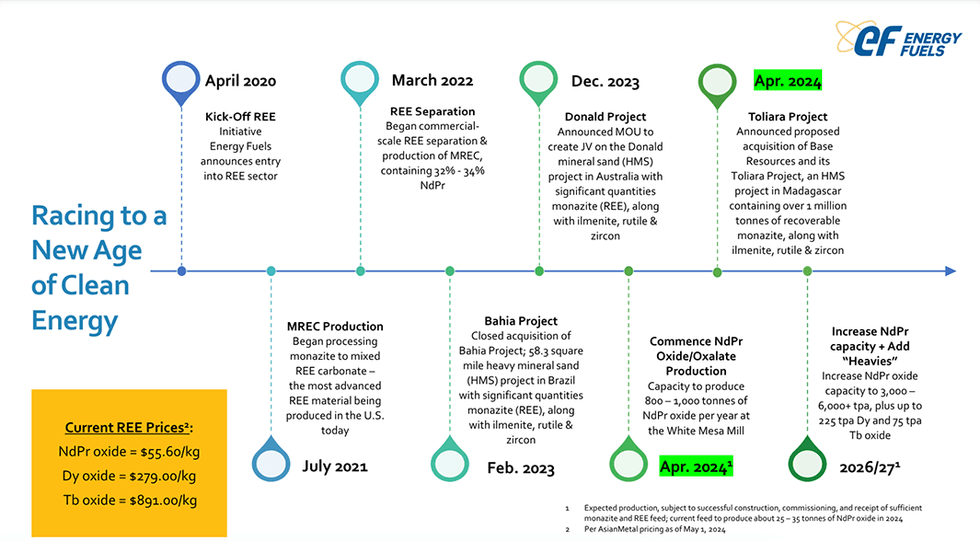

In addition to its core uranium business, Energy Fuels is building out its rare earth element (REE) production and processing at the White Mesa Mill. The company recently completed construction of phase 1 rare earth oxide production with the capacity to produce 800 to 1,000 metric tons (MT) of neodymium-praseodymium (NdPr) oxide per year. The company is designing phase 2 and 3, which will increase NdPr oxide production to 4,000 to 6,000 MT per year, while also adding commercial scale “heavy” rare earth production, including terbium (Tb) and dysprosium (Dy).

In December 2023, Energy Fuels and Astron Corporation executed a non-binding MOU to jointly develop the Donald Mineral sands project, a large heavy mineral sand deposit that has the potential to supply Energy Fuels with approximately 7,000 tonnes of rare earth-bearing monazite sand per year starting in 2026, ramping up to 14,000 tonnes per year soon after.

Further to becoming a global leader in critical minerals production, in April 2023, Energy Fuels executed a definitive scheme implementation deed with Base Resources (ASX:BSE,AIM:BSE) to acquire 100 percent of the issued shares of Base Resources. The acquisition includes Base Resources' 100 percent-owned advanced, world-class Toliara heavy mineral sands project in Madagascar.

Vanadium and medical isotopes present another long-term growth opportunity for Energy Fuels. White Mesa Mill is a significant US producer of vanadium (V2O5), and the only primary producer in the US It currently holds 0.9 Mlbs in inventory and aims to selectively produce and sell into the market based on the strength of price. The company also continues to evaluate the potential to recover medical isotopes from its existing uranium and vanadium process streams. These isotopes are required for emerging cancer therapies.

Sustainability is a key part of the company’s focus. It is committed to recycling naturally bearing uranium and vanadium materials. White Mesa Mill has a separate circuit for processing alternate feed materials, thereby promoting sustainable sourcing, reducing carbon emissions and saving resources.

Further, the company benefits from a management team with a record of building and operating both conventional and ISR uranium mines globally.

Get access to more exclusive Uranium Investing Stock profiles here