Lead Outlook 2021: Oversupply, Upside Risk to Remain

Lead had a volatile 2020, but what’s the lead outlook for 2021? Read on to find out what analysts had to say about the market.

Click here to read the latest lead outlook.

The volatility of 2019, which saw lead prices end the year almost neutral, continued in 2020 ― a time when the coronavirus pandemic’s impact was front and center.

COVID-19 lockdowns and containment measures hit the base metal during the first few months of the year, but lead prices rebounded in the second half.

As the year comes to a close, the Investing News Network (INN) is looking back at the main trends in the lead space in 2020 and what’s ahead for prices, supply and demand in the new year. Read on to learn what analysts and market participants had to say.

Lead trends 2020: Price performance review

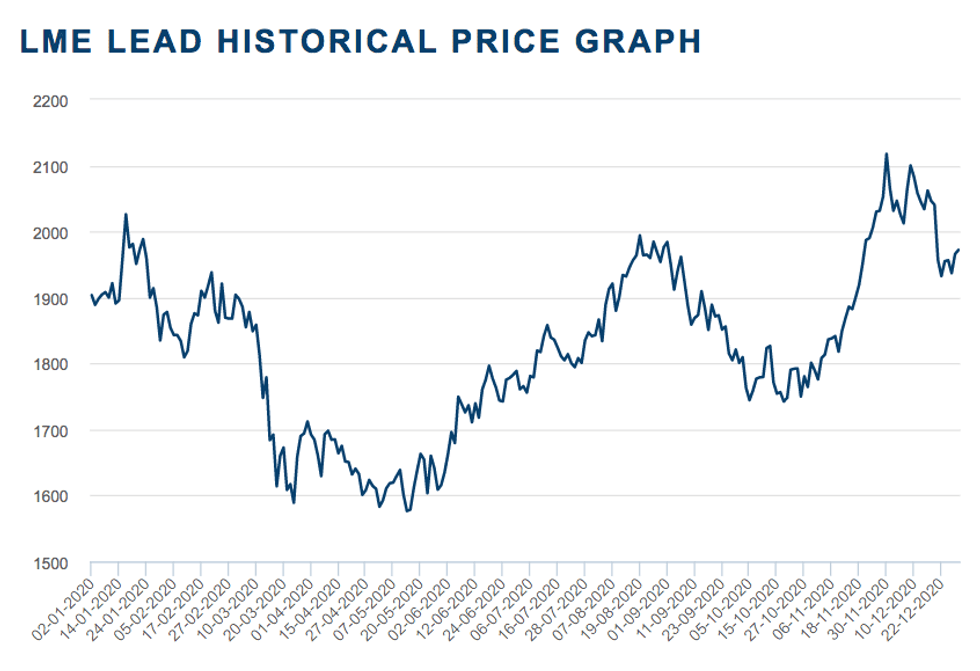

Lead prices started the year trading for US$1,903.50 per tonne, with prices increasing by mid-January on the back of a potential Phase 1 trade deal between the US and China. But as COVID-19 spread around the world, the metal’s price plummeted, hitting its lowest point of the year at US$1,589 on March 25.

2020 lead price performance. Chart via the London Metal Exchange.

Initially, the pandemic hit lead hard, just like every other base metal. When most of the world was in lockdown early in 2020, metal demand sunk, Farid Ahmed of Wood Mackenzie told INN.

“However, what did become apparent quite rapidly was the essential nature of battery demand, even during lockdown,” he said. Although most cars were parked up, trucks were still needed to ship supplies to hospitals, supermarkets and the like, while vans were needed to deliver online shopping and emergency services vehicles were busy.

“Also, industrial batteries were crucial to keeping life running,” Ahmed said. “Global trade volumes had, of course, fallen off a cliff, but some warehouses were extraordinarily busy, especially those handling personal protective equipment and order picking for online deliveries.”

Stationary batteries were also essential for backup power at hospitals, data centers, telecommunications companies and other critical infrastructure. As a result, lead batteries for these applications were required for both expanded capacity and replacement demand.

“This meant that lead battery production was soon restarted after everything initially shut down in spring, and therefore the lead producers also needed to ensure that the battery makers were being supplied with their key raw material,” Ahmed added.

Lead started to rebound sharply in the second half of 2020, reaching a high of US$1,994 by mid-August.

“The recovery (in prices) was stronger than expected as the world emerged from lockdown,” Ahmed said. “The whole base metals pack steadily accumulated value, and lead at first was running with the pack.”

As the world opened up, demand was strong, but supply worries increased as coronavirus-related mine disruptions persisted, particularly in South America.

“The lead price did start to become detached from the base metals group from late summer, when stocks started accumulating in exchange warehouses and second waves of COVID-19 hit,” Ahmed said. “It wasn’t until November that fund investors took a fancy to lead again and helped push the price higher.”

Lead prices hit their yearly high on November 30, at US$2,117.50, but couldn’t hold the gains and pulled back to end the year at US$1,972.

Lead outlook 2021: What’s ahead

After a year with volatility at the fore, investors interested in lead are wondering what might be ahead for the base metal in the 12 months ahead.

Speaking about Chinese demand in 2021, Ahmed said Woodmac anticipates that the global recovery will continue, but harbors some doubts about the true strength of Chinese lead consumption in 2021.

“Demand for Chinese batteries — both original equipment and replacement units — looks strong, but potentially driven more by export markets than domestic consumption,” the expert said. “Nevertheless, we’re forecasting a rebound in Chinese lead use of about 5 percent in 2021 after a quite flat 2020, compared to some 4 percent in the rest of the world following an almost 7 percent dip this year.”

In terms of supply, lead mine production won’t fully recover to pre-pandemic levels for a couple of years yet, according to Woodmac.

“But secondary supply will take up the slack next year, resulting in an oversupply of refined lead,” Ahmed said. Both 2020 and 2021 are expected to bring an oversupplied lead market.

“However, the stocks are still so leaned out from the past few years of running deficits that it will only cause total global stocks to revert to around average levels in terms of days of consumption,” he said. “We’re not going to be awash with lead, and the lead concentrate market will continue to be tight.”

When asked about what could change this forecast, Ahmed said a harsh cold snap in North America or Europe could really test the ability of lead producers and battery makers to keep up with demand.

“Battery makers are already well below their normal inventory levels going into the northern hemisphere’s winter ‘battery-kill’ peak demand season,” he explained to INN. “It wouldn’t take too much to strip the shelves bare of new batteries.”

Woodmac is expecting the price of lead to average a little under US$1,900 in 2021.

“But with more upside risk than downside due to the possibility of a winter demand spike in the coming couple of months putting an acute squeeze on refined lead availability,” Ahmed added.

Meanwhile, analysts at FocusEconomics see lead prices dipping somewhat from their current level following such a sudden rise, with prices likely currently running slightly above fundamentals.

“Much hinges on the speed of the vaccine rollout globally, with any delay likely to weigh on prices,” they said in a report. Panelists polled by FocusEconomics see lead prices averaging US$1,890 in the fourth quarter of 2021 and US$1,956 in Q4 2022.

Commenting on what factors investors should keep an eye out for in 2021, Ahmed said treatment charges for lead concentrates is one to watch.

“They’re already low, and the pressure is to keep them there for the moment as primary smelters’ capacity exceeds available mine supply,” he said.

Additionally, the lead recycling industry — which produces two-thirds of total global output — is heavily dependent on getting scrap batteries, but can’t do much to influence the rate of supply.

“It’s quite feasible that the extraordinary volume of replacement battery demand created after lockdown this summer means that many more vehicles are going into this winter with newer, stronger batteries,” he concluded. “Without some really harsh weather to cause battery failures, lead recyclers may not get the usual volumes of scrap batteries needed to feed their furnaces as battery makers continue to clamor for refined lead.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.