Cannabis Weekly Round-Up: HEXO Finds Unlicensed Area

The Investing News Network rounds up some of the biggest company and market news in the cannabis market for the past trading week.

During the past trading week (November 18 to 22), Canadian cannabis grower HEXO (NYSE:HEXO,TSX:HEXO) announced that there had been unlicensed growing among its operations.

Also during the period, democratic presidential candidate Joe Biden reaffirmed his position on the sweeping legalization of cannabis in the US, while a crop of executives for multi-state operators (MSOs) passed the blame to Canadian players bringing down the collective sentiment on cannabis stocks.

Here’s a closer look at some of the biggest cannabis news over the week.

HEXO finds a problem with operations acquired from Newstrike Brands

The Quebec-based producer told investors it discovered a specific area of one its facilities in Niagara, Ontario, is not properly licensed.

This facility belongs to HEXO by way of its acquisition of Newstrike Brands, which closed back in July.

“While we are disappointed with what we uncovered, we assume responsibility for any issues with UP products prior to the acquisition,” HEXO CEO Sebastien St-Louis said in a statement.

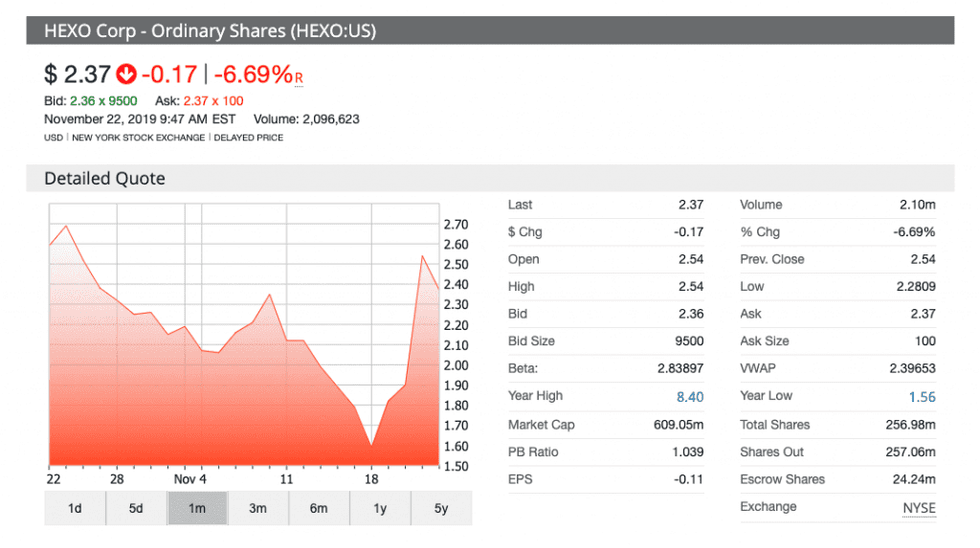

Shares of HEXO on the NYSE dipped almost 7 percent on Friday to US$2.37 percent as of 9:47 a.m. EST.

Biden: Marijuana a gateway drug

At a town hall event with voters this past week, Biden said he still does not support the legalization of cannabis in the US since there isn’t enough research to guarantee the drug is not a gateway to other substances.

“It’s a debate and I want a lot more before I legalize it nationally; I want to make sure we know a lot more about the science behind it,” he said.

WATCH: @JoeBiden on marijuana legalization – "There is not nearly been enough evidence…as to whether or not it is a gateway drug," he said last night, "It’s a debate." Biden said states should decide on legalization & that he supports medical marijuana. @CBSNews pic.twitter.com/s4CE32phLS

— Bo Erickson CBS (@BoKnowsNews) November 17, 2019

Biden, however, expressed his support for medical use of cannabis and said he would support the right for the states to decide what’s best for them.

“It should not be a crime, it should be a civil penalty to the extent that it exists in states that don’t choose to legalize,” he told the audience.

Legalization bill moves in Congress

The House Judiciary Committee approved a bill that would legalize cannabis in the US. The Marijuana Opportunity Reinvestment and Expungement Act (MORE Act) will now head to the Congress floor, where it is expected to be approved thanks to a Democratic majority.

While the positive vote on the bill indicates a changing landscape for the feasibility of marijuana bills in the US, a legal expert said there are still clear pitfalls for these critical policies.

“The Senate doesn’t care about the MORE Act because the MORE Act, very practically speaking, is an approach for legalization that is led by progressives and criminal justice reform advocates. It is not led by moderate Democrats or Republicans,” Saphira Galoob, CEO of federal advocacy firm The Liaison Group, said.

During an event in Toronto about the state of the policy landscape for the marijuana market in the US, Galoob said the Senate will not allow the MORE Act to go through due to partisan reasons.

“As long as the House is Democrat, and as long as the Senate is Republican, you’re going to have an impasse in Congress on what the approach for legalization is supposed to be,” Galoob added.

Market updates

The Retail Council of Canada hosted an event focused on the marijuana industry. Jennifer Lee, a partner at financial advisory firm Deloitte, explained that while Canadians and Americans share many similarities as cannabis consumers, they have key differences for companies and retailers to explore.

“When you see Canada outperforming the US in usage, it’s really because they see the product as a highly social product,” said Lee. The expert explained that in the US the drug has a more therapeutic focus for consumers of the regulated industry.

Arizona-based MSO Harvest Health & Recreation (CSE:HARV,OTCQX:HRVSF) informed shareholders it would no longer move forward with its planned acquisition deal for CannaPharmacy and its cannabis licenses in Pennsylvania, Delaware, New Jersey and Maryland.

Instead, Harvest will now only acquire Franklin Labs, a subsidiary of CannaPharmacy, for a price of US$26 million. The purchase will grant Harvest a cannabis facility in Reading, Pennsylvania.

This deal was held back due to a second request review by the Department of Justice and was part of a trio of delayed deals for Harvest.

As part of their quarterly reports, MSOs Trulieve Cannabis (CSE:TRUL,OTC Pink:TCNNF) and Ayr Strategies (CSE:AYR.A,OTCQX:AYRSF) respectively commented on the dips of the stock market due to Canadian players and shared a perspective on the landscape of marijuana investments.

“Their financial losses, writedowns and negative revenue trends are causing investors, both institutional and retail, to increasingly demand better results and holder value,” Kim Rivers, CEO of Florida-based Trulieve, said during a call with analysts and investors.

Jonathan Sandelman, CEO of Ayr Strategies, said the capital markets are currently “effectively closed” for marijuana operations.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.