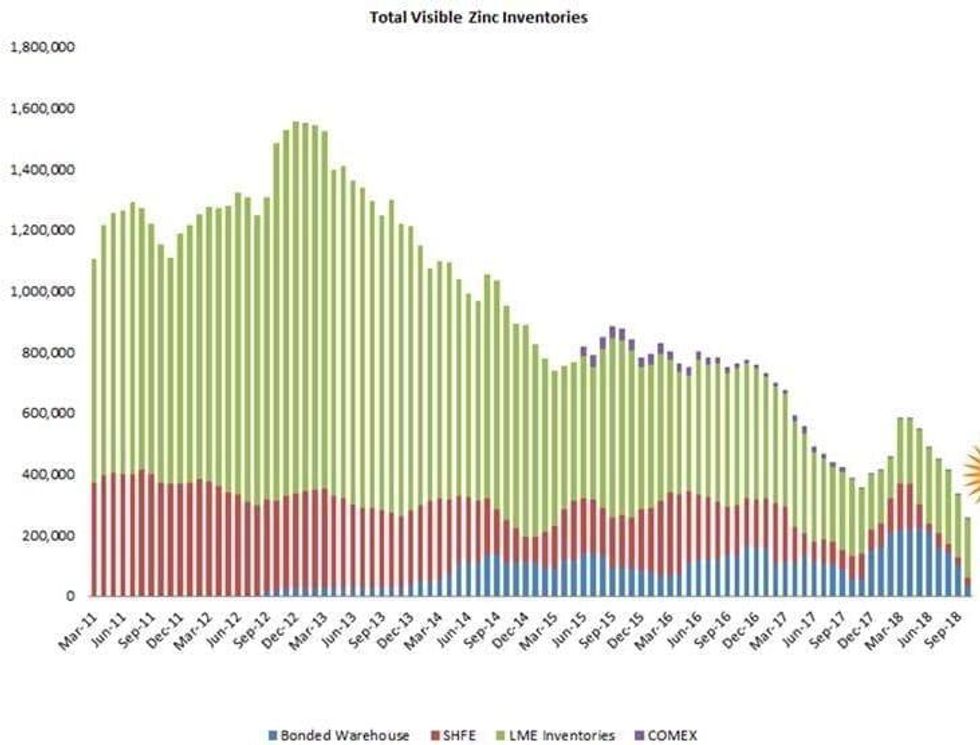

Global zinc stockpiles continue to fall across the board, with analysts noting that healthy demand is creating a deficit when held up against supply.

Zinc stockpiles around the world are continuing their downward trajectory as the trade war smothers base metals prices across the board, with the tightening of zinc supply showing little sign of abating in the short term.

It’s a trend that’s now burning under the spotlight of Scotiabank analysts, who noted that global inventories of the metal are at “extreme lows — below the levels that were ringing industry alarm bells in November 2017.”

“LME zinc stocks were down 3,600 overnight; global visible inventories now sit at their lowest level in at least over 7 years — holding at just 257,000 (well below last year’s November lows) — or just 6.4 days of consumption,” said Scotiabank analysts on Wednesday (October 10).

They also noted that last year, the global economy was less burdened by the trade war.

As reported by the Investing News Network last month, LME stockpiles of zinc are falling at a rapid rate.

While in September they were reported to be at 215,975 tonnes, as of mid-October stockpiles at the LME are now below 200,000 tonnes — a trend base metals analyst Stefan Iounnou of Cormark Securities noted would make for interesting spectating should it continue.

“I think things get really interesting if you see LME approach 100,000 tonnes. At that point we’re talking about world supply — when you add in the other entities — being somewhere under a week of global demand, so things get ‘critical,’ and at that point I think you can see zinc prices spike quite quickly.”

Yet despite the ructions of 2018, demand remains healthy, said Scotiabank.

“Healthy stock drawdowns from LME-approved sheds since the August high at 256,175 tonnes indicate strong physical demand for the metal and the LME’s net holdings have declined to 194,575 tonnes,” they said.

“Furthermore, (approx) 30 percent of all available stocks are now assigned for removal, which indicates healthy physical demand.”

In their October forecast press release, analysts at the International Lead and Zinc Study Group (ILZSG) said that worldwide demand for zinc metal was up 0.4 percent in 2018 to 13.74 million tonnes, and would increase another 1.1 percent to 13.88 million tonnes next year — driven mainly by the US, Europe and India.

They noted that Chinese demand was down due to stronger environmental regulations — though not by much, at negative 0.5 percent.

For supply, the ILZSG said that production would increase by only 2 percent globally this year to 13.03 million tonnes (well behind demand) while 2019 would bring more impressive numbers, with a 6.4 percent increase forecast, bringing global supply to 13.87 million tonnes with thanks in no small part to production from the land down under.

In Australia, MMG’s (HKEX:1208) Dugald River mine has been ramping up since December 2017 and Heron Resources’ (ASX:HRR) Woodlawn mine is projected to commissioned by the end of this year, not to mention New Century Resources’ (ASX:NCZ) tailings project at the Century zinc mine in Queensland.

“The notable increase in Australia’s mine production in 2018 will be partially offset by a 2.5 percent fall in Chinese zinc concentrates supply,” said the report.

“Output is also expected to be lower in Canada, India and Mexico but to rise in Cuba, Kazakhstan, Peru, South Africa, Turkey, and the United States,” it added, though noting that in 2019 Canada, India and Mexico will turn around and produce higher output.

A project that will perhaps make the biggest splash in the near future is Vedanta’s (LSE:VED) Gamsberg zinc complex in South Africa, which the Indian company has said it wishes to have a capacity of 250,000 tonnes per year of finished zinc metal.

Analysts at FocusEconomics said in their October consensus report that they projected the zinc price would trend upwards for the remainder of 2018 due to “firm demand stemming from healthy manufacturing and construction activity” – a trend that would continue into 2019.

Looking ahead, analysts forecast that the zinc price will average US$2,798 by Q4 2019 — marginally up from the US$2,678 projected for the fourth quarter of 2018.

The minimum price projected for Q4 2018 comes from OCBC Bank in Singapore at US$2,321 per metric tonne. Meanwhile, a number of analysts are bullish, with the maximum price forecast coming from the Office of the Chief Economist at the Australian government reaching US$3,000 per metric tonne.

As of Wednesday (October 10), zinc was valued at US$2,691 on the LME — up from the same time last month when it was valued at US$2,404.5 a tonne.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.