Hexo Set to Gain Ontario Retail Stake with Newstrike Acquisition

Canadian cannabis firm Hexo acquires fellow LP and The Tragically Hip-backed Newstrike Brands in an all-share no premium deal worth C$263 million.

Consolidation continues in the marijuana public space as Hexo (NYSE-A:HEXO,TSX:HEXO) buys fellow licensed producer (LP) Newstrike Brands (TSXV:HIP,OTC Pink:NWKRF).

On Wednesday (March 13), the two firms confirmed the acquisition plan, with an overall transaction valued at C$263 million, a figure slightly below Newstrike’s market capitalization of C$275.9 million.

Newstrike has the backing of Canadian rock-band The Tragically Hip as “significant investors” and holds a potential entry into the Ontario marijuana retail market.

The completion of the acquisition will be determined by Newstrike’s investors at a later shareholder meeting.

As agreed between the two producers, Newstrike holders will obtain 0.06332 of a HEXO common share per each HIP share owned.

If the acquisition is approved by Newstrike holders, Hexo estimates the combined company will reach over C$479 million in gross revenues for the 2020 fiscal year. The estimation only accounts for the Canadian cannabis market.

Hexo highlighted the acquisition will provide four additional facilities and increase its annual production of cannabis to 150,000 kilograms.

“Hexo has been facing unprecedented demand for its products and Newstrike is bringing a platform to add significant production capacity to the Hexo team,” Sebastien St-Louis, CEO and co-founder of Hexo, told BNN-Bloomberg.

When asked during the segment if Hexo is prepared to add a premium to the offer in order to get Newstrike shareholders on board, St-Louis said the company is “not interested in bidding wars.”

The executive said he is fully confident the deal with go through due to the established support.

Acquisition offers Hexo entry to Ontario retail market

As Hexo touts a partnership with The Tragically Hip and the new facility capabilities acquired, one of the most crucial assets its purchase brought along is the potential to work on one of the first recreational dispensaries in Ontario.

In February, Newstrike in a partnership with Spiritleaf, a cannabis retailer owned by Inner Spirit Holdings (CSE:ISH), signed an agreement with one of the winners of a lottery to determine the first 25 dispensaries in Ontario.

According to the agreement, Spiritleaf will provide assistance to “build out the store location, license its brand and operating standards, and provide expert product training.”

The end-result would see a self-described “experiential hub” with branding from Up Cannabis to be featured at the store.

In an email statement to the Investing News Network (INN), Darren Bondar, president and CEO of Inner Spirit, said the relationship between Newstrike and Spiritleaf will continue.

“We welcome and look forward to working with the HEXO team and building on the foundation that has been put in place,” the executive said.

In May 2018, Newstrike made a C$2.25 million investment in Inner Spirit in a cash and stock combination deal, to develop the “experiential hubs” in all Spiritleaf stores.

Ontario has set a goal of April 1 for the official opening of the debut for retail stores.

Multiple public cannabis companies, and even some LPs, have established relationships with winners of the Ontario cannabis retail lottery to aid in the roll-out of the retail market.

“It was no secret that deals were being tabled in the week that our retail operators had to complete their retail operator license application,” Brenna Boonstra, director of quality and regulatory consulting Cannabis Compliance, told INN.

Bondar said the collaboration between Spiritleaf and Newstrike will continue with its original plan to place the Up Cannabis brand in a prominent spot for the Kingston store, set to open on April 1.

PM Rendon, spokesperson for Newstrike, told INN the partnership with Inner Spirit “will continue as before” after the Hexo acquisition is completed.

“The power of our brands and partnerships is an important consideration and part of the benefits of the deal,” Rendon said in an email statement. “We will leverage the winning strategies and platforms of both companies to maximize the potential of the combined company.”

In January, Inner Spirit Holdings reported its marijuana dispensaries in Alberta and Saskatchewan made sales of C$583,597.

The Tragically Hip-backed firm merges with Quebec-based LP

Newstrike had previously signed agreements with Manitoba, Prince Edward Island, Nova Scotia, Ontario and Alberta. The LP had also confirmed deals in place with BC and Saskatchewan.

“The combination will deliver meaningful synergies, a stronger financial position with increased flexibility, and will position the combined company to meet growing consumer demand on a national basis,” Jay Wilgar, CEO of Newstrike, said in a press release.

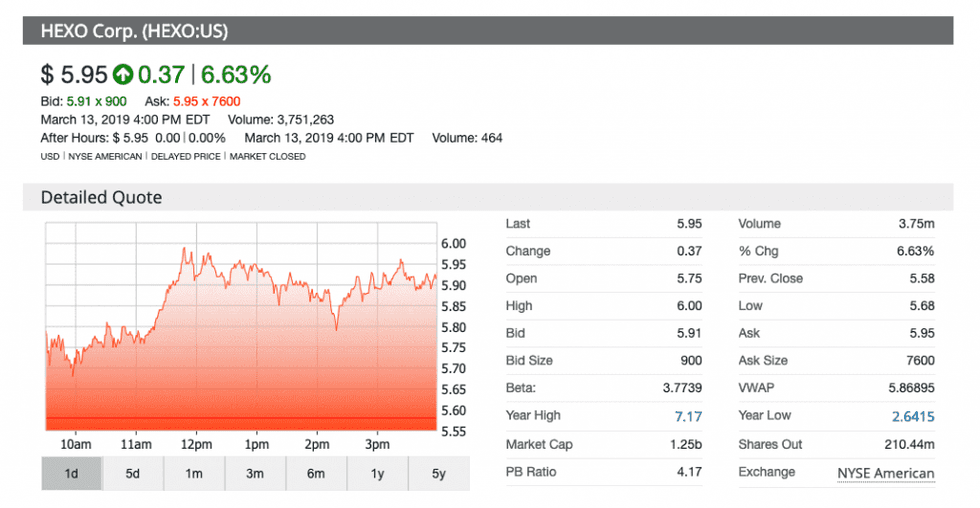

Shares of both producers rallied on Tuesday based on the announcement. Hexo rose 6.63 percent and 5.81 percent in New York and Toronto, to finish with a closing price of US$5.92 and C$7.83.

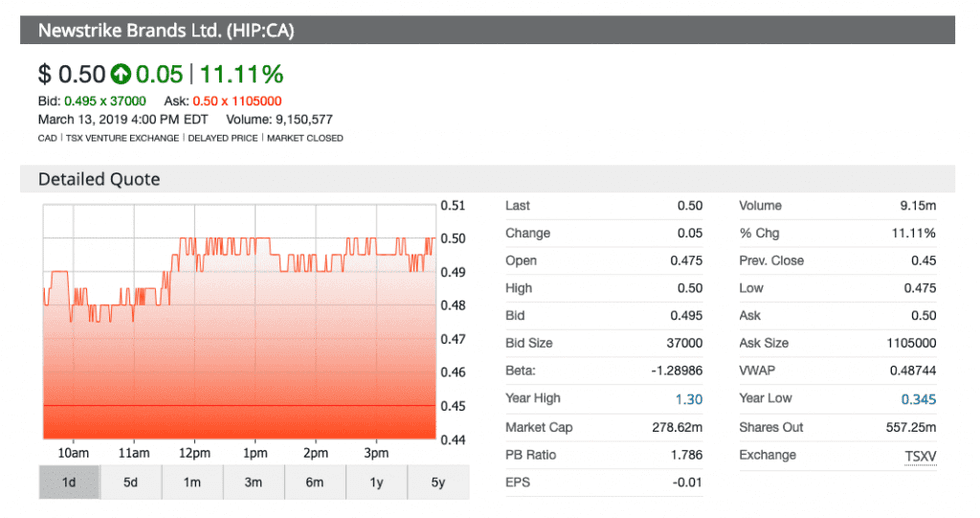

Newstrike on the other hand closed with at a price of C$0.50 representing a 11.11 percent increase for the day.

“Upon completion of the Transaction, existing HEXO and Newstrike shareholders would own approximately 86 [percent] and 14 [percent] of the pro forma company, respectively, on a fully diluted basis,” Hexo indicated.

With this acquisition, Newstrike ends a long-running path for the company since it was dropped by CanniMed Therapeutics as part of a purchase plan disrupted by Aurora Cannabis in January 2018.

Asked whether Wilgar and the rest of the management team at Newstrike would transition into Hexo as well, Rendon said “a transition team will be working between now and the close of the transaction on integration matters,” but no integration is being disclosed until the deal closes.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Inner Spirit Holdings is a client of the Investing News Network. This article is not paid-for content.