Argentina’s Lithium Resource Holds Potential to Power the Global Energy Transition

Argentina’s strategic position within the Lithium Triangle makes it a key player in global electrification and offers a strong investment case.

As the global energy landscape shifts towards cleaner alternatives, Argentina's position within the Lithium Triangle is emerging as a focal point for savvy investors.

This geological marvel, spanning Argentina, Bolivia and Chile, holds over half of the world's known lithium reserves, with Argentina poised to become a linchpin in the global lithium supply chain.

The country's vast salt flats, or 'salares', are not just natural wonders but veritable treasure troves for those looking to capitalise on the burgeoning demand for electric vehicles (EVs) and renewable energy storage solutions.

The significance of Argentina's lithium resources is underscored by recent industry movements. For instance, Rio Tinto's (ASX:RIO,NYSE:RIO,LSE:RIO) $6.7 billion planned acquisition of Arcadium Lithium (NYSE:ALTM,ASX:LTM) highlights the growing interest in brine projects and the strategic value of their location within the Lithium Triangle.

This move signals a broader trend of major players recognising the potential of Argentina's lithium deposits.

The Lithium Triangle: A geological profile

The Lithium Triangle, aptly named for its abundance of the lightweight metal, is the world's largest source of lithium. This region holds the key to meeting the surging demand for lithium-ion batteries that power EVs and store renewable energy. Argentina, with its vast salt flats, is particularly well-positioned to capitalise on this demand.

This region’s extensive salt flats are the result of ancient lakes that have evaporated over millions of years. These salars are underlain by vast aquifers containing lithium-rich brines, formed through the weathering of lithium-bearing rocks. The concentration of lithium in these brines is exceptionally high, with some areas reporting concentrations up to 1,500 milligrams per litre (mg/L), significantly higher than deposits found elsewhere. This unique geological formation, coupled with the arid climate that promotes natural evaporation, creates ideal conditions for lithium extraction.

The geological stability of the region, marked by minimal tectonic activity, further enhances its attractiveness for long-term mining operations. These factors combine to make Argentina's lithium resources not only abundant but also economically viable and strategically accessible for extraction.

Argentina's lithium production primarily relies on brine extraction, a method that offers several advantages over traditional hard rock mining. This process involves pumping lithium-rich brine from underground reservoirs and allowing it to evaporate in large ponds, leaving behind concentrated lithium compounds.

The benefits of brine extraction include:

- Lower production costs compared to hard rock mining

- Reduced environmental impact due to less intensive mining operations

- Higher-grade lithium with fewer impurities, ideal for battery production

These factors contribute to Argentina's competitive edge in the global lithium market, making its projects particularly attractive to investors and battery manufacturers alike.

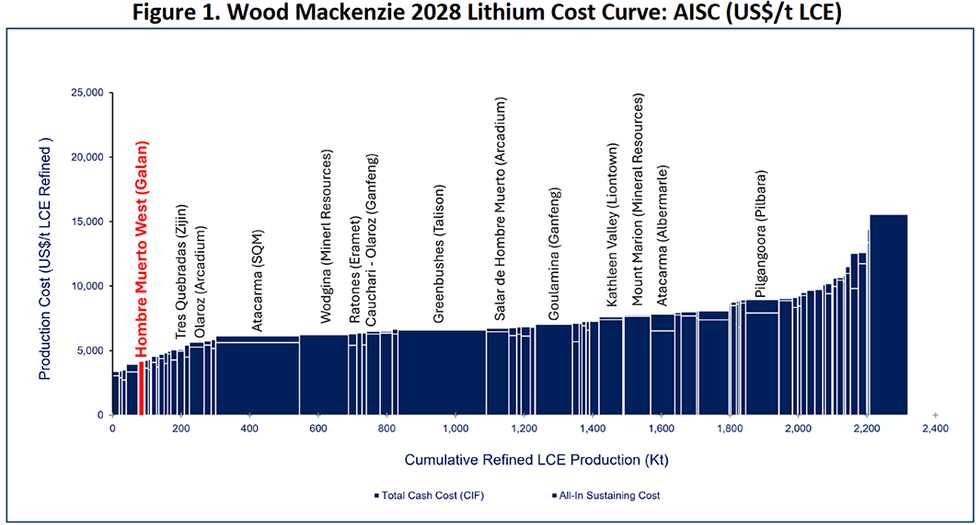

Spotlight on excellence: Hombre Muerto West project

A prime example of Argentina's lithium potential is Galan Lithium's (ASX:GLN) Hombre Muerto West (HMW) project. Located in the heart of Argentina's lithium-rich Salar del Hombre Muerto, this project exemplifies the high-grade, low-impurity brine that makes Argentine lithium so valuable.

Key features of the HMW project include:

- High-grade lithium brine with concentrations of 859 mg/L

- Low levels of impurities, reducing processing costs

- Strategic location near established operations like Livent Corporation's El Fenix site

- A substantial resource of approximately 8.6 million tonnes of lithium carbonate equivalent

The project's proximity to existing operations enhances its value proposition, potentially allowing for shared infrastructure and knowledge transfer. This strategic positioning within the Lithium Triangle underscores the importance of location in the lithium industry.

Wood Mackenzie’s emissions benchmarking service has also placed HMW within the first quartile of the industry greenhouse gas emissions curve, making the project a globally significant, long-term source of lithium.

Argentina's commitment to lithium production

Recognising the immense potential of its lithium resources, Argentina has taken significant steps to foster growth in its lithium industry. The government has implemented a supportive regulatory framework aimed at attracting investment and accelerating project development.

Key initiatives include:

- A $7 billion investment plan to boost lithium production

- Projected export growth from $1.7 billion in 2022 to $5 billion by 2025

- Streamlined permitting processes for lithium projects

- Incentives for companies investing in lithium extraction and processing

These efforts are expected to significantly increase Argentina's lithium output, solidifying its position as a major player in the global supply chain.

Investment potential

The combination of high-grade resources, favorable extraction methods and supportive government policies makes Argentina's lithium projects highly attractive to investors. Companies like Galan Lithium, with their focus on high-grade brine assets, are well-positioned to capitalise on the growing demand for lithium in the clean energy sector.

Key factors driving investment interest in Argentina’s lithium sector include:

- Lower production costs compared to hard rock lithium mining

- High-quality lithium suitable for high-performance batteries

- Increasing global demand for lithium, driven by EV adoption and renewable energy storage

- Argentina's commitment to expanding its lithium industry

As the world transitions towards cleaner energy sources, the importance of securing a stable lithium supply becomes paramount. Argentina's lithium projects offer a compelling opportunity for investors looking to participate in this global shift.

Investor takeaway

Argentina's strategic position in the Lithium Triangle makes it a crucial player in the global lithium supply chain.

With its high-grade brine resources, favorable extraction methods and supportive government policies, the country is poised to significantly impact the future of clean energy technologies.

As projects like Galan Lithium's HMW continue to develop, and as global demand for lithium surges, Argentina's strategic importance in the lithium market is set to grow. For investors, policymakers and industry stakeholders, keeping a close eye on developments in Argentina's lithium sector will be crucial in navigating the evolving landscape of the global energy transition.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.