Lithium Outlook 2022: Demand to Outpace Supply, Price Upside to Remain

As 2022 begins, experts share their thoughts on the lithium outlook and which key factors to watch this year.

Click here to read the latest lithium outlook.

After a year that saw uncertainty dominate and prices for lithium take a turn, 2021 was marked by soaring prices that hit an all-time high as electric vehicle (EV) sales increased globally.

The lithium decade is unfolding at a rapid pace, with investors paying more and more attention to developments in the battery sector as demand for essential metals used to power EVs continues to surge.

Here the Investing News Network (INN) looks at lithium’s 2021 price performance, as well as what analysts and market watchers think is ahead for the commodity in 2022.

Lithium trends 2021: The year in review

At the end of 2020, analysts were optimistic about pricing for lithium in the year ahead — but the speed and amount of the uptrend caught many by surprise.

The lithium market outperformed expectations in 2021, with prices traded on the Chinese and international spot market rising to well above US$30 per kilogram, George Miller of Benchmark Mineral Intelligence told INN.

“(They are) now above US$40 per kilogram in China, underscoring a rise of nearly 60 percent during the (fourth) quarter, and nearly 500 percent across 2021,” he said.

In the last quarter of 2020, a year that tested the supply chain resilience of every market, lithium prices in China started to recover. This was a pattern Fastmarkets expected other regional lithium prices to follow in 2021.

“The major surprise has been the extent to which they have rallied,” William Adams of Fastmarkets told INN.

Domestic China lithium salt prices were up by around 350 percent since the start of 2021, with CIF China, Japan, Korea carbonate prices up by 374 percent and hydroxide prices up by 245 percent, as per the firm’s data. “The other surprise was the extent to which lithium-iron-phosphate (LFP) batteries have gained market share relative to nickel-cobalt-manganese (NCM) batteries and the impact that has had on carbonate prices,” Adams added.

The popularity of LFP cathode material has been on the rise, particularly in China, for shorter-range, durable, lower-cost EVs. This coexists with demand for higher-nickel cathode types, such as NCM, in all end markets; NCM batteries can provide longer-range travel and higher energy density for consumers with range anxiety.

Another trend seen in the lithium space in 2021 was the slow response from producers in announcing the restart of idle capacity — something that was expected to happen throughout the year.

“While some have been announced and are in the process of being restarted, such as Pilbara Minerals’ (ASX:PLS,OTC Pink:PILBF) Ngungaju plant, some idle production, such as Wodgina, is not scheduled to restart until later in 2022,” Adams said. “Alita, which was one of the first to close, has no restart date — this despite record lithium and spodumene prices.”

Lithium outlook 2022: Demand and supply

In 2021, one of the major catalysts that impacted the lithium space was the extent of growth in the EV industry.

“EV sales were spectacular in 2021,” Adams said. “In the January to October period, sales have grown by 189 percent in China, 157 percent in Europe (January to September pro rata) and by 94 percent in the US.”

As 2022 kicks off, Fastmarkets expects continued strong growth in all regions, especially in the US as the country plays catch up with Europe and China.

“Other reasons for expecting strong growth are there will be more EV models available, therefore more choice for consumers, and an easing of semiconductor shortages as 2022 progresses should mean supply constraints should not hold sales back,” Adams said. “But we also expect demand from energy storage applications to gather pace.”

In terms of lithium demand, Benchmark Mineral Intelligence anticipates burgeoning battery-grade demand from outside Asia as commissioning and first commercial production begins at some cathode facilities. “Yet demand is likely to grow fastest in China, which still dominates the cathode and cell production landscape,” Miller said.

Looking over to the supply side of the story, 2021 saw merger and acquisition activity pick up pace, as producers and developers prepared to meet the increasing demand for lithium.

“We expect a significant supply response, but it will be needed,” Adams explained to INN. “Additional production units will also take time to become commercially available given qualification times, and since stocks have been run down the supply chain will need to restock.”

Fastmarkets expects this supply response will alleviate some of the tightness, but will not lead to another oversupply selloff as seen in 2019 to 2020. In fact, all things considered, the firm expects a supply deficit in 2022.

“While by year-end 2022 the rate of production might be higher than actual consumption, production will have taken time to ramp up to that level, plus apparent demand will be higher than actual demand given the need to restock and build up working stock for the new manufacturing capacity being brought online,” Adams said.

Benchmark Mineral Intelligence is also forecasting that the market will be in deficit during 2022, which could impact output from the EV industry.

“We expect growth in supply to be outpaced by demand growth in 2022, which should provide beneficial pricing to the majority of current lithium producers,” Miller said.

Lithium outlook 2022: What’s ahead for prices

Following a strong 2021, investors and market watchers are wondering what's ahead for lithium prices.

“Given an extremely tight market balance last year, we expect demand to outpace incremental supply expansions in 2022, and in turn little to no downside in pricing,” Benchmark Mineral Intelligence’s Miller said.

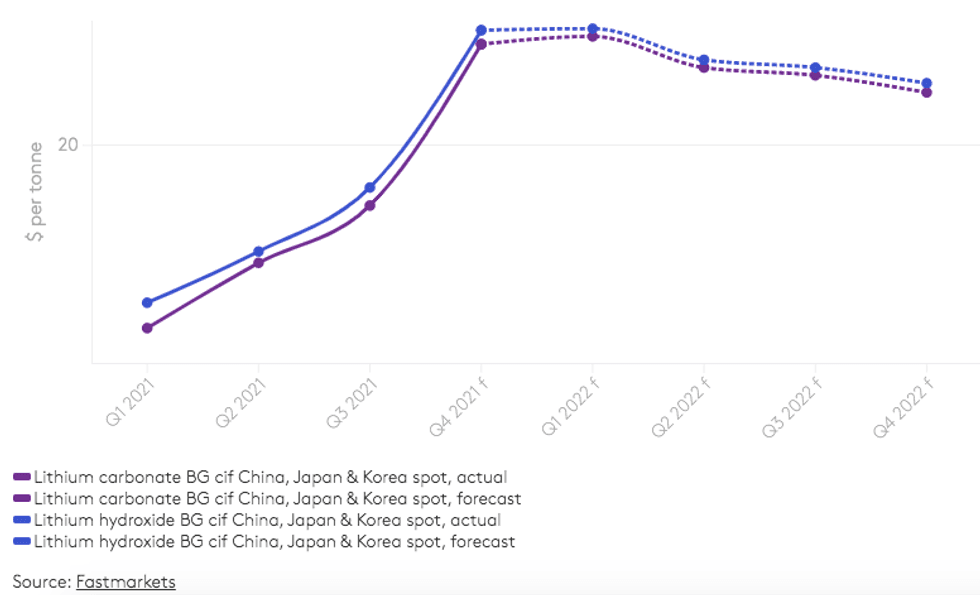

Chart via Fastmarkets.

Fastmarkets is optimistic about prices in the first part of the year due to market tightness.

"A lot of new/additional supply will ramp up, some of it already has, which will help alleviate the immediate tightness, but this new supply will need to be qualified,” Adams explained to INN, adding that new production lines normally face some startup issues.

“(That’s why) we do not expect a surge in supply but a more gradual increase — enough to see prices flatten out and then pull back to some extent,” he said. “However, any extra supply is likely to be absorbed by restocking, given the destocking that has happened in 2021.”

Looking over at the price dynamics between carbonate and hydroxide, Miller said the price of lithium carbonate has now thoroughly surpassed the price of lithium hydroxide in the Chinese domestic market.

“(That’s) due to demand from LFP cathode manufacturers for carbonate, with the price differential now reaching US$6,000, in stark comparison to the historical price premium held by hydroxide,” he said. “We expect this price differential to be volatile throughout the year, prone to shift as each market tightens.”

Commenting specifically on the trends seen in lithium carbonate and hydroxide in 2021, Adams said both rallied aggressively. “Extra-strong demand for carbonate from LFP cathode producers led to it trading at a premium,” he noted. “But with carbonate at a premium to hydroxide, there was no incentive for Chinese convertors to produce hydroxide, so that also led to periods when hydroxide traded at a premium.”

Outside of China, prices traded more evenly, according to Fastmarkets data.

“We expect carbonate to remain at a premium (this year), especially as more hydroxide capacity is scheduled to ramp up in 2022,” Adams said.

But how will demand for different cathodes play out this year? Analysts agree that adoption of LFP is expected to continue, with market share growing in China.

“(LFP) will gradually see more adoption in Europe and US as a number of western OEMs have said they will use LFP in the entry range of vehicles or in their standard-range EVs,” Adams said. “Also given high battery raw material prices for cobalt and nickel as well as lithium, OEMs may well favor LFP chemistries for awhile.”

For Miller, the strong demand for LFP seen throughout 2021 will continue to tighten the lithium carbonate market at a faster rate than the hydroxide market and place upward price pressure on this product.

“The expiration of key patents for LFP may also see the cathode more widely produced outside of China, and in turn see the cathode chemistry capture further market share,” he added.

Lithium outlook 2022: Key factors to watch

Speaking about the challenges junior miners could face in 2022, Adams said the hurdle will be to get up and running as fast as they can. “The opportunities will be there should be a lot of willing buyers/offtakers, and not just from China, with financing being more readily available,” he added.

Adams said investors should expect more partnerships to be formed from downstream to upstream in 2022. “(That means) more securing of supply, more investment in the upstream market of the supply chain.”

Benchmark Mineral Intelligence’s Miller is also expecting far more attention to be paid to raw material supply by cell manufacturers and automakers, which may grow their engagement upstream in order to secure raw materials.

“I will (also) be watching the progress of projects currently under construction and those due to come online during 2022,” he added.

In terms of contracts, Fastmarkets is expecting to see long-term supply deals negotiated.

“Some may be fixed priced, but at these high prices consumers may be wary of locking in prices. I think we are more likely to see supply contracts based on unfixed prices,” Adams said.

There is a trend toward more frequent pricing breaks within contracting, said Benchmark Mineral Intelligence, as producers seek to capitalize on rising prices and increasingly link contracts to market-led price reporting.

“We have also seen more support for juniors in terms of offtake agreements, contracts and financing, which should improve financing opportunities and increase the likelihood of novel supply coming to market,” Miller said.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.