Investor Insight

A high-grade uranium explorer looking to grow its strategic footprint in southern Kazakhstan, C29 Metals is well-positioned to take advantage of a rapidly expanding uranium market and provide significant shareholder value.

Overview

C29 Metals (ASX:C29) is a Perth, Australia-based uranium mineral exploration company with assets in Kazakhstan. The company’s recently acquired flagship asset, the Ulytau uranium project, represents a “transformative acquisition” that places C29 Metals in a strategic position to leverage a rapidly growing global uranium market and Kazakhstan’s rich uranium resource and established mining infrastructure.

The Ulytau project is located near Lake Balkhash in South Kazakhstan and situated 15 km south of the Bota-Burum mine, one of the largest uranium deposits mined in the former Soviet Union.

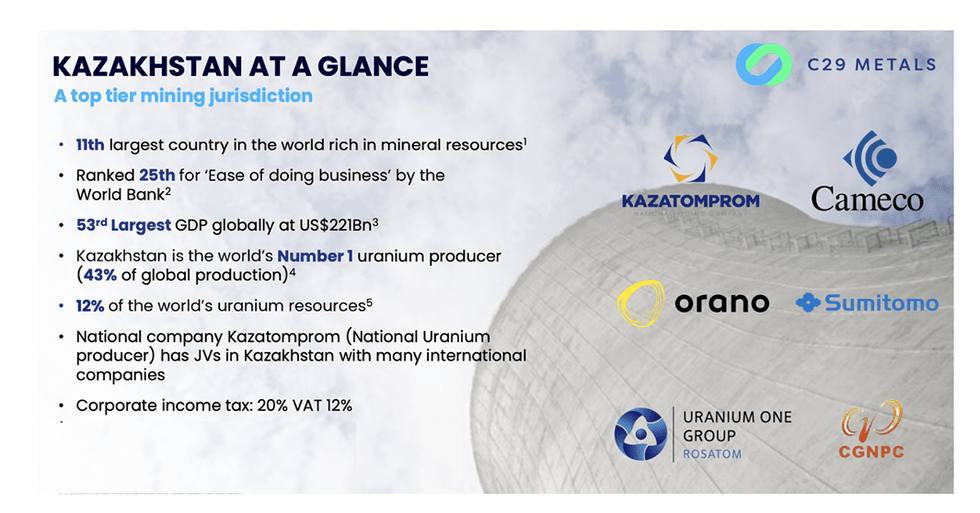

Kazakhstan is considered a top mining country for the following reasons:

- It has a well-developed transportation infrastructure and abundant energy resources, ensuring a stable power supply for mining operations.

- It was ranked 25th by the World Bank for” ease of doing business.”

- As the world’s top uranium producer, Kazakhstan represents 43 percent of the global market.

- It is the lowest-cost producer, globally.

- It holds 12 percent of the world’s uranium resources.

Kazakhstan’s strategic location in Central Asia also provides easy access to major markets in Europe, China and Russia, and the flagship Ulytau uranium project is located 3.5 hours from the country’s largest city of Almaty.

The local village of Aksuyek has a population of ~700 people and will support C29 Metals’ exploration efforts in the near-to-mid-term, providing a base of operations and support services.

The uranium market is expected to grow over the next 10 years, with the World Nuclear Association projecting a 28 percent increase in uranium demand from 2023 to 2030. As electricity demand potentially increases by about 50 percent by 2040, there is significant opportunity for increasing the global nuclear energy capacity, especially as the world continues to pursue its clean energy agenda and a low-carbon economy.

Get access to more exclusive Uranium Investing Stock profiles here