Zinc Trends 2021: Prices Rally as Energy Crisis Hits Supply

What zinc trends rocked the market in 2021? We run through what happened to the metal this past year, from price activity to supply pains.

Click here to read the previous zinc trends article.

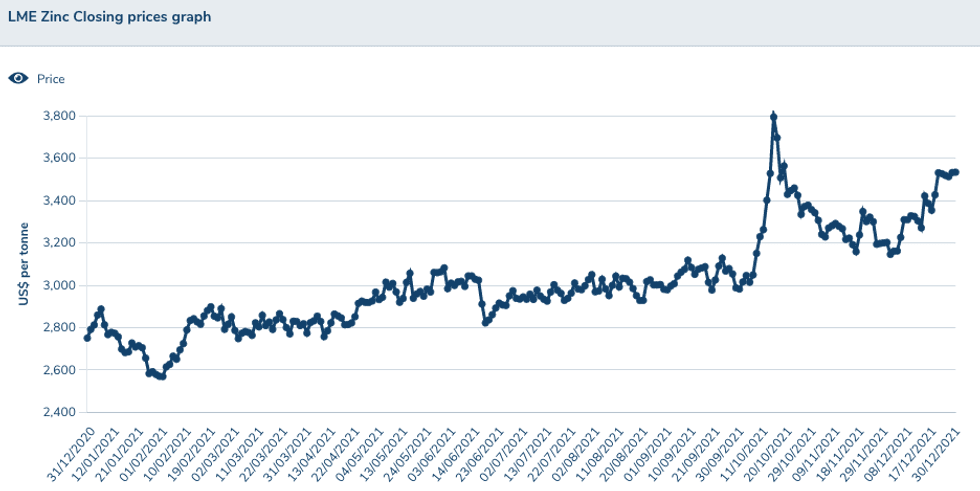

Zinc prices surged more than 20 percent in 2021, touching their highest level in 14 years in October.

A demand rebound after economies around the world lifted restrictions, paired with supply-side concerns over rising power costs, helped the base metal hit a yearly high of US$3,794.50 per tonne.

Here the Investing News Network (INN) looks back at the zinc trends for 2021, from supply and demand dynamics to how the metal performed and what analysts said quarter by quarter.

Zinc trends Q1 2021: Prices kick off on a bright note

Zinc prices started 2021 trading at U$2,775 after posting a more than 18 percent increase in 2020.

Despite falling in the first three months of trading — declining to U$2,539 — zinc prices later rebounded, experiencing volatility throughout the next few months.

Zinc price performance, December 2020 to December 2021.

Chart via London Metal Exchange.

At the start of 2021, Dan Smith of Commodity Market Analytics was looking for zinc prices to average US$2,853.

“The market has broadly performed as expected,” he said in July.

As people around the globe began receiving vaccines and economies reopened, a recovery in demand from the steel sector began, with China seeing the most growth. However, construction and steel activity in the Asian country was expected to wane in H2 — a slowdown that was in turn forecast to weigh on global zinc demand.

“Overall, we still see growth, but at a more moderate pace than the robust expansion which took place in many countries in the first half of 2021,” Smith said.

On the supply side, Peruvian zinc output dipped on an annual basis at the outset of 2021, supporting prices.

In March, FocusEconomics analysts predicted that zinc prices would ease from their Q1 levels by the end of 2021, chiefly due to recovering global output, which reportedly fell 6 percent in 2020. “Major mines in South America, especially in Peru, should gradually come back to their pre-pandemic capacity levels, which will likely allow global production growth to more than outpace the recovery in demand this year,” the analysts said at the time.

Zinc trends Q2 2021: Prices break U$3,000 level

In Q2, the base metal hit its highest point of the first half of 2021, trading at US$3,072.25 on May 28. By the end of June, zinc prices had pulled back, but were still trading north of US$2,900.

“Zinc prices performed much more strongly than we were expecting in H1,” Helen O’Cleary of CRU Group told INN. “Although the concentrates market remained tight, the refined metal market surplus continued to build.”

She continued, “Fundamentals took a back seat and prices were driven higher by stimulus and bullish sentiment.”

By the end of the first half, CRU was expecting zinc demand to continue to recover in H2, driven by strong steel mill orders and infrastructure stimulus, as the metal is used to galvanize steel.

“Global demand will more than recover last year’s losses due to a strong rebound in China, although we do not expect demand in the world ex-China to recover fully until 2022,” O’Cleary said.

In terms of supply, global zinc mine production in 2020 was estimated to be 12 million tonnes, a 6 percent decrease from 2019.

Government-mandated lockdowns and a decrease in zinc prices following the onset of the global COVID-19 pandemic resulted in lower zinc mine production in many countries, particularly in South America.

At the time of the interview, O'Cleary said CRU expected zinc mine output to more than recover 2020’s losses in 2021. “That said, we do not expect the concentrates market to return to surplus until 2022,” O’Cleary said.

Zinc trends Q3 2021: Price rally takes a pause

Zinc prices remained steady throughout the third quarter, hovering around the US$3,000 mark.

“After hitting an over two-year high on 24 September on strong fundamentals, zinc prices started to trend downwards, likely weighed on by signs of waning demand for steel — with galvanizing being zinc’s main end-use,” FocusEconomics analysts said in September. “Global steel production slid for the first time in over a year in August, while strict carbon emission policies in China further dampened demand prospects.”

Zinc demand came back strongly in 2021, especially in Europe, with Wood Mackenzie expecting this to continue into the upcoming year. “The US has seen slower growth, but this is due in part to a smaller drop in demand last year,” Jonathan Leng, the firm's principal analyst, said in October. “For the biggest consumer, China, it has seen lower investment in infrastructure, which has contributed to a moderation of demand growth.”

CRU’s O’Cleary agreed, saying demand had rebounded more strongly than expected in Europe and the US; she believed it was set to continue in Q4.

“Some demand weakness materialized in Asia ex-China in recent months due to COVID-19-related restrictions, but Q4 should be stronger as restrictions are eased,” she said. “In China, demand in Q4 will weaken on the back of power restrictions at some end users and the construction sector slowdown.”

Zinc trends Q4 2021: Prices hit 14 year high

During the fourth quarter, zinc prices jumped to hit their highest level in 14 years, supported by soaring power prices and costs associated with carbon emissions.

As a result of increasing costs, zinc smelter Nyrstar (EBR:NYR) outlined plans to cut production by 50 percent at three European operations. The combined capacity of the smelters is around 700,000 tonnes per year.

For O’Cleary of CRU Group, the timeline and extent of cuts are both unclear, but could tip an already tight market into deficit. “Prices are expected to remain elevated, and metal premia for next year’s annual contracts will reach a multi-year high,” she told INN in a conversation back in October.

Overall, global zinc demand recovered well in 2021, and was up by 7 percent following the previous year's 4.8 percent contraction, according to CRU data.

Zinc prices pulled back from their 14 year high as the fourth quarter unfolded, with downbeat purchasing activity in Chinese markets ahead of the winter season exerting downward pressure on prices.

“On top of this, news of the new COVID-19 variant sparked worries of cooling industrial activity, further weighing on prices,” FocusEconomics analysts said in their December report.

“On the supply side, dynamics remained favorable, notably in Europe, as announcements of operation disruptions at Glencore’s mine in Italy and the Tara mine in Ireland put additional pressure on production, which was already strained due to high energy prices,” the analysts also note in the document. “This, coupled with low inventory levels, cushioned the overall fall in prices.”

On December 31, zinc prices were trading at US$3,534 — an over 27 percent rise since the start of the year.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.