Crypto Market Recap: Strategy Eyes US$1 Billion Capital Raise, Uber Considers Stablecoin Usage

Elsewhere in the crypto space, the UK said it plans to lift its ban on crypto ETNs, and Switzerland adopted a crypto information exchange bill.

Here's a quick recap of the crypto landscape for Friday (June 6) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

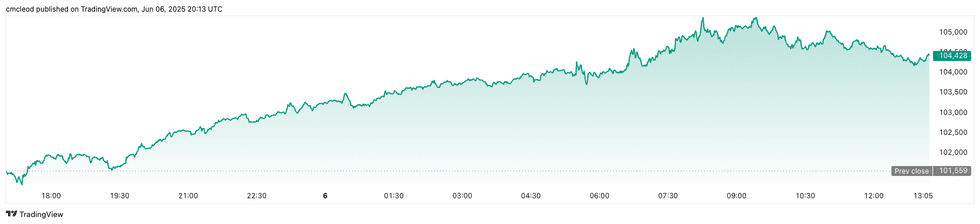

Bitcoin (BTC) was priced at US$104,245 as markets closed for the week, up 2 percent in 24 hours. The day's range for the cryptocurrency brought a low of US$104,006 and a high of US$105,201.

Bitcoin price performance, June 6, 2025.

Chart via TradingView.

After dipping below US$101,000 during the dispute between US President Donald Trump and Elon Musk, Bitcoin recovered to around US$105,000 early in the trading day, influenced by a strong US labor report.

Despite the rebound, analysts are wary due to technical indicators like a weakening relative strength index, suggesting potential downside. A possible rate cut from the US Federal Reserve on June 18 could push Bitcoin to US$112,000, but the outlook is uncertain. Order book data indicates a liquidity trap, and limited short interest points to a fragile recovery.

Additional selling pressure and investor distrust are contributing to shaky market sentiment.

Ethereum (ETH) finished the trading day at US$2,490.63, a 2 percent decrease over the past 24 hours. The cryptocurrency reached an intraday low of US$2,482.52 and saw a daily high of US$2,519.25.

Altcoin price update

- Solana (SOL) closed at US$149.26, trading flat over 24 hours. SOL experienced a low of US$148.86 and reached a high of US$151.79 on Friday.

- XRP is trading at US$2.17, reflecting a 1.6 percent increase over 24 hours. The cryptocurrency reached a daily low of US$2.16 and a high of US$2.18.

- Sui (SUI) peaked at US$3.18, showing an increase of 5.7 percent over the past 24 hours. Its lowest valuation on Friday was US$3.16, and its highest was US$3.19.

- Cardano (ADA) is trading at US$0.663, up 2.8 percent over the past 24 hours. Its lowest price of the day was US$0.6604, and it reached a high of US$0.6693.

Today's crypto news to know

Uber considers stablecoins for cost reduction

On stage at the San Francisco-based Bloomberg Tech Summit on Thursday (June 5), Uber Technologies (NYSE:UBER) CEO Dara Khosrowshahi said the company is “definitely going to take a look” at using stablecoins to help reduce the cost of moving money around the world.

“We’re still in the study phase, I’d say, but stablecoin is one of the, for me, more interesting instantiations of crypto that has a practical benefit other than crypto as a store of value,” he said. “Obviously, you can have your opinions on Bitcoin, but it’s a proven commodity, and you know, people have different opinions on where it’s going,” he added.

UK set to lift ban on retail access to crypto ETNs

The UK’s Financial Conduct Authority (FCA) has announced plans to lift its ban on retail investors buying crypto exchange-traded notes (ETNs), a major shift from its earlier risk-averse stance.

Initially barred due to concerns over volatility and investor protection, the FCA now says consumers should have the right to choose whether these high-risk assets fit their portfolios. David Geale, the FCA's digital assets chief, said the move is part of a broader push to "rebalance" the regulator’s approach to financial risk. The proposal, which would allow ETNs to be sold on FCA-registered investment exchanges, will now enter a public consultation phase.

This regulatory pivot follows the UK’s introduction of draft laws in April aimed at integrating crypto into the formal financial system. The FCA emphasized that its separate ban on crypto derivatives for retail traders will remain in place.

Switzerland adopts crypto information exchange bill

The government of Switzerland has adopted a bill to enable the automatic exchange of information (AEOI) on crypto with 74 partner countries, including the UK, all EU member states and most G20 countries.

The measure excludes the US, Saudi Arabia and China. The bill is currently under discussion in parliament and, if approved, the AEOI framework for crypto assets will take effect on Jan. 1, 2026.

Switzerland will only engage in AEOI with partner states that also desire information exchange with Switzerland.

Strategy to raise nearly US$1 billion to buy more Bitcoin

Strategy (NASDAQ:MSTR), the company known for its aggressive Bitcoin acquisition strategy, is launching a nearly US$1 billion capital raise through its new 10 percent Series A STRD preferred stock. The offering includes over 11 million shares and promises a high fixed yield, making it attractive to yield-hungry investors in a low-rate environment.

Unlike other Strategy offerings like STRK (convertible) and STRF (senior status), STRD offers the highest payout at 10 percent, but comes with more risk due to its non-cumulative dividend and junior status. Dividends are only issued when declared, and the shares cannot be called under normal market conditions.

Proceeds will go toward “general corporate purposes,” which notably include expanding its Bitcoin holdings.

Metaplanet plans US$5.3 billion warrant offering to scale Bitcoin treasury

Tokyo-based Metaplanet (OTCQX:MTPLF,TSE:3350) is taking its Bitcoin commitment to the next level with a massive US$5.3 billion stock warrant issuance, the largest of its kind in Japan.

The company is offering 555 million shares through stock acquisition rights, using a novel moving-strike pricing model that adjusts with market value — a first in the Japanese market.

This 555 Million Plan follows an earlier US$600 million raise and is part of Metaplanet’s goal to hold over 210,000 BTC by 2027, approximately 1 percent of total Bitcoin supply.

The vast majority of the proceeds — around 96 percent — will go toward direct Bitcoin purchases, while a small fraction will support debt management and derivative strategies like selling puts.

Maple Finance expands syrupUSD to Solana

Lending platform Maple Finance announced on Thursday that it has expanded user access by deploying its syrupUSD yield-bearing stablecoin to Solana-based platforms Kamino and Orca.

Previously, it had only been available on the Ethereum blockchain.

According to the announcement, Solana integration is launching with US$30 million in liquidity, which will establish “a deep and stable foundation for lending, trading, and collateral provisioning."

This new system was made possible by using Chainlink's Cross-Chain Interoperability Protocol (CCIP), which started operating on the Solana main network on May 19. CCIP lets different blockchain systems, specifically those using Ethereum Virtual Machine and Solana Virtual Machine technology, share information.

The ability to transfer data between these distinct blockchain environments is expected to significantly boost efficient and affordable growth within the digital ecosystem.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.