5 Factors Defining the “New Normal” in the Lithium Space

At this year’s Benchmark World Tour stop in Toronto, Andrew Miller, head of price assessments, talked about the “new normal” in the space.

At this year’s Benchmark World Tour stop in Toronto, Benchmark Mineral Intelligence Head of Price Assessments Andrew Miller gave a presentation about what he called the “new normal” in the lithium space.

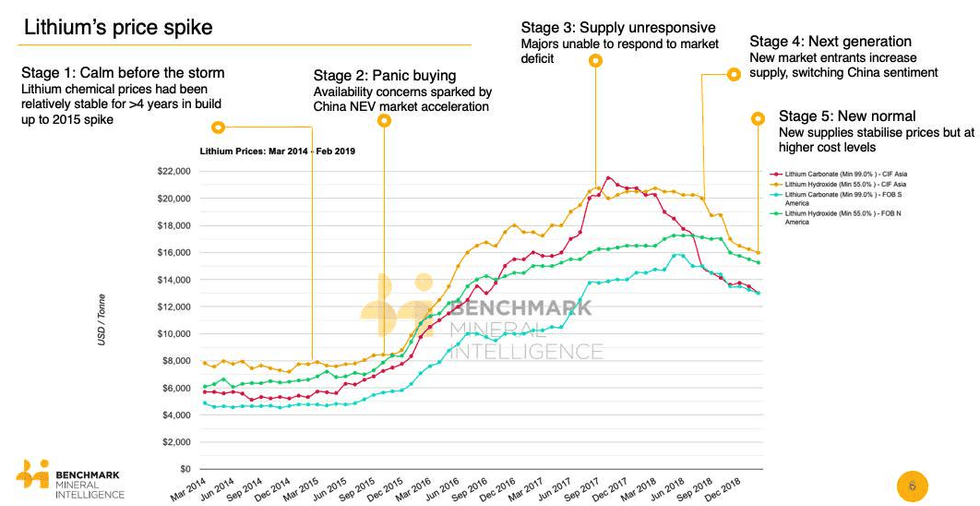

Speaking about how prices have performed in the past few years, Miller said the space saw a ramp up in prices starting in 2015, with the key factor impacting the market being that supply wasn’t able to react fast enough to what the industry was requiring at that point.

“(Even though) demand growth levels (from the lithium-ion battery space) were relatively moderate … supply wasn’t able to keep up and that meant we had a period of about two years of sustained higher lithium prices,” he said.

Starting at the end of 2017 and throughout last year, the space started to see a bit of response from the supply side and a new generation of mines coming to production. That resulted in a price correction both for lithium carbonate as well as hydroxide.

“We are now in a period where there is a ‘new normal’ in the market,” Miller explained. Read on to learn the five supply and demand factors that are defining this “new normal” that every battery metals-focused investor should pay attention to in the coming years.

Chart via Benchmark Mineral Intelligence.

1. Cost curve evolution

Looking at the supply side of the lithium story, Miller explained that the cost curve has evolved due to the introduction of new mines.

“Largely, the new supply comes from spodumene operations, which historically is a higher cost route for lithium carbonate,” he said.

New spodumene producers are selling their production to chemical converters in China, which then convert it into lithium carbonate or lithium hydroxide.

“There is a new floor in lithium prices. We don’t expect prices to be able to go below US$8 to US$9 (per tonne for lithium carbonate),” Miller said, adding that the market has seen stable prices for lithium carbonate because Chinese converters can’t produce below those levels.

2. Narrowing premium between lithium hydroxide over carbonate

Another key factor impacting the lithium space has been the narrowing premium between the two main types of lithium used in batteries, carbonate and hydroxide.

“Typically, there’s been a premium for lithium hydroxide in the market,” he said. That’s because, traditionally, lithium hydroxide has been produced from lithium carbonate extracted from brines, which adds to production costs.

“[But] with the new spodumene production … you are able to produce lithium hydroxide directly,” Miller explained. In theory, that could mean lower costs than producing lithium hydroxide from brine.

As a result, a new question has been brought up — will the premium in the market switch to carbonate over hydroxide?

According to Miller, the premium for hydroxide remained last year because of how lithium hydroxide was being produced, and also because of the excitement around the switch to higher nickel cathode batteries, which predominantly require that type of lithium.

“The reality is that it is going to be a more gradual shift,” Miller said.

The demand for lithium hydroxide has not grown as fast as expected, which is also decreasing the premium over carbonate.

“This year and next year, we still think there will be some premium for hydroxide, but the narrowing of that premium is something to watch in the coming months,” he added.

3. Healthy growth in electric vehicle production

Moving over to the demand side of the lithium story, Miller talked about the healthy growth he expects to see in electric vehicle production worldwide.

“The Chinese market has increased significantly for new energy vehicles, despite the subsidies being reduced,” Miller explained. “Electric vehicle production has not been impacted by this. There has been steady and considerable growth in the space, (not only in China but also in other parts of the world).”

In fact, Miller said electric vehicle production in Q1 in China was up over 100 percent compared to the same period last year. However, the reduction of subsidies might see a bit of a slow in growth in production going forward.

“We don’t expect (the phase out of subsidies) to see a collapse in the market, we expect to see healthy growth in terms of electric vehicle production in China and elsewhere in the world,” he added.

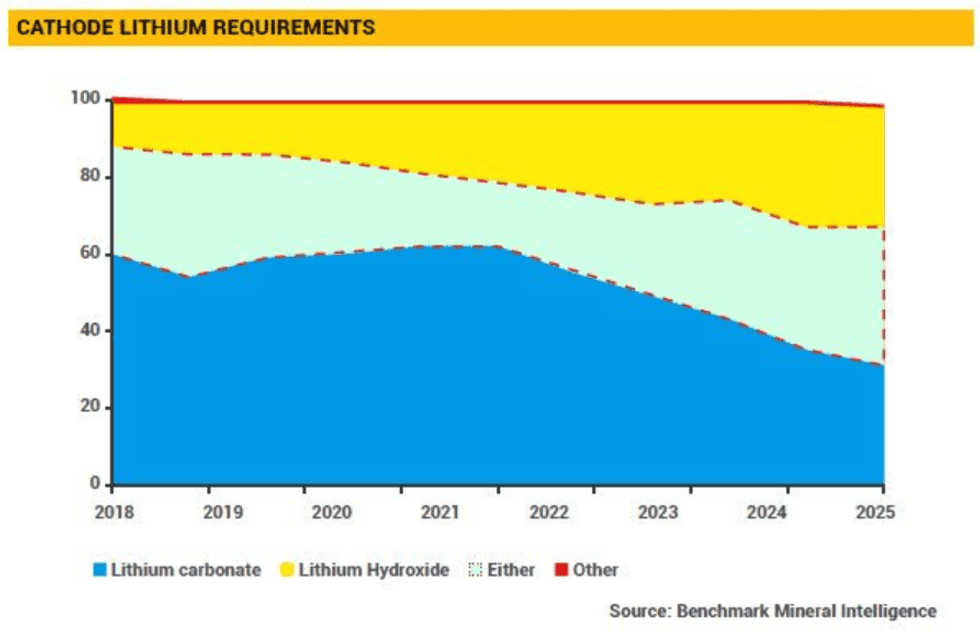

4. The mix in cathode choice

Last year, the changes in subsidies in China were aimed at supporting cathodes with higher energy density. That is why there was such an emphasis on how quickly a switch to those cathode chemistries could become a reality.

“With the subsidies being phased out, there is not that pressure anymore in the market at the moment,” Miller explained.

“There are a number of cathode chemistries that could use either lithium carbonate or hydroxide,” he said. “We think that is the area in the market where you are going to see the biggest growth and expansion.”

For the expert, the hydroxide shift is not going to happen overnight, but it is expected to be a longer-term trend in the industry.

Chart via Benchmark Mineral Intelligence.

5. Long-term growth projection in battery capacity

Miller also pointed out that, in the long term, the growth projections for the raw materials used in lithium-ion batteries just keeps getting bigger and bigger.

“If you look at China alone, by 2028, there’s almost 1.2 terawatt hours of capacity being lined up — that equates to over 900,000 tonnes of lithium,” Miller said. “That would mean an increase of three times the total size of the market last year, just for China.”

Other parts of Asia are also expanding, as well as Europe and the US.

“For any one of these regions, you need a fundamental shift in terms of lithium supply coming into the market in a relatively short space of time, over the next decade, and these numbers keep getting bigger.”

For Miller, unless money starts going into the lithium industry now, by the 2022 to 2023 period the market could start to see massive deficits emerge again.

“And this deficit will not be the size of the 2015 one, when there was moderate growth in the sector, this is going to happen when you really start to see an uptake in the use of lithium-ion batteries,” he added.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.