Crypto Market Recap: Whales Flock to Ethereum, Trump Media Eyes Bitcoin-Ether ETF

Elsewhere, Vietnam became the latest country to formally legalize cryptocurrencies through a sweeping digital technology law.

Here's a quick recap of the crypto landscape for Monday (June 16) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

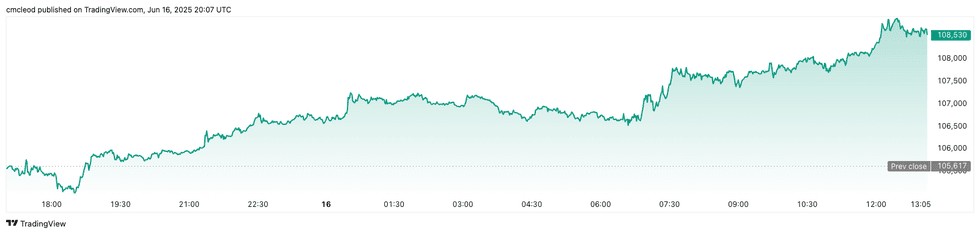

Bitcoin (BTC) was priced at US$108,585, an increase of 3.1 percent in the last 24 hours. The day's range for the cryptocurrency brought a low of US$106,615 and a high of US$108,785.

Bitcoin price performance, June 16, 2025.

Chart via TradingView.

Bitcoin has entered the week in recovery mode, erasing recent losses tied to geopolitical tensions. It surged from around US$106,600 to US$108,800 on Monday in the first half of the trading day.

This rebound puts the bulls back in control and may mark the beginning of a new price discovery phase. BTC is now eyeing US$110,500, with some traders forecasting targets of up to US$170,000 to US$230,000 in this cycle.

Ethereum (ETH) is currently priced at US$2,655.05, a 4.7 percent increase over the past 24 hours, after opening at its lowest valuation of US$2,612.07 and reaching a high of US$2,661.06.

Altcoin price update

- Solana (SOL) is priced at US$157.83, up 3.5 percent over 24 hours. SOL experienced a low of US$155.28 at the open and reached a high of US$158.57.

- XRP is trading at US$2.33, up by 7.8 percent in 24 hours, and at its highest valuation today. The cryptocurrency's lowest valuation was US$2.25.

- Sui (SUI) is trading at US$3.14, showing an increase of 3.7 percent over the past 24 hours. Its lowest valuation was US$3.10 as the markets opened, and it reached an intraday high of US$3.15.

- Cardano (ADA) is priced at US$0.6550, up four percent over the past 24 hours. Its lowest valuation on Monday was US$0.6441, its price as the markets opened, and its highest valuation was US$0.6565.

Today's crypto news to know

Ethereum whales accumulating

Ethereum wallets with 1,000 to 10,000 ETH are accumulating at the fastest pace since 2018, adding over 800,000 ETH on Sunday (June 15) evening according to Glassnode data, signaling strong insider confidence.

Meanwhile, institutional interest continues to surge, with Ethereum staking platforms like Lido attracting significant capital inflows despite short-term price dips.

This robust stacking and staking activity suggests that foundational demand remains strong despite ETH price consolidation. Market insiders and institutions appear poised for a potential breakout, supporting a positive medium- to long-term outlook for Ethereum.

Tron to go public in reverse merger

SRM Entertainment (NASDAQ:SRM) announced a reverse merger to rebrand as Tron, launching a US$210 million Tron treasury funded by a US$100 million equity investment. The move will bring Tron to the public market.

According to the press release, SRM Entertainment will issue 100,000 Series B convertible preferred shares, which can be converted to 200 million common shares at US$0.50 each, along with 220 million warrants to acquire 220 million common shares at an exercise price of US$0.50 each.

Tron founder Justin Sun will advise the new company.

This follows reports of suspicious activity around the January launch of US President Donald Trump’s memecoin, $TRUMP. At the time, a cold wallet was identified with the user name “Sun” and was noted to hold a very significant amount of $TRUMP. This wallet quickly rose to become the top holder. Sun later confirmed he was the largest holder.

Dominari Securities, which hired Donald Trump Jr. and Eric Trump as advisors in February, structured the deal, and Eric Trump is reportedly expected to take a role, according to sources for the Financial Times. This occurs as the GENIUS Act faces a Senate vote on Tuesday (June 17) and amidst scrutiny of Trump's crypto ties, evidenced by his US$57.7 million in earnings from World Liberty Financial, a firm he and his sons founded.

Trump Media files for Bitcoin-Ether ETF

US President Donald Trump’s media empire is doubling down on digital assets, filing for a dual Bitcoin and Ethereum exchange-traded fund (ETF) under the Truth Social brand.

The proposed ETF, which aims to offer direct exposure to BTC and ETH, will be managed by Yorkville America Digital and marketed as a low-barrier, cost-effective gateway into crypto investing. This follows the firm’s earlier filing for a standalone Bitcoin ETF and public plans to use debt financing to buy BTC outright.

Critics warn of potential conflicts of interest as Trump simultaneously promotes crypto policy and holds a controlling stake in Trump Media & Technology Group (NASDAQ:DJT), now valued in the billions. The White House has denied any crossover influence, saying the president is “walled off” from personal business decisions.

Meanwhile, Trump Jr. and Eric Trump have been actively marketing crypto products and even launched a new “Trump Phone” — all under a nationalist “Made in America” campaign that plays well with Trump’s base.

Strategy buys another US$1.05 billion worth of Bitcoin

Michael Saylor’s Strategy (NASDAQ:MSTR) has added another US$1.05 billion in Bitcoin to its balance sheet, acquiring 10,100 BTC between June 9 and June 15, per a new SEC filing. This brings the company’s total holdings to over 592,000 BTC — purchased at a cumulative cost nearing US$42 billion since August 2020.

Despite Bitcoin’s recent price volatility, Saylor reaffirmed the firm’s “buy and hold indefinitely” strategy and its mission to promote BTC as a global reserve asset.

Shares of Strategy initially slipped 0.4 percent on the news, even as the S&P 500 climbed 1 percent.

Nonetheless, the company’s long-term bet on Bitcoin has paid off handsomely: its stock is up nearly 3,000 percent since entering the crypto space, compared to a 78 percent gain for the S&P over the same period.

Vietnam passes landmark law to regulate crypto

Vietnam’s National Assembly has officially passed the Law on Digital Technology Industry, making it the country’s first legal framework that directly regulates cryptocurrencies and virtual assets.

Set to take effect on January 1, 2026, the law separates digital assets into two core categories — crypto and virtual — excluding traditional securities and CBDCs from its scope.

The legislation also empowers the central government to define asset classes and regulate compliance standards around anti-money laundering, cybersecurity, and terrorism financing.

Officials said the move responds to “persistent gaps” flagged by the Financial Action Task Force (FATF), which gray-listed Vietnam in 2023 for weak AML controls. Analysts believe the law could pave the way for FATF delisting and unlock further international investment.

In parallel, the law extends incentives like tax relief and land-use perks to AI, chip, and data center firms — a clear attempt to position Vietnam as a hub in the global semiconductor supply chain.

Gemini, Coinbase near EU approval

Anonymous sources for Reuters say crypto exchanges Gemini Group Global and Coinbase Global (NASDAQ:COIN) are nearing approval to operate in the EU, joining a growing list of exchanges expanding their operations under the MiCA system. Gemini is expected to receive licensing in Malta, and Coinbase in Luxembourg.

Neither company confirmed the report, but a Coinbase spokesperson told Reuters that Luxembourg is a “well-respected global financial center.”

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.