Nickel Trends 2019: Bright Year Brings Major Price Rise

What nickel trends drove prices in 2019? We run through top supply, demand and price catalysts in this overview of the space.

Click here to read the latest nickel trends article.

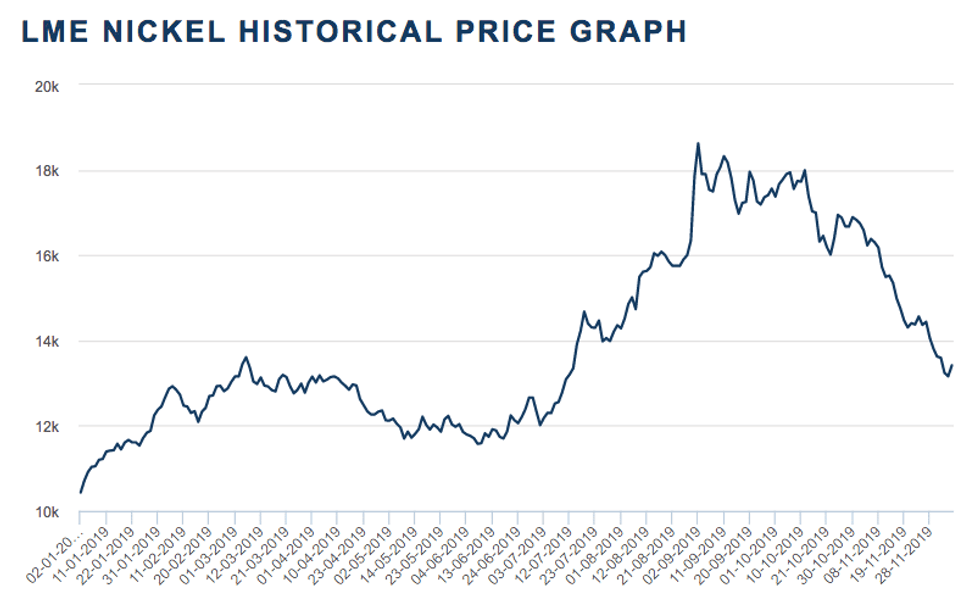

For nickel, 2019 was a tumultuous year as investors and analysts alike speculated on the metal’s future in the face of the electric vehicle (EV) boom and Indonesia’s nickel ore export ban.

Nickel is ending off the year gainfully, increasing by 28.56 percent between January 2 and December 6.

However, this increase pales in comparison to the jumps nickel made during the summer, when it traded for US$18,620 per metric ton — 27.95 percent more than its December 6 price.

Since the end of the third quarter, nickel’s price has eased from its summer heat, but it has still maintained the gains it made prior to the summer. Here’s how nickel did in each quarter of 2019.

Nickel trends Q1: New projects in the spotlight

Nickel’s new year began with the metal trading for US$10,435, but it had increased to surpass the US$11,000 mark by the end of the first week of January.

Chart via London Metal Exchange.

The beginning of 2019 also featured many companies announcing new projects for the coming years. Cobalt 27 Capital, now Conic Metals (TSX:NKL), entered into a definitive scheme implementation agreement with Highlands Pacific in an attempt to take over Highlands.

Meanwhile, Horizonte Minerals (TSX:HZM,LSE:HZM) received full licensing on its Araguaia ferronickel project in Brazil, meaning the company moved forward with construction.

It was also during Q1 that nickel was hailed as potentially the fastest-growing battery metal in the EV boom. At the time, Simon Moores, managing director at Benchmark Mineral Intelligence, delivered a testimony to the US Senate regarding his outlook on energy and minerals.

Over the course of Q1, nickel’s price rose steadily, increasing by 24.68 percent.

Nickel trends Q2: US-China trade talks hurt nickel

Nickel kicked off the second quarter in 2019 with a small drop off in price, which continued for the first two months of Q2. The metal began the period trading for US$13,150, but by May 9, the price had dropped by 11.02 percent to US$11,700.

During Q2, supply grew while demand weakened, both of which pushed prices down. According to Ricardo Torné, FocusEconomics‘ lead economist, this drop came as a shock to many in the industry.

“Nickel prices slumped recently on narrowing supply deficits and weaker growth prospects in China amid the intensifying trade spat with the US, which has knocked demand,” he said to the Investing News Network (INN) previously. “This came as a surprise to many analysts who had expected prices to trend higher through the first half of the year.”

It was during Q2 that analysts began pointing to Indonesia’s flourishing nickel market; the metal was on track to become the country’s top export, surpassing palm oil.

Nickel’s price began to pick back up in June, and finished the quarter trading for US$12,660, a 3.72 percent overall decrease over the course of three months.

Nickel trends Q3: Prices soar on export ban speculation

Nickel’s third quarter was by far its most dramatic, with the metal making massive gains within the span of weeks, if not days. The metal began the quarter trading for US$12,330, and by August 2 it had increased in value by 51 percent to US$18,620.

The jump in price can be linked to rising speculation regarding Indonesia’s nickel ore export ban, which the government confirmed in September. Fears of lacking supply bolstered prices as analysts predicted a loss of 350,000 metric tons of nickel ore concentrate due to the ban.

In addition to supply concerns, nickel’s price also benefited from the continued buzz regarding EVs.

“The other thing (affecting nickel prices) I would say is the EV hype. I mean, for the longer-term trend, EVs are still there,” Colin Hamilton, managing director of commodities research at BMO Capital Markets, told INN at the time. “For the battery raw materials, a lot of the hype has disappeared from the market at the present time. For nickel stainless steel demand, it still remains relatively strong.”

Nickel trends Q4: A steady end of the year

Nickel’s price began to cool off during the fourth quarter. Between October 1 and December 5, the metal dropped by 24.26 percent.

Indonesian nickel was of particular interest during this quarter, with Indonesia banning nickel ore exports in October, two months earlier than expected. In addition, companies like Eramet (OTC Pink:ERMAY,EPA:ERA) announced the acceleration of projects based in Indonesia.

In light of the news of Indonesia’s nickel ore export ban, Jinchuan Group (HKEX:2362) announced it will work to fill the supply gap in the global market.

Looking forward, Indonesia hopes to approve battery-grade nickel plants soon; they would allow Indonesian plants to produce battery-grade nickel chemicals by the onset of 2020.

In other news, Norilsk Nickel (MCX:GMKN) announced plans to decrease dividends for shareholders temporarily in order to free up capital to focus on investments for the coming decade.

As mentioned, despite its fall during Q4, nickel still increased year-to-date, jumping 28.56 percent. As 2019 and Q4 simultaneously approach their end, nickel was trading for US$13,160 as of December 5.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Sasha Dhesi, hold no direct investment interest in any company mentioned in this article.