The index tracks the performance of companies listed on the TSX and TSXV that are “significantly involved in the cannabis market.”

TMX Group (TSE:X) has launched its newest index, which tracks the performance of cannabis companies in North America trading on two of its exchanges.

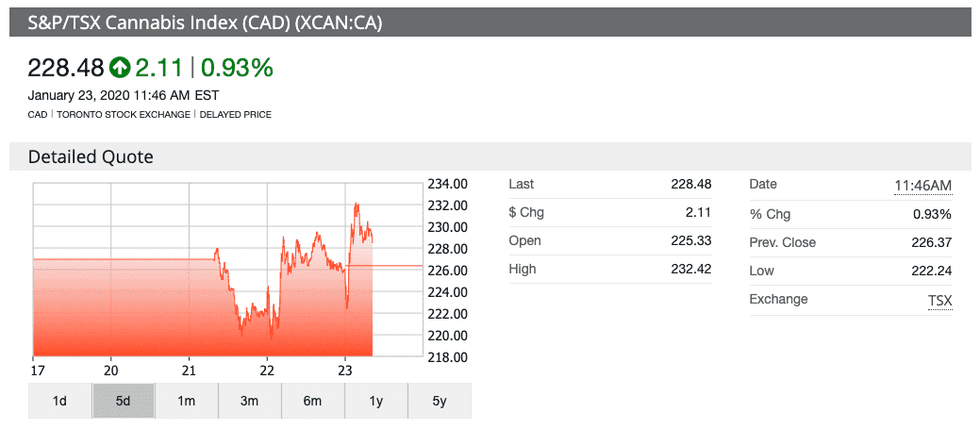

The S&P/TSX Cannabis Index (TSX:XCAN) debuted on Monday (January 20), closing its first day of trading at C$230.24. As of 12:02 p.m. EST on Thursday (January 23) it sat at C$226.81.

The index tracks the performance of companies listed on the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) that are “significantly involved in the cannabis market,” a press release reads.

This benchmark index currently features 15 cannabis holdings with operations across the supply chain, from cultivation to research and development; the average constituent market cap is C$1.19 billion.

To be eligible for this exclusive list, firms’ shares need to be issued and trading for three months before the index’s quarterly rebalancing.

Constituent companies also need to maintain a float-adjusted market cap of or over C$180 million at the rebalancing date, among other requirements.

The index features some of the largest players in the Canadian cannabis space, including giants like Canopy Growth (NYSE:CGC,TSX:WEED) and Aphria (NYSE:APHA,TSX:APHA), as well as smaller firms.

Here is a list of the index’s current holdings ordered by weight:

- Canopy Growth

- Aurora Cannabis (NYSE:ACB,TSX:ACB)

- Cronos Group (NASDAQ:CRON,TSX:CRON)

- Aphria

- Charlotte’s Web Holdings (TSX:CWEB,OTCQX:CWBHF)

- Organigram Holdings (NASDAQ:OGI,TSX:OGI)

- MediPharm Labs (TSX:LABS,OTCQX:MEDIF)

- HEXO (NYSE:HEXO,TSX:HEXO)

- Auxly Cannabis Group (TSXV:XLY,OTCQX:CBWTF)

- Valens GroWorks (TSXV:VLNS,OTCQX:VLNCF)

- Village Farms International (NASDAQ:VFF,TSX:VFF)

- Neptune Wellness Solutions (NASDAQ:NEPT,TSX:NEPT)

- PharmaCielo (TSXV:PCLO,OTCQX:PCLOF)

- The Green Organic Dutchman (TSX:TGOD,OTCQX:TGODF)

- Supreme Cannabis Company (TSX:FIRE,OTCQX:SPRWF)

The introduction of the new cannabis index follows TMX Group’s launch of a global version of the list, the S&P/MX International Cannabis Index (TSX:MCAN), last year.

The international index tracks companies that trade on the New York Stock Exchange and the NASDAQ, as well as the TSX and the TSXV, and it has 22 holdings across Canada, the US and the UK.

“Through our collaboration with TMX, we’re giving market participants a simple way to dissect and analyze this growing market segment,” said Joseph Kairen, senior director for indices at S&P Dow Jones Indices, in a December press release.

Eligibility criteria for the international index include a market cap of at least US$120 million and an average and median daily value traded of US$400,000.

Both of the indices are calculated and managed by S&P Dow Jones Indices.

The Toronto Stock Exchange quietly launched a new cannabis index on Monday. The index, dubbed the "S&P/TSX Cannabis Index" includes 15 cannabis firms listed on the TSX & TSX Venture exchanges. 10 Cdn producers, 3 extractors, a US-based hemp producer and a Colombian-based producer pic.twitter.com/0tuHyOgJQz

— David George-Cosh (@itsdgc) January 22, 2020

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: MediPharm Labs and Valens GroWorks are clients of the Investing News Network. This article is not paid-for content.