London Nickel Price Up After Hitting Lowest Since 2003

Three-month nickel on the LME was sitting at $8,775 per metric ton on Tuesday after achieving its biggest one-day gain since September 2012.

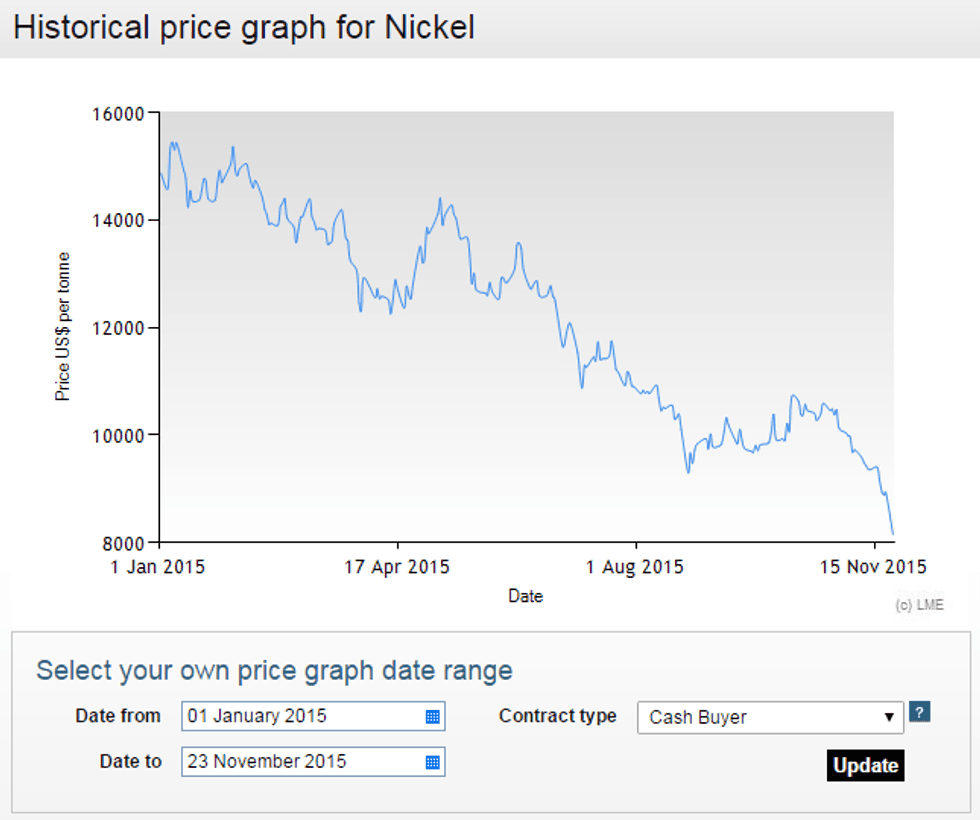

The London nickel price has seen a few short-term price bumps this past year, but overall the base metal has trended decidedly downward, dropping 46 percent since the start of 2015.

As yet, that trend shows no signs of stopping. While three-month nickel on the LME was sitting at $8,775 per metric ton on Tuesday after achieving its biggest one-day gain since September 2012, market watchers to do not see that rise continuing. “I think we may already have seen the bounce in copper, zinc and nickel,” Axel Rudolph of Commerzbank (ETR:CBK) told Reuters.

Furthermore, Tuesday’s gain came after very poor trading activity on Friday and Monday. On Friday, LME nickel for three-month delivery sank to $8,735, its fifth loss in a row and a 12-and-a-half-year low; it remained at 2003 levels on Monday.

This chart outlines this year’s activity for the London nickel price:

What about that deficit?

The London nickel price’s poor performance might seem odd given that this time last year some market watchers — including Scotiabank’s Patricia Mohr — were calling for a deficit by Q2. Mohr said at the time, “[the nickel price is] expected to soar once NPI plants in China have used up their inventory on hand — forcing Chinese stainless steel producers to turn to more costly imports of FeNi and nickel cathode.”

Unfortunately, it appears that inventory was never used up. According to Bloomberg, while nickel stockpiles in LME-monitored warehouses are currently at the lowest level since December 2014, “they’re still almost five times larger than they were four years ago.”

What’s more, depletion is more likely to slow than speed up — The Wall Street Journal states that as of this month stainless steel demand is forecast to grow by just 2 percent, down from 4 percent predicted in April. Given that the stainless steel sector accounted for about 72 percent of nickel demand last year, that doesn’t bode well for nickel stockpiles or for the London nickel price.

And unfortunately, even with demand sinking, nickel producers appear unwilling to reduce supply.

“Stainless demand still looks quite sluggish, and [there] doesn’t seem to be a willingness from the nickel producers to really cut production,” Nicolas Robin, commodities fund manager at Columbia Threadneedle Investments, told the Journal.

Indeed, news hit just last week that Vale (NYSE:VALE) will not shutter its nickel smelting and refining operations in Manitoba until 2018. They had originally been set to close this year, but the company has since struck a deal with workers and Environment Canada to keep running longer, Reuters states.

Furthermore, hopes that Glencore (LSE:GLEN) might decide to reduce its nickel output have come to naught. The commodities giant recently announced cuts to its zinc and lead production, and the move sparked hopes that nickel would be next. However, as yet Glencore has made no such move.

Investor takeaway

The current London nickel price climate isn’t great, and doesn’t look set to improve in the near future. The weak demand and lack of production cuts outlined above are two factors weighing on the metal, and there’s another on the horizon: the US Federal Reserve’s anticipated December rate hike.

Speaking Monday about nickel and other commodities, Bloomberg’s Ryan Chilcote said that “the market is increasingly concerned” about the potential hike. In his mind there are two things happening: “again concern about demand destruction because all of these things are getting more expensive in dollar terms for countries that aren’t starting with a dollar. And then secondly, the cheaper it gets to produce these commodities … because their currency is staying where it is or lower vs. the dollar, the more supply you get.”

However, beyond that there is a bright spot on the horizon. According to the International Nickel Study Group, the nickel market should experience a small deficit in 2016 after a likely surplus in 2015. Investors in it for the long haul may be cheered by that possibility.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Nickel Outlook 2015: Deficit May Be in the Cards by Q2

Nickel News Latest: Nickel Price to Rise as Vale Halts Production

How is Glencore Influencing the Nickel Price Today?