Europe’s Lithium Supply Chain - Key Facts

INN looks at the geological landscape in Europe, the region’s refining capabilities and its next steps in developing a lithium supply chain for the EV space.

As the electric vehicle (EV) revolution continues to unfold, interest in lithium is picking up pace again due to its essential use in the batteries that power EVs.

Demand for the metal is surging around the world, and Europe has started to look for ways to strengthen its lithium-ion supply chain to meet its growing needs.

In fact, lithium was added to Europe’s critical raw materials list for the first time in 2020, joining other key battery metals such as cobalt and natural graphite.

Here the Investing News Network (INN) looks at the geological landscape in Europe, the region’s refining capabilities and its next steps in developing its lithium supply chain for the EV space.

Building out a lithium supply chain in Europe

Europe’s plans for an upstream lithium-ion supply chain remain significantly underdeveloped, George Miller of Benchmark Mineral Intelligence told INN. The firm is forecasting that the region’s market share of global raw material lithium supply will be less than 3 percent by 2025, while its market share of lithium chemical supply will be approximately 2 percent on the same time scale.

“At current, Europe is better poised to gain control of the downstream in the lithium-ion battery supply chain, with plenty of automakers in the region seeking local supply from cathode, anode and cell manufacturing firms,” Miller said.

For Jake Fraser of Roskill, the absence of lithium production in Europe altogether is what creates the opportunity to develop this capacity.

“It comes down to having the right development-ready projects with robust economics to establish a local source of supply,” he said.

European EV sales accounted for more than 50,000 tonnes of lithium consumption in 2020, and given current growth rates this is set to climb significantly, with a compound annual growth rate of 45 percent out until 2025, according to Benchmark Mineral Intelligence.

Lithium mining in Europe

According to the EU’s study on critical raw materials, domestic production of lithium concentrates in the region is insignificant compared to global production, at about 110 tonnes of lithium content. Furthermore, the production of processed lithium compounds in the EU is also negligible.

Speaking about Europe’s potential to expand its lithium mining, Miller said the geography of the region lends itself to hard-rock production as opposed to brine production, and contains some promising lithium mineralization of spodumene, lepidolite and jadarite.

“There are opportunities here, but it will be difficult to displace countries, including Australia, China and those within the Lithium Triangle, which have the current competitive advantage in lithium mining and processing due to lower labor, energy and reagent costs,” he added.

Imports from Australia cover the majority of the EU’s demand for lithium concentrates, while Chile is by far the EU’s largest supplier of refined lithium compounds.

If Europe were to adopt a “refined, but not mined” industry model, third party sourcing of feedstock would be crucial and would likely increase exposure to higher production costs, Fraser said.

“The difficulty here will be competing with China for spodumene concentrate units, assuming mineral conversion is the preferred processing route, where available units to the open market not under offtake agreements are becoming increasingly scant,” he added.

According to Roskill, in the short term Australian producers will remain the sole sourcing option, while in the medium term supply from new projects elsewhere could become available, including Africa.

Meanwhile, Benchmark Mineral Intelligence forecasts that Australian and South American lithium supply will continue to play a crucial role in meeting market demand throughout this decade, controlling about 85 percent and 60 percent of lithium supply out until 2025 and 2030, respectively.

Looking at the resources in the EU, lithium hard-rock mineral deposits are located in Portugal, Czechia, Finland, Germany, Spain and Austria. Significant brine resources also exist in Germany.

Germany

In Germany, ongoing exploration of mineral resources continues to take place, but three main deposits have already reported results to keep an eye on:

Zinnwald deposit: Deutsche Lithium, a joint venture between SolarWorld (OTC Pink:SRWRF) and Zinnwald Lithium (LSE:ZNWD), has been working on the Zinnwald deposit in Zinnwald-Georgenfeld, located on the eastern side of the country near the border with Czechia, since 2011.

Bacanora Lithium (LSE:BCN) sold its 50 percent share to Zinnwald Lithium in a reverse takeover in October 2020. The London-listed company now owns 44.3 percent of Zinnwald Lithium and holds a net profit royalty of 2 percent.

The Zinnwald deposit held a total lithium resource of approximately 40 million tonnes at 0.76 percent lithium oxide as of October 2018. Mineral reserves stand at 31.2 million tonnes at a grade of 0.65 percent lithium oxide, according to a 2019 feasibility study.

Sadisdorf tin-lithium project: Lithium Australia’s (ASX:LTM) Sadisdorf tin-lithium project has an inferred lithium mineral resource of 25 million tonnes grading 0.45 percent lithium oxide, as announced in December 2017.

Vulcan project: Geothermal brines at the Vulcan lithium project in the Upper Rhine valley of Germany currently hold an estimated total inferred mineral resource of 2.484 million tonnes of lithium at a lithium brine grade of 181 mg/L lithium, Vulcan Energy Resources (ASX:VUL) reported in December 2019.

Czechia

In Czechia, European Metals’ (ASX:EMH) Cinovec project is said to host the largest lithium resource in Europe. Cinovec is a hard-rock lithium deposit with a total indicated mineral resource of 372.4 million tonnes at 0.4 percent lithium oxide and 0.04 percent tin, and an inferred mineral resource of 323.5 million tonnes at 0.39 percent lithium oxide and 0.04 percent tin, containing a combined 7.18 million tonnes of lithium carbonate equivalent and 262,600 tonnes of tin.

Serbia

Discovered in 2004 by mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO), seasoned lithium investors will have heard of the Jadar lithium-borate deposit in Serbia. It is a massive deposit where lithium is hosted by the previously unknown borosilicate mineral jadarite.

Rio Tinto has invested and committed more than US$450 million to the project to date, and in March 2017, the company upgraded the Jadar mineral resource in accordance with JORC standards to 136 million tonnes. Total equivalent borate product resources are 21 million tonnes B2O3 and equivalent lithium product resources are 2.5 million tonnes of lithium oxide.

Spain

In the San Jose deposit, which is 75 percent owned by Australia’s Infinity Lithium (ASX:INF), lithium is hosted mainly in lithium-mica minerals. The project will be developed by open-pit methods with the ore treated and refined onsite to produce high-quality, battery-grade lithium hydroxide. The company completed a prefeasibility study in 2019.

Portugal

According to the US Geological Survey, lithium production in Portugal hit 900 tonnes in 2020, with reserves estimated at 220,000 tonnes. Lithium is currently extracted in Portugal in the form of lepidolite, with lithium deposits found in the Guarda, Braga and Villa Real districts.

Exploration and development of lithium projects is ongoing. Savannah Resources (LSE:SAV) has been working on the Mina do Barroso hard-rock lithium project in Northern Portugal. Lepidico has an interest in the Alvarrões lepidolite mine, although the firm is currently focused on its Karibib project in Namibia.

Austria

European Lithium’s (ASX:EUR) Wolfsberg spodumene deposit has a positive prefeasibility study. The company is currently working on increasing measured and indicated resources for its definitive feasibility study so that project design and evaluation will be at a mining rate of approximately 800,000 tonnes per year, further increasing the mine life. If all conditions are met, European Lithium is aiming to kick off lithium hydroxide production at the project by the end of 2023.

Finland

Keliber Oy holds several advanced lithium deposits in the Central Ostrobothnian area. Observations of lithium have been made in the region as early as late 1950s.

The company’s JORC-compliant measured and indicated mineral resources amount to 11.767 million tonnes using a 0.5 percent lithium oxide cut-off grade. Including the inferred mineral resources category, the mineral resources of the company amount to 14.194 million tonnes. The lithium oxide grade of the mineral resources is 1.08 percent.

Keliber Oy is owned by Finnish investment companies and private investors, as well as Norwegian mining industry investment company Nordic Mining.

Lithium processing in Europe

Extracting lithium is just the first step in the supply chain, as the metal has to be refined before it can be used as a raw material in lithium-ion batteries and other applications.

China hosts the majority of the world’s lithium-refining facilities from hard-rock minerals, and Chile has most of the world’s capacity from brine operations. In Europe, the production of refined lithium compounds is again almost non-existent.

With that in mind, Miller said it is certainly possible for Europe to expand its lithium-refining capacity, where cathode producers may look for more traceable and local supply going forward.

“Especially given industry trends towards supply localization, recycling and lower emissions for EVs on a lifecycle analysis basis,” he said. “In this way, lithium refiners in the EU may look to set themselves apart as low-emissions suppliers, which could develop as a segment of the lithium chemical market.”

On the other hand, Miller added, associated lithium majors within China have had a huge headstart on the European region in terms of lithium refining.

“(They) have developed ample refining capability as a result, as well as a competitive advantage that is set to sustain,” he said.

Similarly, Fraser said gaining more share of lithium processing in the region is a possibility, and various business models are currently being assessed. These include mine-to-refined integrated projects, standalone concentrate converters and reprocessing lithium carbonate to battery-grade hydroxide.

“Each potential path to industry development has its upsides and downsides, but the fundamental risk to the latter two is the exposure to higher feedstock costs and supply security, which would increase overall cost competitiveness of the operation,” he added.

What’s ahead

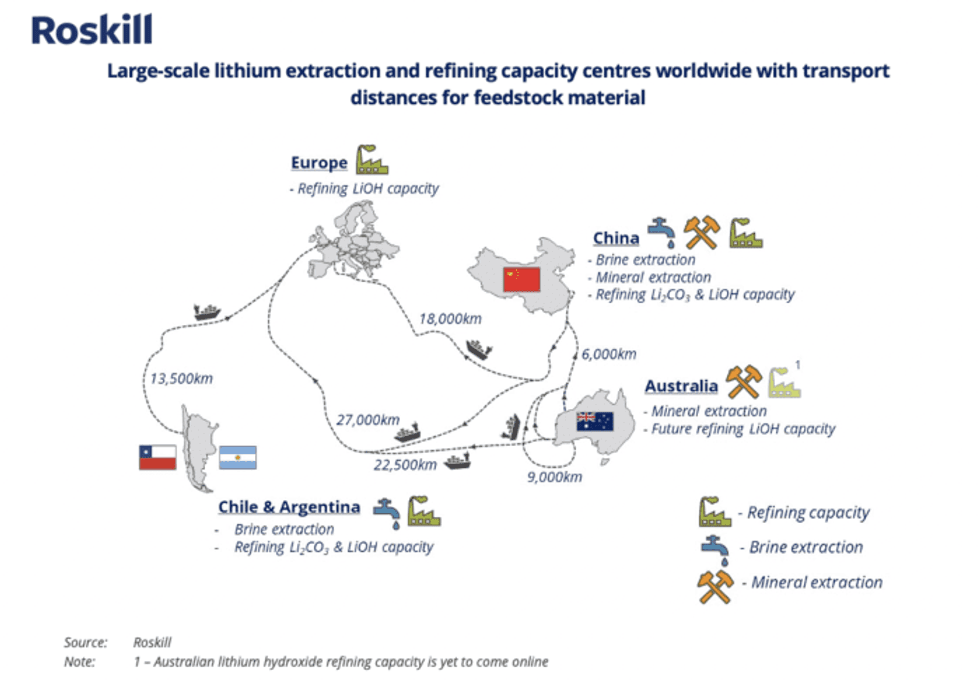

For Fraser, outside of supply security, sustainability is one of the biggest concerns of European automakers. Part of the challenge of refining third party spodumene from Australia for processing in Europe is the increased carbon dioxide footprint from shipping.

“The distance of shipping from Australia to Europe as compared to China is more than triple at 22,500 kilometers,” he said. “However, at present Europe is buying lithium from China that is having to travel from Australia to China for processing before heading to Europe.”

Graphic via Roskill.

Looking ahead, sustainability will play an increasingly significant role in lithium supply for the region as automakers strive to prove the environmental, social and governance credentials of their EV supply chains, in line with consumer trends, Miller said.

“Amongst several other impacts, this is likely to lead to enhanced traceability throughout the lithium supply chain, attempts from automakers to localize as much of their EV supply chain as possible to reduce transport emissions and moves from all parts of the lithium-ion supply chain to strive towards renewable energy to power mining, manufacturing and chemical refining,” he added.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Lithium Reserves by Country | INN ›

- Lithium Trends 2021: Prices Soar on Surging EV Demand | INN ›

- Lithium Outlook 2022: Demand to Outpace Supply, Price Upside to ... ›

- Top 9 Lithium Stocks (Updated January 2022) | INN ›

- Tesla May Get into Lithium Mining, Will Others Follow? | INN ›

- Lithium Mining Projects in Europe ›

- Europe Needs Lithium, Where Will it Come From? ›

- Is Europe Moving Fast Enough to Build a Resilient Lithium Supply Chain? ›