The Investing News Network spoke with Stefan Ioannou of Haywood Securities to get his thoughts on the copper space in 2016.

UPDATE: Check out our 2017 Copper Price Forecast

At the end of 2014, analysts were not expecting much from copper prices.

Many were suggesting that a turnaround was a few years down the road, and Stefan Ioannou of Haywood Securities predicted that things could get a bit worse — he said copper could very easily dip below $3 per pound for “some period of time” in 2015.

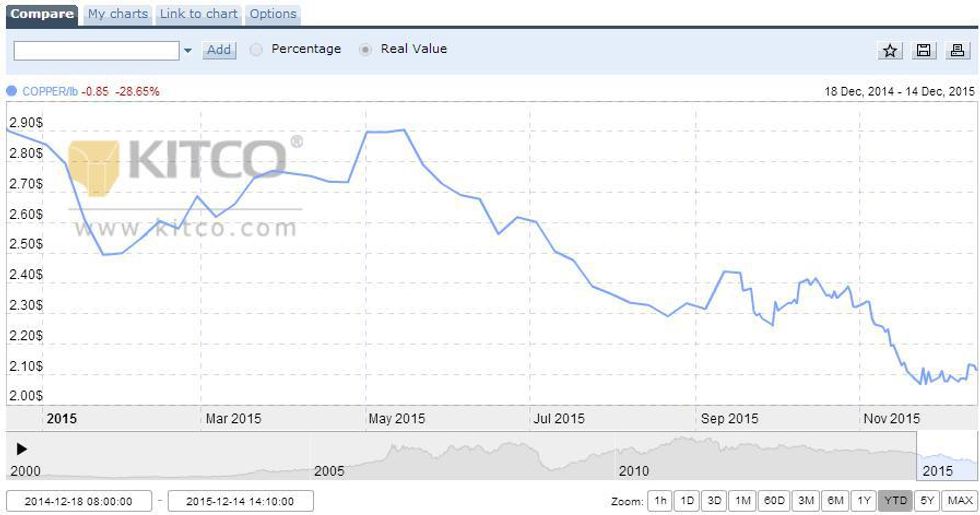

That copper price forecast certainly rang true. Copper prices did indeed stay below $3 for most of 2015, and even threatened to dip below $2 at one point. Overall, spot copper prices are down 28 percent so far in 2015, currently trading at $2.11 per pound.

This chart from Kitco provides a helpful visual of how copper prices have performed this year:

A tough year for metals in 2015

A stronger US dollar and slower-than-expected growth in China have weighed on copper prices in 2015, but for many investors, the extent of the shift downward still came as a surprise. “I think obviously we entered the year expecting it to be a relatively flat to weaker year, but most investors were surprised to see the copper price slip as low as $2 through the latter half of the year,” Ioannou said in conversation with the Investing News Network.

Beyond that, a broader rout in commodities prices has led to weaker investor sentiment in the overall metals space. Ioannou agreed that this overall shift in sentiment has had an impact on copper.

“The overall sentiment across the commodities space in general had an impact on copper investments as well,” he said. “An average retail investor looking to invest is seeing a lot of negative headlines for commodities in general, and copper is one of the main ones. It’s definitely taken the shine off investing in resource stocks, let alone copper-specific stocks,” he said.

Copper production under pressure in 2016

Ioannou also pointed out that with copper at $2, roughly 20 percent of the world’s production is not economic on a C1-cash-cost basis. Producers have been able to hang on thus far, but if low prices persist, there could be further production curtailments and mine shutdowns down the road. “Hopefully that will be a catalyst that will help prices move higher over the medium term,” Ioannou said.

There have already been cutbacks in the zinc space, with Glencore (LSE:GLEN) curtailing production and Nyrstar (EBR:RYR) putting its Middle Tennessee mines on care and maintenance. “The stage is set for copper to follow suit,” Ioannou said. To be sure, Glencore has also announced cuts to its copper production, while Freeport-McMoRan (NYSE:FCX) is planning to cut its copper output by 250 million pounds next year.

Going into 2016, Ioannou stated that he expects prices to moderate around the levels they’re currently at, with things not looking up until the medium to longer term. However, he advised keeping an eye out for 2015 year-end financials from copper companies as they start to come out next year.

“There’s a lot of concern right now that within the producer space there are balance sheet issues,” he said. “It’s a bit of a black box right now, but once we get the year-end financials … with that we’ll have a much better idea about how the first part of 2016 is shaping up with regards to copper price. I think you’re going to see a lot of guys start to either see the light at the end of the tunnel or hit the panic button.”

Interestingly, Ioannou also suggested watching out for wildcards on the exploration side. “A high-grade discovery in any of the metals could really spark a turnaround in the resource industry. We’ve seen it happen in the past. It would have to be a world-class, high-grade discovery, but that’s sort of always a wildcard that’s sitting in the background,” he said.

Copper companies to watch in 2016

Certainly, it’s a tough time to be investing in metals. Ioannou said that it may even be worth waiting for a definitive positive move in copper prices before investing in the space.

Still, for those who want to get into copper now, he suggested looking at companies with established production profiles and strong balance sheets that are operating well despite the current market. “Some that provide some safety at current levels would be Lundin Mining (TSX:LUN), Hudbay Minerals (TSX:HBM) and Nevsun Resources (TSX:NSU),” he said.

On the junior side of things, Ioannou didn’t mention any companies specifically, but did note that there are juniors that have managed to sign joint venture agreements with major mining companies. “These are juniors that are still going to have exploration results coming out,” he said. “It’s not coming out of their own pocket. And those would be the ones to watch, because there’s not as much concern about them running out of money to have meaningful advancement on their projects.”

That idea certainly appears to line up with what investors are thinking. Taking a look at some of the top-performing copper companies on the TSX Venture this year, all have large partners for their projects. For example, Arena Minerals (TSXV:AN) has a US$16-million option agreement with Japan Oil, Gas and Metals National for its Atacama copper project, while Quaterra Resources (TSXV:QTA,OTCMKTS:QTRRF,FWB:QR2) is partnered with Freeport-McMoRan Nevada for a number of copper deposits in Yerington, Nevada.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading:

Copper Outlook 2015: More of the Same in Store